- The S&P / ASX 200 opened 0.3% higher on Tuesday, with Chinese protests dissipating peacefully.

- Raw material price pressures return with the northern hemisphere winter and threaten a European economic revival.

- The upward trajectory of the Aussie market remains doubtful as high commodity prices start impacting customer demand.

COVID Fatigue

Chinese protests across the major city centres dissipated peacefully after a show of government presence. The central committee has had to do little to quell dissatisfaction with the zero-COVID policy.

The winter months will bring both an extension of troubling pathogens and frayed nerves as China looks to ride out what will likely be the last few months of its overarching response to COVID.

Markets reacted favourably to the peaceful dissolution of protesters, the Hang Seng bounced close to 4% in morning trade, and oil markets were up 1.5%.

Week in data

The positive momentum into Tuesday comes up against some heavy-hitting macroeconomic data to be published in Australia and abroad.

We can expect Australian building permits, key consumer price index (CPI) prints, and Chinese business sentiment (PMI) on Wednesday.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

This is followed later in the day by critical European inflation data, US GDP, and US employment changes (ADP).

Outside of the rebound in Chinese markets panacea, international markets wait with bated breath on the statisticians for direction.

Penny-pinching

After making a remarkable recovery to the index from the month of October, the S&P / ASX 200 is currently only 3% away from the year open. A stabilisation of the iron ore price in the 90-100 USD/MT range, gas for delivery in North Asia the 25-35 USD/MMBTU localisation, and Newcastle coal rebounding toward 380 USD/MT, the benchmark Aussie stock market index is displaying remarkable resilience.

Rallying commodity prices will do little to assuage the runaway inflation of our trading partners and will likely put pressure on Aussie resource volume orders. The UK’s natural gas consumption is already 15% lower than at a comparable time last year.

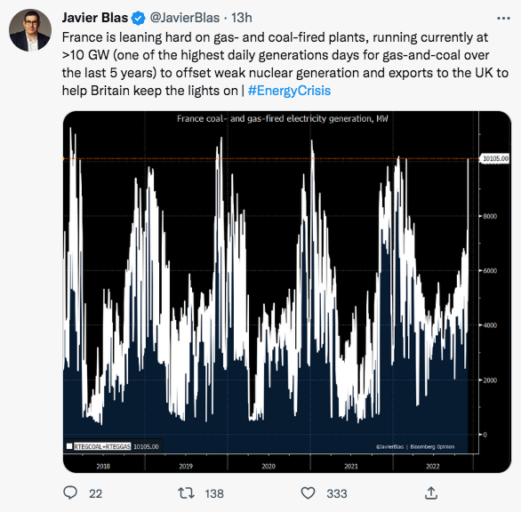

Still-air over Northwest Europe is reducing the amount of power generated from wind, draining precious coal and gas stocks, and driving up spot power prices.

Source: Twitter

With lockdowns in China to resume, energy demand this winter will again be lower than pre-pandemic. UK and European customers are finding ways to lower their energy consumption in the face of high prices. For those reasons, the recent rallies in gas and coal are likely to be short-lived.

A retracement of the November gains in the Aussie benchmark may potentially be given up as the reduction in demand causes prices to retreat somewhat.

Summary

The Australian market continues to be buoyed by record prices for a basket of raw materials.

While battery feedstocks, nickel, and lithium continue to search for new highs, most of our resources may struggle to find a bid at these levels. International customers will probably turn to reduced consumption rather than pay through the nose.