Unico Silver shares (ASX: USL) have been capturing headlines, with the price moving to new multi-year high, closing at A$0.425, a hold of the high coming after an impressive 28.8% increase to start the week. The surge, fueled by exceptionally promising drill results from the La Negra prospect within the Joaquin Project in Argentina, reflects a surge in investor confidence and aggressive buying activity. Trading volume was robust, with 7.36 million shares changing hands, pushing the company’s market capitalization to A$186.1 million. There is clearly some optimism surrounding Unico Silver’s strategic direction and its potential to become a significant player in the silver mining sector.

The stellar performance today extends a month-long rally, with USL shares up 57.41% on the period, and more than doubling (112%) since the start of the year. The stock has also significantly outperformed both the Australian Metals and Mining sector and the broader ASX market during this period, signaling its strength and resilience in a competitive environment. While shares remain below the all-time high set back in 2020 during the height of silver speculation, the current path will have bulls smiling.

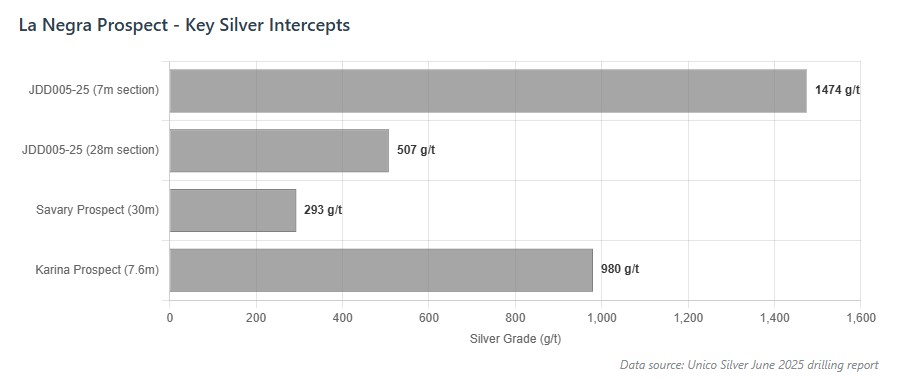

The catalyst for the recent upswing is the recent release of assay results from the infill drilling program at La Negra. In June, Unico Silver reported a standout intersection in drill hole JDD005-25, revealing 28 meters at an impressive 507 grams per tonne (g/t) silver from a shallow depth of 33 meters.

Within this section, a particularly rich 7-meter segment graded a staggering 1,474 g/t silver. These results are not just encouraging; they are transformative, confirming the existence of thick, shallow, high-grade silver mineralization.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

This discovery strongly supports Unico Silver’s PLUS 150 development strategy, which focuses on developing high-value, free-milling silver ounces, promising to significantly enhance the project’s economic viability.

Furthermore, Unico Silver’s strategic acquisition of the Joaquin Project from Pan American Silver Corp. in May has further solidified its position. This acquisition consolidated two contiguous properties, creating a substantial land package totaling 35,946 hectares.

The Joaquin Project boasts a historical foreign estimate of 16.7 million tonnes at 136 g/t silver equivalent, translating to a substantial 73 million ounces of silver equivalent. This strategic move not only expands Unico Silver’s resource base but also provides increased development flexibility and optionality.

Beyond La Negra, Unico Silver has also reported promising drill results from the Cerro Leon project, confirming multiple new discoveries. The phase-two diamond drilling program identified high-grade silver intercepts, including 30 meters at 293 g/t silver equivalent at the Savary prospect and 7.6 meters at 980 g/t silver equivalent at the Karina prospect.

Unico Silver shares are currently riding a wave of positive momentum, driven by drill results and strategic acquisitions. The focus now shifts to the upcoming Mineral Resource Estimate in late 2025, which will be a critical milestone in validating the company’s long-term potential. Despite the run up, risks remain, and proper assessment should be done before taking a position in any stock.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2025.

We’re giving away this valuable research for FREE.

Click below to secure your copy