It was an eventful week in the markets.

The Fed raised the Fed funds rate by 0.75% with the UK and Swiss banks following suit.

The S&P is levelling out this morning after the S&P 500 slid 6% on the week and the S&P ASX/200 reached a 52-week low of 6,416, down 7% on the week.

Oil prices

The benchmark Brent crude oil price is down 2.5% for the week.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

From your morning commute, picking the kids up from school, trips away, down to the groceries you buy, nothing has such a pervasive impact on your daily outgoings as oil prices.

So, what of all these lending rates raises by central banks?

Raising rates is designed to slow down the economy – it serves to dampen demand rather than up supply.

Current demand changes

Has there been a change in demand?

Yes, to a degree – we will look at the US as a proxy given the ready availability of recent data.

Across the US, the average price at the pump is up over 60% from the same time last year.

Finished gasoline supplied to the onshore market by US refineries (a demand indicator) was 9,093 thousand barrels per day last week – at the same time last year, it was 9,116.

That is with fewer commuting trips and less travel due to COVID in 2021.

Implied future demand changes

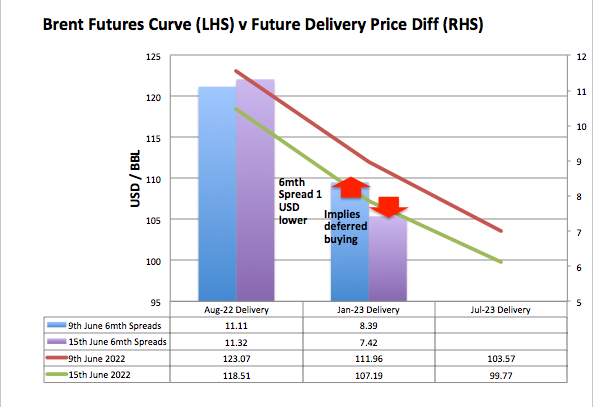

One methodology to assess the future demand and supply balance is to consider the oil futures curve, in particular the difference between the price willing to be paid today and in the future.

A higher price today versus a later date is called a ‘backwardation’ market and implies a tight supply/demand balance.

A shift to higher prices for the later delivery implies that buyers are willing to defer and demand is lower.

If we look at the Brent future curve over the last week, we can see that it is still currently a tight market today.

In comparing the price for six months delivery later versus 12 months delivery later, we can see that there has been some easing in the market view of the strength of the future market – it’s still tight but going in the right direction for consumers.

Source: https://www.theice.com

What of the other side of the coin, supply?

Oil supply

Libya outages continue to prop the market, and exports have slowed to a trickle.

Outages have been attributed to political unrest timed to coincide with tight oil markets in order to garner international attention and mediation.

A settlement could return just over 1 million barrels a day onto the market once production is ramped back up, though that could take several months from an agreement.

OPEC has between 1 and 3 million barrels a day of spare capacity.

Saudi Arabia is currently in a bind between drawing military aid from the US to assist with a restless Yemen to the south and a potential international slowdown on the horizon damaging future revenues.

US President Joe Biden meets with Saudi leadership next month and some concessions will need to be made by both parties for incremental supply to come to the market.

The US has responded with crude and natural gas liquids production up 10% and 20% year-over-year respectively – a full 2.3 million barrels a day higher than last year.

There is room for future increases in production this year, with the US rig count at 733, up 60% from last year.

Russian oil has been cut off from Western markets, but it is still finding a home in China and India.

It is impossible to cut Russia off from world markets entirely without skyrocketing the price for everyone given the position of the largest exporter in 2021 at 7.8 million barrels a day.

The European and US buyers are scratching around for every available barrel in order to substitute Russian supply, and when events such as those in Libya unravel, they have a disproportionate impact on prices.

Summary

We continue to see high demand and tight supply across the globe for all energy markets.

Central bank responses, diplomatic mediation efforts, and drilling activity are ramping up in order to address both sides of the supply and demand coin.

Elevated oil prices will swing the risk to a global economic ‘hard landing’ over a ‘soft landing’ – it remains to be seen which of those we’ll get.