The inflation and employment relationship

- Australian unemployment in participating workforce continues to slide

- CPI and wage inflation will continue to be fuelled as we near full employment

- What are the likely outcomes of moving toward full employment and policymaker responses?

The current state of affairs

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

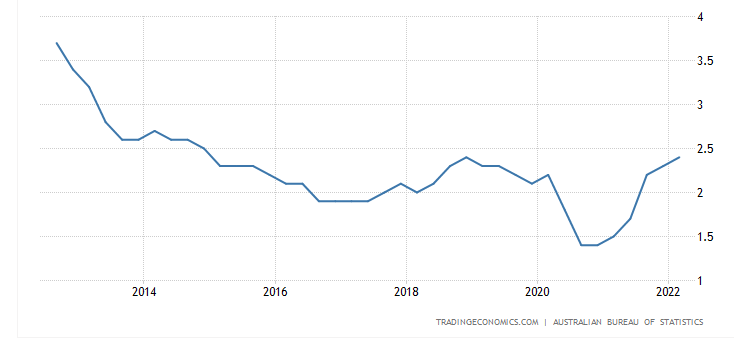

The Australia Bureau of Statistics (ABS) publishes a year-over-year (YoY) wage inflation index every quarter. Growth moderated during the pandemic but quickly recovered.

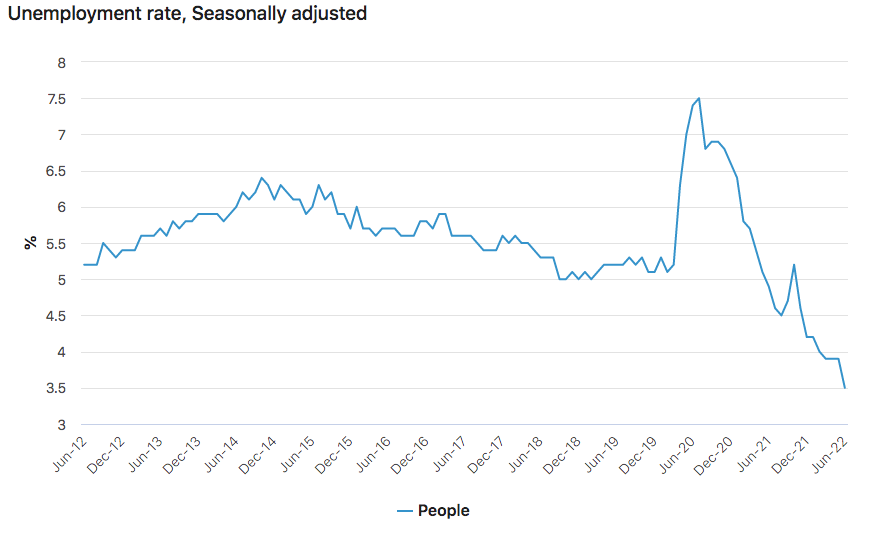

Unemployment in the participating workforce decreased to 3.5% in June, with the participation rate increasing to 66.8%.

The theory

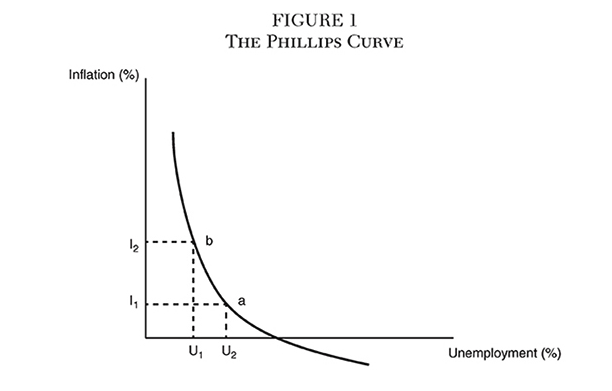

Milton Friedman was a preeminent leader in economic theory, and his work on the relationship between inflation and unemployment is often referred to in economic textbooks.

The theory suggests that with Australia’s tight labour market, incremental changes in unemployment will have a steeper impact on wages and subsequent price inflation.

As corporations fight for the best talent from a reduced supply, wages are likely to shoot up quickly.

Policymakers’ responses

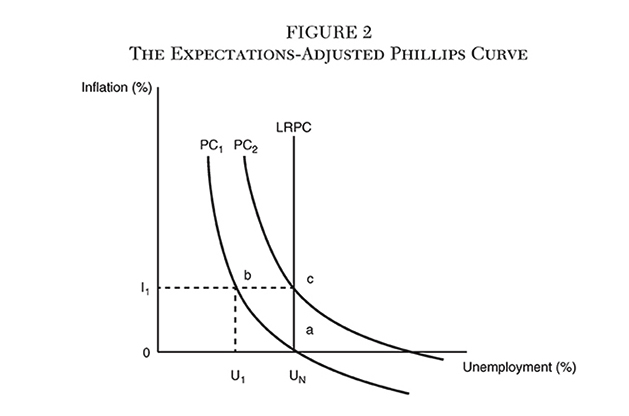

As the current reality is baked into our living conditions and outlook, the Phillips curve will reset, and changes in unemployment will have a more moderate impact on prices.

This is not before business budgeting cycles reset, which will be more than a few months into the future. Finance managers will be concerned about wage inflation impacting their net operating margins.

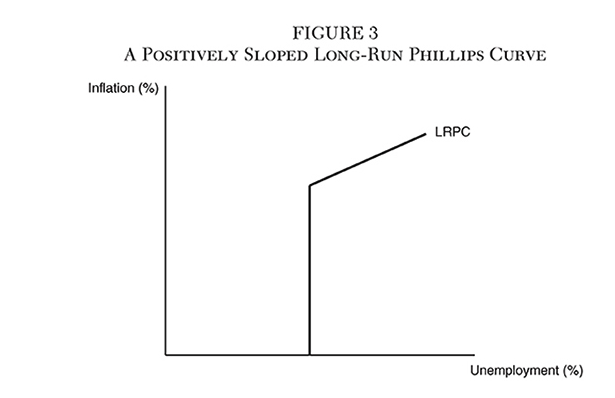

There is the risk that we enter the third stage of this curve, with high and variable inflation unsettling growth. It would be damaging for business and quickly increase unemployment.

It is a delicate situation for the Reserve Bank of Australia (RBA) to navigate as the arbiter of prices in Australia, trusted with creating the green business pastures of tomorrow.

Paul Volcker served as Chair of the Federal Reserve. Volcker’s monetary policies of heading inflation front-on to achieve price stability were proved to calm markets and improve growth prospects in the long term.

It is his playbook that is most closely followed by policymakers the world over and why we see such rapid rises in interest rates at home as Governor Philip Lowe attempts to stem the increase in prices.

Raising interest rates, incentivising saving and investment deferral versus spending is the primary policymaker toolkit response. It comes at the expense of the mortgagee and borrower but ensures that not too much is burnt out on inefficient expenditure, protecting future business growth and employment.

Energy inputs

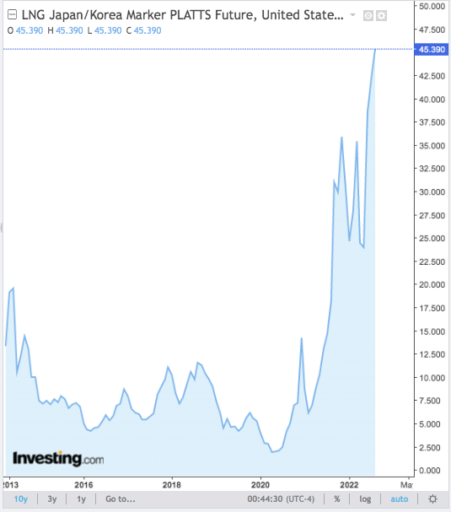

International energy markets provide input on a wide array of goods and services and have been driving global inflation with supply from Russia displaced and supply chains reorganised.

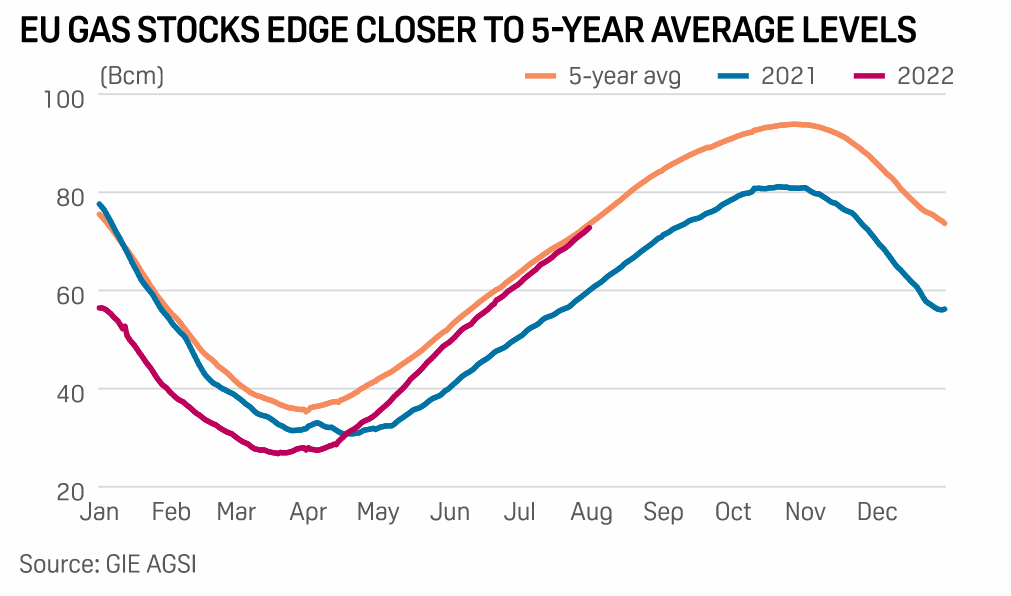

Recently passed European legislation requires natural gas stocks to be at or above 80% capacity by winter this year and 90% next year. The forced hand on importers has driven seaborne natural gas (LNG) to exceedingly high prices.

New seaborne gas demand from Europe is driving prices higher for its allies as Japan and Korea feel pressured to compete for winter restocking supply.

The high prices and restocking requirements on gas have kept coal demand high into winter. Australian coal has been one of the beneficiaries.

Europe has managed to get on track by paying through the nose for its gas and coal, but there is hope they can get through the winter without further emergency action or throttling supply to consumers.

As inventories return to normal, the likelihood is that in the coming months we will find a top in coal and gas prices, and the baseline inflation can start to retrace some of its recent runups.

Australia reset

With little room for additional employment growth without shooting up inflation, policymakers will be looking for commodity prices to moderate. Ideally, through new supplies at home and abroad with a more productive workforce.

As we look forward to a situation where the price of core consumables can find a top and start to retrace, a near future of moderation in policymakers’ responses and a slowing of interest rate hikes becomes possible