- Asia opened lower on Monday, with the ASX shedding 2% at the open.

- The NASDAQ closed 1.8% down on Friday and a further 0.6% lower before the opening.

- Is inflation starting to turn the corner, and can we expect some relief from higher borrowing costs in the near future?

A rocky start to the week

The S&P ASX/200 started the week 2% down on Monday. Coal and energy were leading the Australian market lower with investors taking profits as the near future is looking increasingly uncertain for the economy.

Whitehaven Coal Ltd ASX:WHC (WHC) is down by over 10%, with fellow coal producer New Hope Corporation Ltd ASX:NHC (NHC) trailing close behind by shedding 10% of its value in morning trading.

The gas benchmark for sale in North Asia, JKM, is down over 5% Monday, and the decline in natural gas is pulling down the share price for Woodside Energy Group ASX:WDS (WDS) by 6%.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Nervous investors

The one bolthole not attacked thus far is the US Dollar. On promises of a more conservative approach to money supply and a higher yield, the security of the more extended duration debt instrument is drawing cash from other global assets.

The US Dollar index (DXY) is at levels not seen since January 2002, currently 113.84. It is helped further by the UK revealing a swathe of tax cuts in the face of a budget deficit and inflationary headwinds. The GBP is swooning and closing in on parity with the USD.

Is inflation turning a corner?

Some critical raw material prices have most definitely started to turn the corner. The energy and transportation sector has been leading the way down. JKM is off 30% from the recent highs, coal for delivery into European ports is down over 15% from July, and North Sea crude oil is down by 30% from June. Cosco Shipping Development Co HK:2866 (2866) has slumped 35% on lower freight container costs.

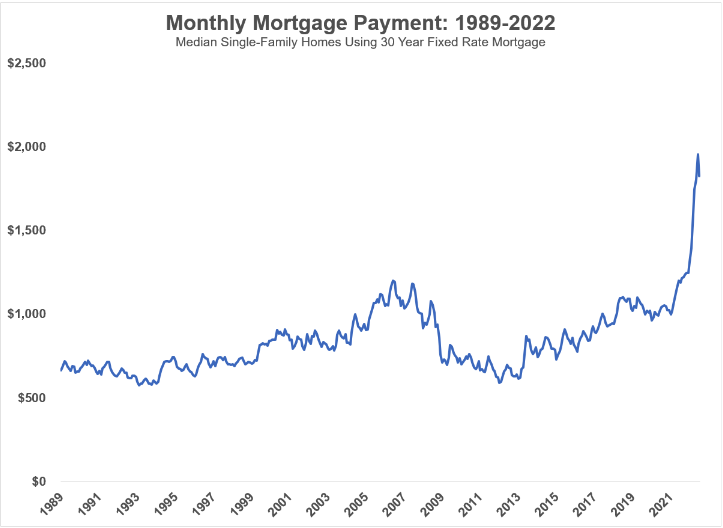

The US monthly mortgage payment on a median single-family home provides a stark picture of the current high cost of housing and borrowing.

Thus far, housing valuations have been insulated by low unemployment. Further afield in the US, it seems the pendulum is about to swing and a pullback in retail will send many of the pandemic-era small businesses to the wall.

In the coming months, we can expect unemployment to start to tick upward in the United States and Europe. The economic contraction has commenced, but it is yet to play out fully in the critical housing and nondurable goods sectors.

The weeks and months ahead

Given the sharp sell-off in the stock market, central bank policymakers may begin to take a more cautious approach to interest rate hikes. That will ease some of the concern around borrowing costs, but the work will not be done until the housing index and grocery prices abate.

Unfortunately, a rise in unemployment may finish the job that the Fed has started. Inflation has some way to go to fall back below policymakers’ targets, and the sledgehammer to demand that unemployment will provide may be the only route the Fed is considering.