- All eyes are on the Australian housing market.

- Australian consumer confidence is tied to the home price outlook.

- A look at ANZ and the potential impact of a downturn in housing.

Goldman Sachs predicts that the rate hikes will reach 2.6% this year, a rise of 2.5% in 2022.

This month, the ANZ-Roy Morgan Consumer Confidence dropped to a record low of 80.4.

Australian banks

With the average Australian clearly concerned about the coming rate hikes, what does this mean for the Australian finance sector?

ASX:ANZ (ANZ) is down 20% this year, and as a result, the dividend yield has climbed to 6.7%, based upon a share price of 21.87 as of 21st June.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

A dividend yield of 6.7% for a bank is certainly enticing given the relative security of the business model – with the added incentive of ownership in that as rates are going up, banks will likely produce higher net interest income and commissions.

The market is paying out this higher yield as the income comes with the increased risk that more borrowers will default as households become stretched.

Are we likely to see more delinquent borrowings?

Two things need to happen before mortgage quality materially declines:

1) Home value decreases to such an extent that the owner holds negative equity (i.e., the borrowings are greater than the value of the house).

2) Changes in a personal situation, perhaps in health or unemployment.

Forward-looking house valuations

The residential housing market is valued at almost AUD$10tn today – about four times the annual GDP, a high number, which has analysts suggesting that we’re in for a sizeable downturn.

We are likely returning to the historical average of declining house turnover after the meeting of pent-up demand following the COVID-19 lockdown.

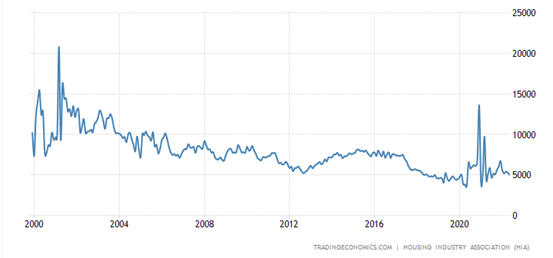

This chart is of the new home sales in Australia over time:

This level of declining turnover tells us that:

1) Most Australians are buying houses to dwell in rather than flip.

2) Median ownership is greater than five years, and as a result, the majority of beneficiaries in the price rises have equity greater than 20%.

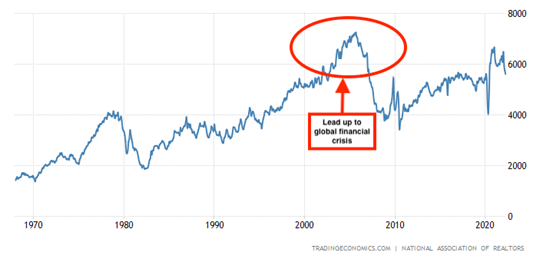

This can be contrasted with the lead-up to the global financial crisis shown above, where there was a sharp rise in the number of existing-home sales in the US.

So, while interest and demand may dry up at these levels, expect to see less supply come on to the market to prop prices in Australia.

The rental market currently remains very tight all over Australia, providing additional support through rental yield.

The economy and home prices

The last 20 years have been supported by a generational resource boom that has served to push unemployment among the participating workforce to all-time lows.

Globally, policymakers are attempting to take the heat out of prices, and this could lead to belt-tightening among the new jobs creator leaders in the resource sector.

The trough in global commodity prices in 2016 is an indicator of how bad it might get, but we still have some way to go to reach those levels.

Iron ore and copper are more than double the price of 2016, and coal and LNG are many times the 2016 prices.

In the event of a downturn, it will be very difficult for resource companies to lay off staff for some time when their coffers are so full.

A tight labour market will further serve to prop house prices through elevated demand.

Contagion from rate hikes

This is likely where the real risk lies in house price projections.

The average Australian house price increase for the last five years has been between 5% and 7%, and the average Australian pays down 20% on a AUD$1m property.

Recent buyers with a fixed rate for one to five years are now rolling into a variable just as rates are skyrocketing.

For banks, this is the riskier end of borrowers given the lower equity.

First-time borrowers will find themselves on thin ice if prices were to fall 20% or more.

In the last four years, all housing financing excluding re-financing totals AUD $1.1tn.

This equates to roughly 1 million Australian homes.

Actuaries will tell you that misfortune befalls the few with predictable regularity.

Even with sustained low unemployment, stretched borrowers facing higher fuel, heating and food costs on top of their soon-to-be-higher mortgage may start to fall behind with increased regularity.

A run on foreclosures will accelerate any price declines through additional supply and put more of those 1 million homes in jeopardy.

Impact on bank financials

Let’s do some rough workings on a sharp spike in delinquencies.

Foreclosure at the height of the financial crisis reached approximately 1/42 in the US.

Let’s conservatively say that 1/40 or 25,000 homes should be provisioned for.

For ANZ, this equates to AUD$3.8bn.

ANZ financials state that the fixed hedge and cash equates to about 37% of the loan book, leaving 63% variable exposed.

63% of AUD$3.8bn leaves a provision of AUD$2.4bn, ex the current reserve of AUD$0.8bn, and the impact is a loss of AUD$1.6bn.

This is offset by rising rates through higher net interest income and commissions.

Going on prior-year sensitivities to interest rate changes, it is anticipated that the offsetting interest and commission income will be +AUD$1.5bn.

Results are in

ANZ can expect to have to raise its loan loss provisioning over the next 12 months

The rate hike’s impact on income should serve to dampen the majority of the increase in reserve losses from a downturn in housing anywhere from 10% to 20% lower.

The dividend yield looks even more attractive on these assumptions.