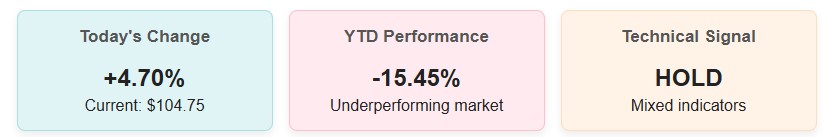

WiseTech Global shares (ASX: WTC) added 4.7% today after announcing its largest-ever acquisition: the purchase of U.S.-based logistics software company E2open for $2.1 billion. The deal, at $3.30 per share in cash, is fully debt-funded from a new syndicated facility.

According to WiseTech’s ASX announcement, the acquisition is a “strategically significant change in global scale and reach,” adding adjacent markets, customers, and products that position WiseTech to create a global, multi-sided trade and logistics marketplace. The transaction is expected to be EPS accretive within the first year, despite around $40 million in transaction and integration costs, and will add 500,000 connected enterprises to WiseTech’s network.

The market’s reaction was positive however, analysts are divided. Some cite the increased risk from the debt-funded nature of the deal, whilst others see it as a strong step for growth and diversification. Questions also remain about WiseTech’s ability to turn around E2open, which has seen client retention issues and a falling share price prior to the deal.

The acquisition fits WiseTech’s vision to “be the operating system for global trade and logistics.” By integrating E2open’s complementary suite, WiseTech extends its CargoWise ecosystem into domestic logistics, carrier integration, and global trade. The company reaffirmed FY2025 guidance and will update its strategy and FY2026 outlook in August.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review