John Athanasiou, Red Leaf Securities

BUY RECOMMENDATIONS

Hotel Property Investments (HPI)

HPI owns hotels in Queensland and South Australia. It recently acquired another in Melbourne. HPI recently raised $50 million from an institutional placement, so it will have sufficient funds to acquire other attractive properties if they arise. It can comfortably pay a dividend yield above 5 per cent, which adds further value in a low cash rate environment. Value will return to hotels in line with easing of restrictions in New South Wales and Victoria.

Dropsuite (DSE)

We expect DSE to benefit in a growing Cyber security industry. This company’s software platform enables cloud back up and archiving of software services. DSE is poised to grow organically in response to a growing subscriber base and via acquisition after a successful $20 million placement. We anticipate DSE will be re-rated once it reaches cash flow breakeven, so keep an eye on its upcoming quarterly report.

HOLD RECOMMENDATIONS

The a2 Milk Company (A2M)

The infant formula company has announced it will vigorously defend a class action alleging misleading or deceptive conduct in breach of the Corporations Act. The company is also accused of breaching continuous disclosure rules in posting four downgrades on September 28 and December 18 last year and February 25 and May 10, 2021. The company considers it has at all times complied with its disclosure obligations and denies any liability. Despite the class action, we believe the company is likely to develop new export markets. We expect any good news flowing from the daigou channel will support the stock. However, risks remain.

Orocobre (ORE)

A compelling and appealing theme for investors in the past year has been electric car batteries, creating a boom for the lithium industry. ORE is our preferred stock in the lithium sector. But there’s no rush to buy as the share price has soared in the past 12 months. We suggest investors monitor the momentum in the battery space.

SELL RECOMMENDATIONS

Appen (APX)

The share price of this language technology and data services company has fallen from $13.82 on August 25 to close at $8.74 on October 7. First half statutory net profit after tax fell 55 per cent to $US6.7 million. The company downgraded full year underlying EBITDA guidance at the end of August. We prefer other stocks with more positive outlooks.

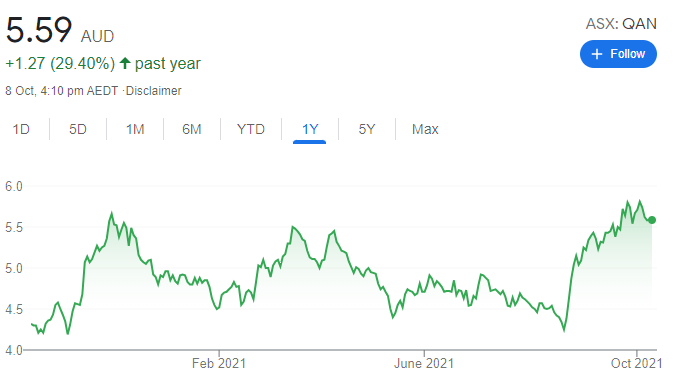

Qantas Airways (QAN)

With state border restrictions set to ease, several travel sector stocks have performed well. Qantas has risen from $4.25 on August 20 to close at $5.58 on October 7. In our view, much of the good news has already been priced into the stock. Apart from potential COVID-19 disruptions across the world, another risk is increasing fuel costs. Investors may want to consider taking gains.

Tony Locantro, Alto Capital

BUY RECOMMENDATIONS

Copper Search (CUS)

Drilling is expected at the Emu Creek prospects in South Australia in the near term. CUS has several high risk/high reward targets in the Gawler Craton. Following a recent $12 million initial public offering, we expect a steady flow of drilling results. Based on the risk profile of the targets, CUS should only be considered by those with a high appetite for risk.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Proteomics International Laboratories (PIQ)

PIQ has developed the ProMarkerD test for predicting diabetic kidney disease. In August, PIQ contracted Biotem to produce immunoassay test kits at scale for the northern hemisphere. Increasing the manufacturing capacity of ProMarkerD may potentially generate more interest from partners and licensees. PIQ is collaborating with the University of Melbourne and the Royal Women’s Hospital to develop a simple blood test for endometriosis. In our view, price weakness has provided a buying opportunity.

HOLD RECOMMENDATIONS

Aurumin (AUN)

AUN has reported encouraging drilling results at Mt Dimer in Western Australia following the Lightening deposit’s high grade intersection – 4 metres at 48.69 grams a tonne of gold and 1 metre at 153.50 grams a tonne of gold. A small inferred resource of 64,700 ounces at the Johnson Range Project in Western Australia may generate value. In our view, AUN represents a growth opportunity in the junior gold sector.

Red Metal (RDM)

RDM is underpinned by the Maronan project, a big lead-silver and copper-gold deposit in Queensland. RDM’s alliance with Oz Minerals provides speculative upside if drilling of multiple high risk targets in Queensland produces encouraging results. Strategic landholdings are in the vicinity of Rio Tinto’s Winu copper discovery. RDM is highly speculative.

SELL RECOMMENDATIONS

Flight Centre Travel Group (FLT)

The share price of this global travel agency has risen from $14.27 on August 23 to trade at $23.08 on October 7. Planned easing of COVID-19 restrictions in Sydney and Melbourne has fuelled optimism in the travel sector. The strong share price provides an opportunity to lock in gains, as significant good news already appears to have been factored into the stock.

Commonwealth Bank of Australia (CBA)

The shares continued to trade above $100 on October 7. CBA is Australia’s biggest home lender. We’re concerned about whether some borrowers can continue servicing existing high levels of mortgage debt, particularly in Sydney and Melbourne, despite tighter lending restrictions being imposed on the banks at the end of October. Investors may want to consider taking some money off the table at these share price levels.

Angus Geddes, Fat Prophets

BUY RECOMMENDATIONS

Telstra (TLS)

The new T25 strategy is more tilted towards growth than its T22 predecessor, which, in our view, was more of a turnaround strategy involving a dramatic simplification of the business and a huge amount of cost cutting. Tailwinds on the horizon include a return of roaming revenue. Also, post paid market share gains paint a brighter outlook for average revenue per user growth in mobile devices in fiscal year 2022. TLS delivered EBITDA growth in the June half. Headwinds from the National Broadband Network continue to fade.

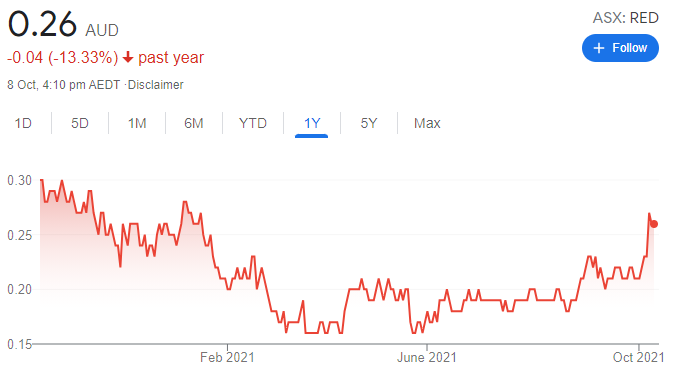

Red 5 (RED)

The company is constructing its King of the Hills gold project in Western Australia. First gold production is expected in the June quarter of 2022. Apart from Red 5 increasing production, we’re forecasting higher gold prices in the future. In our view, Red 5 has strong prospects, particularly as the King of the Hills project is now funded. Drilling prospects in surrounding tenements are another attraction.

HOLD RECOMMENDATIONS

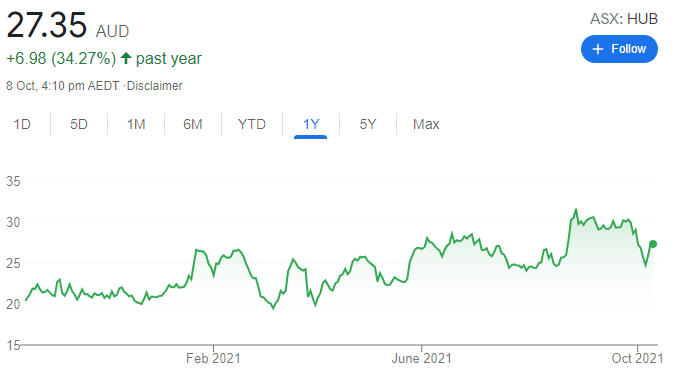

HUB24 (HUB)

This specialist platform continues to grow quickly. It’s benefiting from funds flowing out of banks and larger institutions to independent platforms. Total funds under administration in fiscal year 2021 were $58.6 billion, up 237.4 per cent on the prior year. The company is continuing to invest in new products and staff to support scale and innovation. We retain a positive view on HUB given the high degree of operating leverage amid structural tailwinds supporting the company in a fragmented sector. However, HUB is a hold on valuation grounds.

Spark New Zealand (SPK)

The company’s 5G rollout continues to progress well. Mobile revenue is growing on the back of market share gains despite roaming weakness. Strong demand is growing the cloud, security and service management business. Cost cutting is assisting, with Spark pointing to increased earnings in fiscal year 2022.

SELL RECOMMENDATIONS

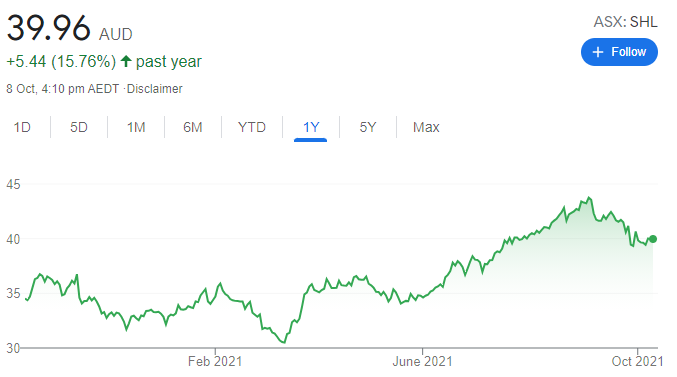

Sonic Healthcare (SHL)

This pathology services provider has performed well during the pandemic. The company has also benefitted from its geographic and business diversity, with operations in Australasia, the UK, US and Europe. We continue to hold a positive view of the company’s core business and its growth prospects. But we see better value elsewhere. On our analysis, the company is trading on a lofty 2023 price/earnings multiple of 26 times.

Decmil Group (DCG)

This diversified infrastructure player downgraded revenue guidance in June due to COVID-19 project delays pushing other work in the order book into fiscal year 2022. A lot of its business is weighted towards government. So revenue can be potentially impacted if government work slows or issues arise. The shares continue to struggle at this point in time.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.