- The S&P ASX/200 is down 13% year-to-date at the close of play on 21st June.

- The selloff is providing attractive yields for some household names.

- A stock that has proven returns and for the foreseeable future.

Fortescue Metals Group (ASX:FMG)

Fortescue Metals Group (FMG) has turned the Chinese economic miracle into market-busting returns for its shareholders, yet is down 8% this year.

A supplier of seaborne iron ore to China, FMG is susceptible to the swings in the international iron ore price.

Iron ore is the primary component of steel – steel’s tensile strength is used in construction to complement the compressive strength of concrete.

Australia is the largest international supplier of iron ore.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

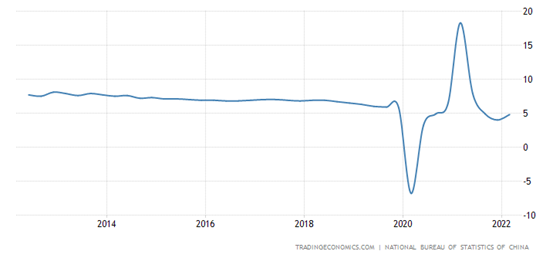

With an infrastructure building boom fuelling economic growth stuttering on international lockdowns, iron ore has wavered in recent months.

GDP growth in China:

The Iron Ore price chart is reflecting recent oscillations in Chinese economic output:

Two acts are at play for China: the Belt and Road Initiative and the transition from an industrialised to a service economy.

Both require modern city constructions across Southeast Asia to prosper.

Building things that require a lot of steel is still very much part of the present and future for China and wider Asia.

Obstacles to growth

The Asian Development Bank (ADB) estimates a US$26tn funding gap through 2030 for the Belt and Road Initiative.

Partner government borrowing has been an issue in a number of countries, most notably Sri Lanka.

There will always be difficulties in any project, but China has shown the manpower and determination to overcome enormous obstacles in the past, and the odds are in favour of progress.

Given the incredible magnitude of the Belt and Road Initiative, if even a fraction of the project gets completed, a great deal of iron ore will be required.

FMG will benefit through a stable demand for its quality and reliably supplied product, enabling the firm to sustain a healthy payout for investors.

FMG continues to deliver

Through the ups and downs over the last 10 years, FMG has consistently returned a dividend to shareholders.

When prices were depressed in 2015 to below the 50 USD/MT handle, the company was still able to pay out AUD$113m to shareholders at an approximate yield of 2.5%

We have a lot of headroom from 115 to 50 USD/MT that provides assurance to new shareholders.

The current yield basis of the last franked dividend is 9.8%.

The board will retreat from this level of payout as last year saw unprecedented highs in iron ore.

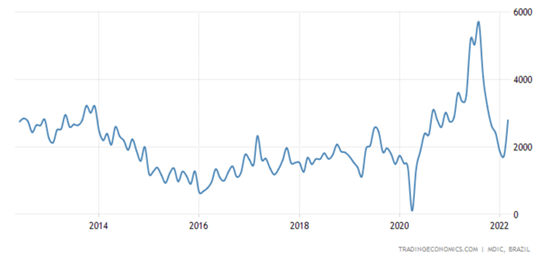

The sharp rise was primarily due to the loss of Brazilian supply following the Vale dam collapse.

This monthly chart of Brazil’s monthly iron ore export volumes illustrates that competing supplies are returning to the market.

The additional supply will serve to dampen international prices, so we are unlikely to see the 2021 highs north of 200 USD/MT anytime soon.

The massive ongoing building plans across Asia should serve to keep demand propped, so equally we are unlikely to return to 2015 prices in a hurry.

If prices are collared in the 100 USD/MT region, it is probable through continued operational improvements that FMG will be able to provide a very healthy dividend for years to come.

Results are in

The world is changing at an ever-increasing rate and the construction of cities, roads, highways and ports will continue apace.

FMG will continue to play a large role in Asia with quality Australian iron ore supply.

FMG is a dividend yield workhorse definitely worth considering for your portfolio.