West African Resources shares (ASX:WAF) have taken a pause in recent sessions, after a period of substantial gains, with the stock up 84.69% since the start of 2025. The share price hit resistance around the psychologically important $3 level, hitting a high of $2.98, on to retreat into today’s close at $2.72 for a 3.89% loss on the session, and close to a 10% pullback from highs.

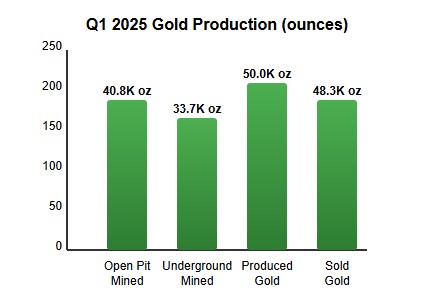

WAF’s recent performance has been underpinned by strong operational results and strategic initiatives. The company’s Q1 2025 production update revealed a solid output of 50,033 ounces of gold, sold at an impressive average price of US$2,832 per ounce. This performance keeps the company on track to meet its 2025 production guidance of 190,000 to 210,000 ounces, with site sustaining costs projected to remain below US$1,350 per ounce. The FY2024 financial results further bolstered investor confidence, showcasing a 49% increase in profit after tax to $246.2 million, a 10% revenue jump to $730 million, and a healthy cash reserve of $392 million. The company’s unhedged gold sales strategy has allowed it to capitalize on rising gold prices, contributing significantly to its profitability.

The upcoming Kiaka project is a major catalyst for future growth. Nearing completion, with first gold pour anticipated in Q3 2025, Kiaka is expected to substantially increase WAF’s annual gold production to approximately 420,000 ounces. This expansion positions WAF as a significant mid-tier gold producer and strengthens its long-term earning potential.

Reflecting this optimism, analysts recently revised the one-year price target for WAF to $3.54 per share, suggesting significant perceived upside from the current price action. The company’s inclusion in the S&P/ASX 200 Materials Sector Index further validates its growing prominence and enhances its visibility among investors.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

However, recent developments in Burkina Faso are injecting a dose of uncertainty into the WAF narrative today. The government’s new mining code, mandating an increase in the state’s free-carried equity interest in mining projects from 10% to 15%, will directly impact WAF’s operating projects. While the company has agreed to align with the new regulations, handing over an additional 5% stake, this move will inevitably affect its future revenue streams and profitability. Executive Chairman Richard Hyde’s comments emphasized the company’s willingness to cooperate with the government, but the financial implications cannot be ignored. This development is a contributing factor to the pullback in the share price, as investors reassess the risk profile of operating in Burkina Faso.

While the company’s operational strength and growth prospects remain attractive, this needs to be carefully weighed against the evolving political landscape in Burkina Faso and its potential impact on future performance. A drawdown after such a strong run in share price can be healthy, and with the stock in uncharted territory up at all time highs in recent days, price discovery dictates that markets look for support and resistance, where none has previously been found.

A potential period of consolidation, a deeper correction, or a retest of $3 could all be on the cards. This psychological level, and any battle that ensues between bulls and bears at that point could prove to be important determine the short-term trajectory of WAF’s share price.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2025.

We’re giving away this valuable research for FREE.

Click below to secure your copy