- Global inflation is sky-high, and recessionary signals are on the rise.

- US GDP for Q2 2022 is published Thursday as a curtain raiser to the central banker’s annual Jackson Hole Symposium.

- International central bankers, Federal Reserve officials, other policymakers, and academics meet annually to discuss the economy. Will they be able to stave off an economic hard landing?

The economic landscape

The European Union economy is firmly in the doldrums, and economic data prints validate that picture.

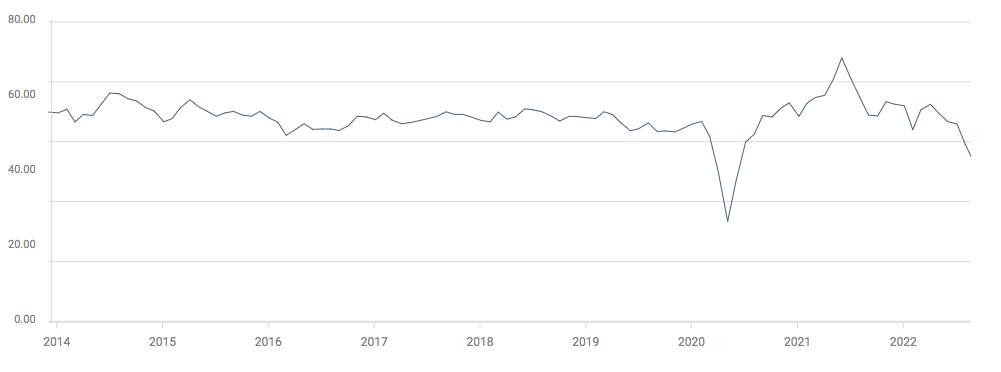

August’s preliminary European consumer confidence figure is closing in on the Global Financial Crisis (GFC) lows.

S&P European consumer confidence chart

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Most managers in the service industries, the largest sector in developed economies, overwhelmingly foresee a gloomy outlook for their businesses. The surveys suggest most will walk the path of scrimping and saving rather than spending and expanding.

S&P US services PMI dip

The trend in the data is downward, and there is potential for more pain in the markets to close out the week following high-impact US durable goods orders, Q2 US GDP, and words from the Jackson Hole Symposium.

Hardly surprising outcomes

The costs of doing business are high across the board. The pandemic and return of conflict to Europe slowed and rerouted supply lines and the movement of labour.

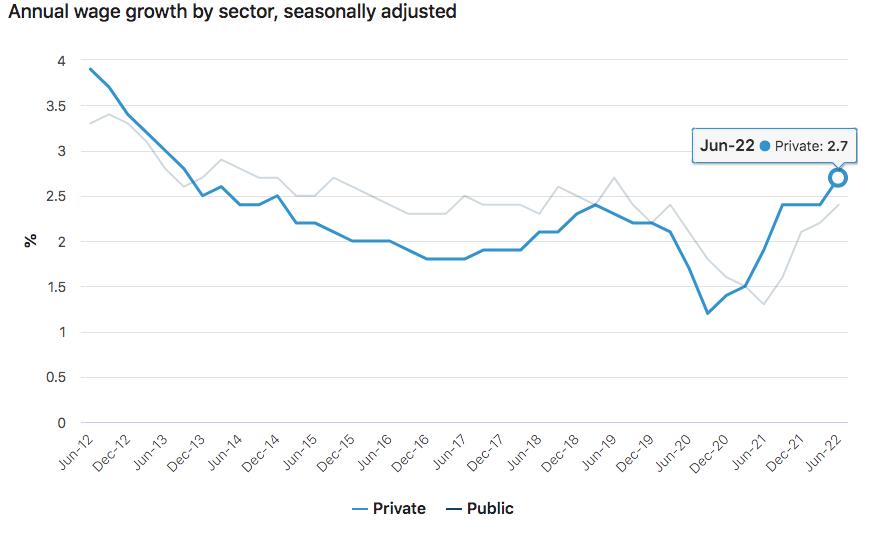

Restrictions in international and domestic movement, an aging population, and a bloated stock market giving early retirees an exit are some of the reasons wages are climbing.

Australian corporations are having to share out more of their profits with employees through salary growth.

The pressure on wages and raw material prices are doing little to brighten the outlook for corporation managers.

Monetary policy

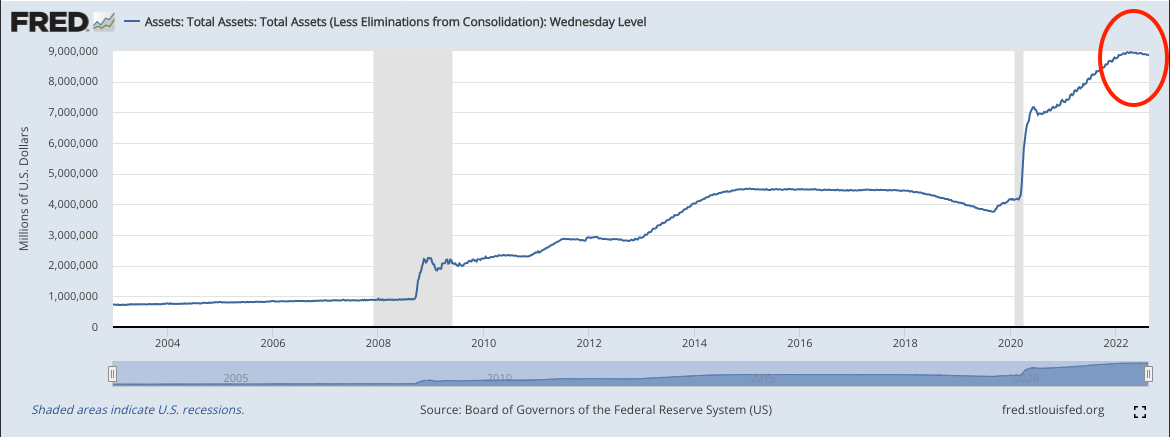

The recent eras of easy money are retreating, and policymakers faced with high inflation will continue to rein in wasteful expansion and spending.

The size of the US Federal Reserve balance sheet is well above historical highs. Of late, the board has taken the tapering approach, slowing down asset purchases and allowing certain debt instruments to mature without renewal.

Some markets have responded. Oil has been trading downward from June this year to hover over the $100 USD / barrel level.

There is little the Fed can do to assuage geopolitical grievances. Coal, gas, zinc, aluminium, wheat, seed oils, and many other commodities remain stubbornly high on threatened or rerouted supply routes.

Likely discussion points from Jackson Hole

We can expect Western economy policymakers to stay the course in their attempts to get on top of inflation. Any large stimulus packages brought in now to divert from a slowdown will only fuel massive price rises and crush enterprise.

With the current path, the hope is that a few of the more wasteful enterprises will be wound down or absorbed into fitter operations, creating a stronger foundation for productivity to catch up to demand and bring down prices.

Australian outlook

Australia is quite fortunate because it has a diverse portfolio of customers from the East and the West.

China is now looking to reopen for business post-pandemic, benefitting from the diversion of legacy raw materials supply from Russia to Europe. The Chinese economy is better insulated from inflationary pressures than the West.

As coal and other raw material sales from Australia to Europe inevitably start to retrace in the face of price-driven demand pressure, there is hope that China can take up some of the slack and prevent Australia from sliding into a recession with Europe.