Michael Gable, Fairmont Equities

BUY RECOMMENDATIONS

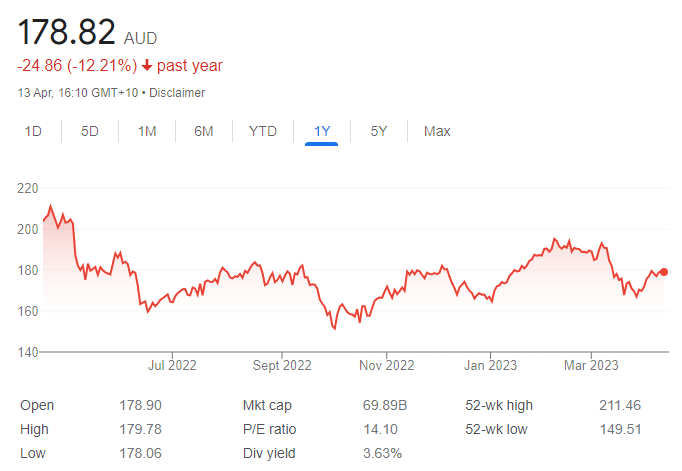

Macquarie Group (MQG)

Share price weakness in March brought the stock back to a strong level of support. In our view, weakness was primarily due to overseas banking sector risks emerging after the collapse of Silicon Valley Bank. However, we believe Australian investors over-reacted to overseas events. Consequently, we believe MQG can be considered a buying opportunity for a company with a strong track record of performance.

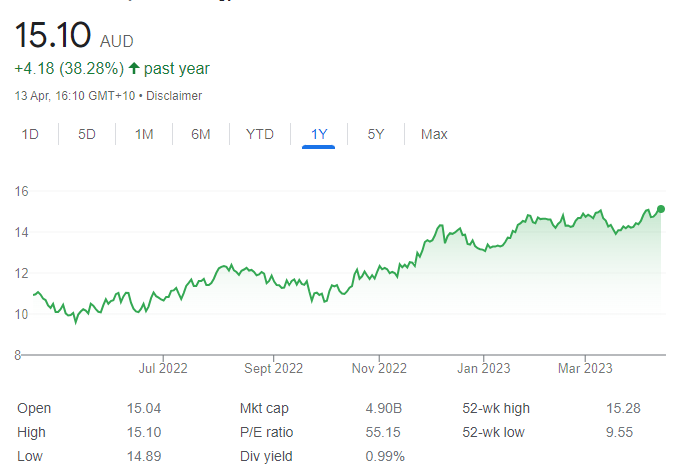

Mineral Resources (MIN)

MIN is a mining services company and iron ore producer. The share price remains in a long term uptrend. However, weakness in the past few weeks saw the share price ease back to the bottom of the trend and provide a new entry point. We continue to remain bullish about the outlook for commodities given buoyant Chinese demand. We expect a weaker US dollar to offer price support to the sector.

HOLD RECOMMENDATIONS

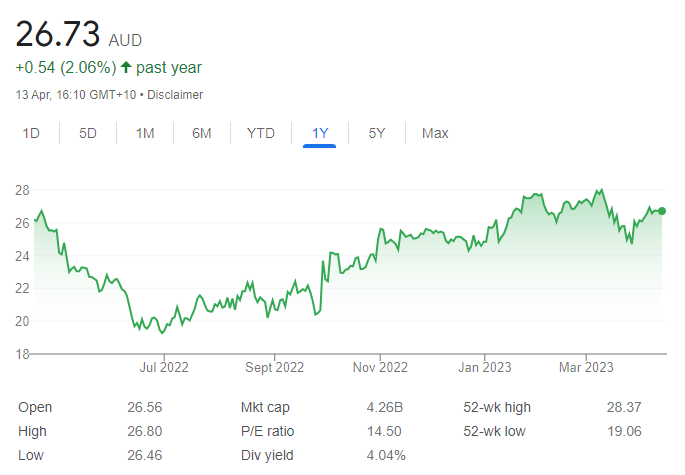

Fortescue Metals Group (FMG)

We expect iron ore prices to rise this year on the back of increasing Chinese demand and a falling US dollar. The FMG share price has risen from $15.50 on November 1, 2022 to trade at $22.29 on April 13, 2023. We believe the company offers a bright outlook that may be enhanced once investors feel more confident about the performance of global economies.

Woodside Energy Group (WDS)

We remain optimistic about the energy sector. Oil production cuts recently announced by OPEC Plus should sustain buying support for WDS. The company produced 157.7 million barrels of oil equivalent in fiscal year 2022, an increase of 73 per cent on the prior corresponding period. Production enjoyed a significant contribution from heritage BHP assets. The shares have risen from $31.47 on March 27 to trade at $34.36 on April 13.

SELL RECOMMENDATIONS

Magellan Financial Group (MFG)

The fund manager experienced net outflows of $3.9 billion in March, 2023. Total funds under management fell from $45.4 billion on February 28, 2023 to $43.2 billion on March 31, 2023. The shares have fallen from $16.34 on April 14, 2022 to trade at $7.84 on April 13, 2023. In our view, a recovery will take time.

Myer Holdings (MYR)

The share price rose from 33 cents on July 1, 2022 to $1.13 on March 9, 2023. The shares have since retreated to trade at 86 cents on April 13, 2023. Our charting analysis suggests a top may now be in place. Moving forward, this discretionary retail giant is exposed to shoppers struggling with higher interest rates and increasing cost of living expenses. Investors may want to consider cashing in some gains.

Top Australian Brokers

- IG – Extensive product array and user-friendly platforms – Read our review

- eToro – market-leading social trading platform – Read our review

- IC Markets – experienced and highly regulated – Read our review

- Quadcode Markets – multi-asset CFD broker – Read our review

Tony Paterno, Ord Minnett

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

BUY RECOMMENDATIONS

Qube Holdings (QUB)

This integrated provider of import and export logistics services reported a bumper first half 2023 result. Underlying revenue of $1.497 billion was up 23.1 per cent on the prior corresponding period. Underlying net profit after tax of $124.9 million was up 41.4 per cent. The result highlights a material upswing in customer volumes. QUB benefits from diversified revenue streams. Guidance for strong underlying earnings growth has been re-affirmed for this financial year.

Ampol (ALD)

The fuel giant reported group statutory net profit after tax of $796 million in fiscal year 2022, an increase of 42 per cent on the prior corresponding period. Ampol declared a final fully franked ordinary dividend of $1.05 a share and a special dividend of 50 cents a share. The company delivered strong refiner margins. It reported a strong start in fiscal year 2023. ALD retains a strong balance sheet.

HOLD RECOMMENDATIONS

South32 (S32)

Like most other major miners, South32’s balance sheet remains strong. However, as its first half fiscal year 2023 result demonstrated, rising costs remain a headwind in the mining industry. We expect free cash flow to be supported by higher near term commodity prices, which is likely to lead to additional shareholder returns. Elevated commodity prices also suggest that value-accretive acquisitions remain difficult to find.

Macquarie Group (MQG)

Macquarie’s third quarter trading update was better than we expected. Net profit after tax for the nine months to December 31, 2022 was marginally higher than the prior corresponding period. The commodities and global markets division, a key driver of earnings growth in recent years, is again exceeding our expectations. Management continues to invest in technology, and, with excess surplus capital, is well placed to continue taking market share.

SELL RECOMMENDATIONS

Technology One (TNE)

TNE has many attributes of a high quality business. The company has a sound customer base. It generates a big proportion of revenue from government and semi-government institutions. Unlike many technology companies, TNE’s share price has defied weakness in the broader sector for much of the past year. But in our opinion, overly optimistic assumptions are required to justify the current share price.

Premier Investments (PMV)

At recent prices, the shares were trading at a material premium to our intrinsic valuation, reflecting the market’s more positive outlook for consumer demand. Australian fashion retailing has been extraordinarily buoyant in the six months to January 2023. However, we expect Premier’s sales growth in Australia to weaken in the second half of fiscal year 2023. We forecast global sales to increase by only low single digits. We expect higher interest rates to impact consumer demand.

Braden Gardiner, Tradethestructure

BUY RECOMMENDATIONS

Hartshead Resources NL (HHR)

This oil and gas explorer recently announced an agreement to farm out a 60 per cent interest in its Southern Gas Basin assets to RockRose Energy, an established UK producer. Hartshead retains a 40 per cent interest for any future production. The deal leaves Hartshead with funding and a clear pathway to development and cash flow. The shares were trading at 3.7 cents on April 13. Investors with an appetite for risk may find value in HHR.

Hammer Metals (HMX)

Hammer is an active mineral explorer, focused on discovering copper-gold deposits at the Mount Isa project in Queensland and the Yandal Gold province in Western Australia. The shares have risen from 5.2 cents on March 27 to trade at 9.5 cents on April 13. The share price rise was accompanied by an increase in volumes, suggesting buyers expect to see higher prices. HMX is a high risk, high reward play, in my view.

HOLD RECOMMENDATIONS

Bellevue Gold (BGL)

The share price has risen from 99.5 cents on February 24 to trade at $1.477 on April 13. I believe gold prices will continue rising in 2023 as the US dollar remains under pressure. I expect BGL momentum to continue. The company has started mining the Vanguard open pit in a bid to generate early cash flow via a toll treating arrangement.

Lycopodium (LYL)

LYL provides integrated engineering, construction and asset management services. The company delivered revenue of $159.9 million in the first half of fiscal year 2023, up 56 per cent on the prior corresponding period. Net profit after tax of $19.8 million was up 29 per cent. In my view, the company will continue to attract more buyers, although holders may want to consider locking in some profits.

SELL RECOMMENDATIONS

Cobram Estate Olives (CBO)

This olive oil company has operations in Australia and the US. Total revenue of $75.9 million for the half year to December 31, 2022 was up 4.3 per cent. However, the group reported a loss after tax of $9.9 million. The share price has fallen from $1.455 on January 3 to trade at $1.307 on April 13. According to my technical analysis, the share price appears weak, so investors may want to consider reducing exposure.

Magnis Energy Technologies (MNS)

This vertically integrated battery technology and materials company operates in the lithium-ion battery supply chain. The share price has fallen from 43.5 cents on February 16 to trade at 23 cents on April 13. Technically, the price breached a major support level, which triggered further selling. In my view, it will take time for investors to regain confidence, so other stocks appeal more for capital growth.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.