- International markets reacted favourably to US company earnings

- High employment is resisting policymakers’ attempts to reduce demand

- With demand stubbornly high, what options are left to bring down prices?

The United States had something of a relief rally on Friday. As company earnings started coming in for the second quarter of 2022, the financial markets reacted favourably to bank earnings remaining resilient even after elevated loan loss provisioning. The S&P500 was up almost 2% to 3,863 points.

The positive news from the banks’ earnings cycle provided the impetus to the consumer discretionary sector.

For example, casinos and higher-end retailers were up on an expectation of a more positive economic outlook.

Consumer non-discretionary, for example, budget retailers, were subject to losses as money swung back to the spending side of the economy.

The trend carried over into the Australian market open.

Consumer non-discretionary

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Woolworths Group Ltd ASX:WOW (WOW) opened 1% lower to $37.19, and Coles Group Ltd ASX:COL (COL) trended in the same direction by 1% to $18.74.

Consumer discretionary

Harvey Norman Holdings Ltd ASX:HVN (HVN) up 0.75% to $3.98 AUD.

Aristocrat Leisure Ltd ASX:ALL (ALL) adding 0.5% to $36.66 AUD per share nearing the trading day close.

Runaway inflation

Modest gains at the open but a welcome change from the barrage of runaway inflation data. Yet through all the supply chain difficulties, price rises and geopolitical upheaval, employment has thankfully remained stubbornly high.

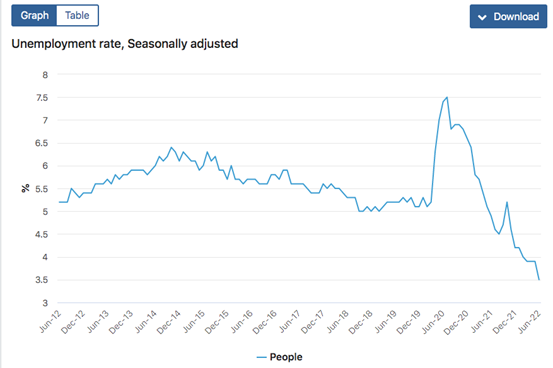

Australian unemployment amongst the participating workforce lowered further to 3.5% in June.

Central banks are attempting to nudge global demand down to compensate for supply chain challenges.

While employment remains elevated and propping demand, the only way out of this bind is to increase production to bring down prices.

To keep the wheels on track and lower prices, an international incentive of production increases in energy feedstocks will run up against climate commitments. There will have to be some give in one or the other.

The week ahead in data

New Zealand announced their latest price index data on Monday morning and annualised inflation measures indicating prices are up over 7% year on year.

The updates will be coming thick and fast from Tuesday through Friday.

The Reserve Bank of Australia releases its meeting minutes on Tuesday. The language will be scoured for any suggestion an acceleration in the current path of interest rate rises is required.

Other key economic data releases in the week ahead that have the potential to upend the markets:

- Tuesday: Key unemployment data is released from the UK

- Tuesday: European bank lending surveys

- Wednesday: RBA Governor Lowe’s speech

- Wednesday: China’s central bank (PBoC) interest rate decision

- Thursday: Japanese and European central bank interest rate decisions

The immediate outlook

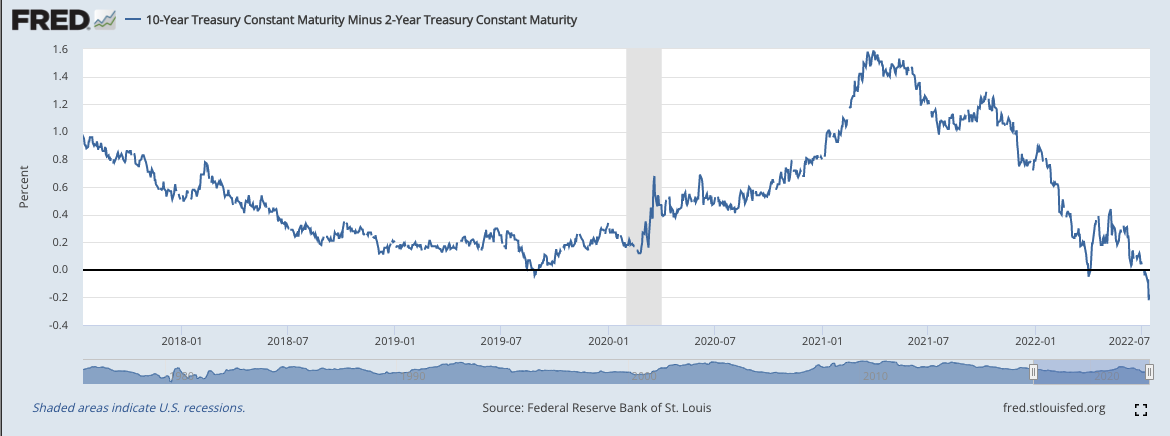

An inversion of the 10-year minus the 2-year yield has shown to be an indicator of a recession in the past. It has flipped down rather sharply.

The theory is that the market expects a reduction in longer-term rates upon a declining economic outlook, with money moving to the longer duration part of the yield curve to ride out the storm.

The unwinding of many decades of the interconnectedness of the global markets is unprecedented on the scale we are seeing today. All previous measures of economic health should be taken with a grain of salt.

Summary

As is often said, the best cure for high prices is high prices. Oil and gas drilling in North America is responding. Brazil is ramping up iron ore output, and coal production is growing internationally.

Combined with increased production, there are signs of slowing demand, with copper prices falling below $7,000 USD per MT from record highs of over 10,500 USD per MT earlier in the year. Iron ore price is narrowing to $100 USD per MT at quite a rapid clip.

The future is always uncertain, but international companies are responding to the challenges at hand by hiring and ramping production. That should provide some comfort to those concerned about the immediate future.