On Wednesday, China signalled an end to zero COVID and commenced a mitigation policy.

The Fed faces a difficult few days as inflation data is due on Tuesday, followed by a critical interest rate decision on Wednesday.

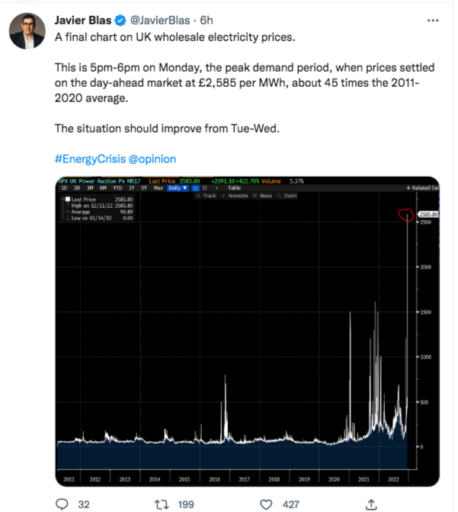

Cold and still air over Northern Europe is causing power prices to surge.

The Good

China has finally ended the most overarching and stringent COVID-19 policies on the planet. The country is scaling back an approach from one of elimination to mitigation of the emergent pathogen.

Iron ore has reacted favourably and bounced from the low 90s to north of 110 USD/MT. The news was welcomed by iron ore producer Fortescue Metals Group ASAX:FMG (FMG), currently trading at 21.02 AUD per share, up 8.5% on the month.

The reopening should boost oil producers and refiners because of increased demand as millions of Chinese visit relatives they’ve been unable to reach for the last three years.

An oil market in the doldrums is trading higher in Monday morning trade by 0.8%.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The Bad

The US Federal Reserve continues to face the incredibly difficult balancing act of continuing the rapid exit from a multi-decade low-interest-rate environment to keeping the lights on in some budding technological and growth sectors.

The strain is being felt, with NASDAQ down 30% year-to-date. The Fed is attempting to tread lightly over the emergent technologies of AI while clubbing down on some of the recent excesses of Silicon Valley.

Wednesday brings another critical interest rate policy decision, having already signalled a slowing of the rate-hike cycle, a strong inflation print on Tuesday could shift the tack.

Australian tech investors await the announcements with bated breath; an inflation print above the consensus expectation followed by a 75bps rate hike will weigh heavily on the tech sector. Xero Ltd ASX:XRO (XRO) and Wisetech Global Ltd ASX:WTC (WTC) are companies that will bear the brunt of such an outcome.

The Ugly

Cold still air over Northern Europe is driving power prices ever higher.

UK consumers are battling severely elevated power prices, which will continue to slash seasonal demand from the UK and Europe.

Further weighing on natural gas demand will be the key UK manufacturing and industrial production data due on Monday, followed by employment figures and the German inflation data on Tuesday.

Woodside Energy Group Ltd ASX:WDS (WDS) is down 7% on the month despite elevated prices. The nimble contracts of Santos Ltd ASX:STO (STO) have sent the company stock down a lesser 4%.

The production data will likely weigh on the benchmark indices on Monday, building up to the heavy-hitting employment and US data out on Tuesday.

Summary

The main narratives of the last few months continue into the new year. Positive news from China on the scaling back of zero-COVID will be welcomed by the resource producers but less so by the Fed and consumers already battling elevated prices.

The Fed might have hoped that China would hold on for a few more months to give a little breathing room in their policy direction as their job in managing the course of prices just got that bit harder.

Europe and the UK are presently faced with the nightmare power-producing scenario of cold, overcast, and still air. The weather fronts will shift in the coming days. Still, too many weather patterns such as this one in the next few weeks and months and the energy situation will become critical, perhaps plunging economies into a deep recession.