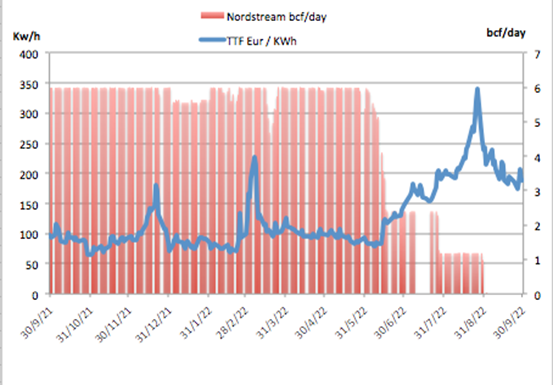

- Russia-Europe gas linkage Nordstream closed indefinitely.

- European prices have stabilised, suggesting the supply restructuring is nearing completion.

- How durable is the new energy supply chain? Can we see an inflation retracement on the horizon?

International inflation tightrope

The US has been walking the tightrope of importing and exporting inflation. It has been attempting to reign in prices at home for its residents and abroad for its trading partners that are currently exchanging commodities in US dollars.

Pincer attack on inflation

The monetary approach to lower prices has the Federal Reserve exporting inflation by stemming new money and raising interest rates. The result of these actions has the US dollar rallying 20% over the last 12 months, lowering import costs for US residents and suppressing prices denominated in US dollars.

At the same time, the Department of Energy (DOE) is importing inflation and moderating the stronger dollar effect by releasing crude oil from the Strategic Petroleum Reserve (SPR), thereby facilitating much higher oil and oil product exports. In concert, the FERC (department of DOE) has rubber-stamped a vast catalogue of LNG export terminals.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

This concerted effort has been successful regarding the energy basket component of inflation. Oil and gas are down by 27% from June highs, more than compensating for US dollar strength. It remains to be seen whether this will now extend to housing and wage inflation.

In the books

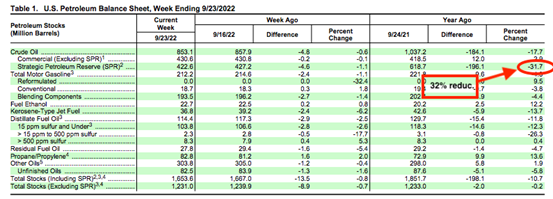

As we come to the end of the planned SPR release, what information can we derive from the US petroleum balance sheet?

A 32% drawdown over the year and 35% from the 2020 highs takes US import coverage from 100 to 65 days. There is still ample room for manoeuvring as most imports originate in the far more secure Canada versus the Arab League in the 70s, from whence the SPR policy commenced.

Gas supply chains

Before the Ukrainian conflation, European countries relied heavily on gas flows from Russia. The doubling in export capacity of LNG over the last 24 months to more than 11 bcf/day has mitigated the loss of Nordstream’s 6 bcf/day draw by Europe.

Despite the extended maintenance in 2022 and last week’s catastrophic damage closing Nordstream indefinitely, the European prices have stabilised, suggesting that European gas prices are independent of Russian supply.

The indefinite closure of Nordstream has not come without cost. European inflation is sharply up through September 2022. However, it is hoped that most of the supply line reorganisation is complete and will dampen future price spikes.

Australian impact

Stabilised energy prices are critical to our balance of payments and international trading partners’ prosperity. With a window into the next six months suggesting that energy prices are under control, there is some respite from the barrage of souring economic data.

Heating up

Following the slow start to the week with public holidays in China, Germany and Australia, the market news week will quickly ramp up.

Sensitive interest rate decisions in Australia and NZ, followed by a raft of international price and payroll data, will give a window into our near-term economic outlook.