- Displacement of Russian oil to Europe could derail the world’s oil market.

- The US private and public market response to the crisis has surpassed even the most optimistic expectations.

- How has the US suppressed oil prices, and can this continue?

Oil’s importance

For the average consumer, oil is one of the most significant expenditures through direct and often unavoidable costs associated with travel and heating.

Then there are the indirect and more pervasive elements. Examples are the oil-linked gas contracts that fertilizer companies pay to acquire ammonia, the plastics used to preserve our food and clothe our children, and many other applications. Hence any sustained elevation in oil prices causes inflation to tick inexorably upward.

Russian displacement

Europe imported 3.4m bbls per day of oil and oil products from Russia in 2021.

When Russian oil was shut out from the European market, there was the possibility oil prices worldwide would rise as Europe sought a replacement.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

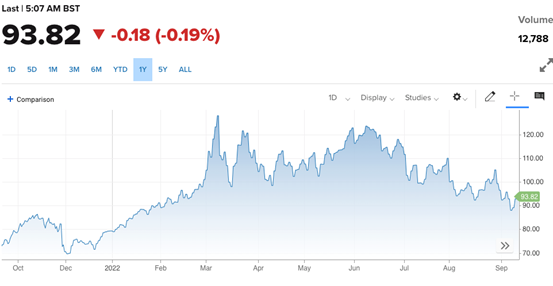

Since June, the price has fallen by over 20 per cent. How have the oil markets managed this, and is it durable?

The US response

The United States is doing the lion’s share of the lifting. Along with gas exports, oil exports from the United States to Europe have doubled this year.

In 12 months, the US has gone from a net importer of oil and oil products for 753k bbls/day in September 2021 to exporting over 2m bbls/day. A 2.8m bbl/day swing to exports. Roughly the entire demand for German oil imports.

A 2.8m bbls/day export swing is greater than the entire production of the UAE, so the US is now fifth on the oil exporter table for 2020. All managed in just 12 months. Truly remarkable.

Durability

The US has created an additional Iranian size exporter in 12 months for three main reasons.

- A vast network of partially completed short-lived wells to draw upon.

- Enormous strategic reserve to release from their tanks.

- Stymied demand onshore in the US.

The network of partially completed wells has been tapped to raise production at a low cost from 11m bbls/day at the commencement of 2021 to 12m bbls/day. The inventory of partially completed wells is depleted by over half from the 2020 highs. The rundown on reserves means there will not be a sharp uptick in production in the immediate future, and we are nearing capacity.

The Strategic Petroleum Reserves (SPR) were factored to hold approximately 90 days of imports at 7m bbls/day, so 630m bbls, give or take. The US government has sold 180m bbls or 30% at approximately 1m bbls/day to ease prices. This strategy has a finite lifespan and is pitched to end this month.

Following a remote work model post-COVID, the US demand picture and the unassailable victory of eCommerce over retail, reducing trips to the mall, has dampened oil demand in the US. Year over year, it is down approximately 1.4m barrels/day.

By the numbers

Formula: Production increase (1m) + SPR (1m) + Demand (1.4m) = 3.4m gave the headroom to provide an additional 2.7m a day to market.

The demand gains may start to turn in the short term as the easy wins of less car travel have now been banked. The SPR release is tabled to end soon. This will leave only 2.4m / day of exports on the table coming into winter.

While the United States has done a remarkable job, it is up to the other exporters to step up to bridge the gap that is starting to appear. If not, we will return to rising prices again this winter.