- Core inflation in Europe and the UK is approximately 10% per annum.

- US inflation is not far behind; inclusive of energy, it is nearly 8%.

- Gold has long been seen as an effective hedge against inflation yet has stuttered around the 1,750 USD/MT mark for over two years.

Gold rush

Australia’s modern history is inexorably tied to gold. The frontier was marked by the incremental discovery of the precious metal and the associated waves of immigration that followed.

Key milestones in the development of the Commonwealth can be attributed to the incremental discovery and exploitation of gold resources.

Today Australia is one of the leading gold producers in the world, extracting and refining around 321 metric tons per annum and contributing over $20b US Dollars per year to the Australian economy in raw materials alone. In 2020 gold was our fourth largest export in US dollar terms.

Gold and inflation

Under the Bretton Woods system and earlier, currencies were convertible to gold only by governments and not citizens. Gold, in this role, was the immutable store of wealth. Currencies and their relative prices may have fluctuated by gold returning the same quantity of goods per weight. Gold at that time was a near-perfect hedge against inflation.

When Nixon’s administration dismantled Bretton Woods, removing the requirement to hold gold reserves facilitated greater flexibility in managing inflation and economic pressures.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

However, gold has remained in some capacity as an alternative and durable store of wealth and as a critical share of foreign exchange reserves for many countries, including the United States.

Though no longer directly linked to a country’s purchasing power, the amount of gold held by private and public institutions is still a very powerful statement of the value of total holdings and productivity.

Real rates

From the decoupling of gold and currency to the coupling of currency and monetary policy, gold valuation transitioned from a measure of a country’s wealth to a formula of the yield paid by the government minus inflation. Otherwise known as the real rates.

When currencies decline in value, gold prices will rise. The value of gold will appreciate when inflation outstrips the zero-risk interest coupon and there’s no compensation for the loss in purchasing power.

When real rates are rising, gold will decline as the “risk-free” yield is more attractive in cash than holding the defensive gold position.

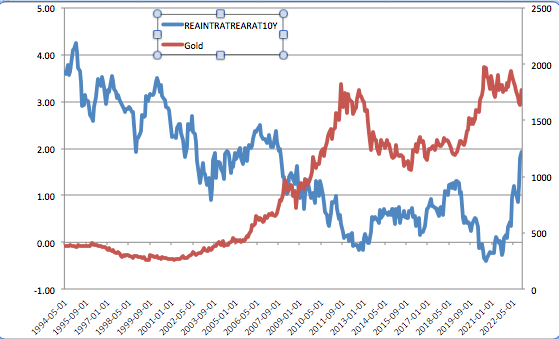

When real rates are falling, gold will be a more attractive holding than cash. The correlation in this relationship is referred to as inverse and, on a scale from 0 to -1, is a strong one at -0.75.

This graph illustrates that relationship. It is the inflation-indexed 10-year US treasury security. Currently, we’re seeing real rates appreciate following the sharp rise in Federal Reserve baseline funding rates.

The path forward

As reported, the US Federal Reserve is searching for an off-ramp to commence the slowdown in rate hikes. A likely outcome of the tapering of the rate-hike cycle is that real rates will decline.

A decline in real rates will most probably lead to an appreciation in the gold price. Given we’re starting from relatively high highs of 1,750 USD/MT, surpassing 2,000 USD / MT in 2023 is certainly on the cards.

Outlook

A stubborn inflationary environment and a gradual slowing in rate hikes is the most probable macroeconomic path in 2023, a positive one for gold.

There are a lot of milestones to clear between here and the Federal Reserve pivot, and the rapid technological advances in Artificial Intelligence have the potential to increase productivity and quickly lower inflation.

However, on the balance of probabilities, we may see the shine return to gold.