Pressure signs

International commodity market prices are still attracting high bids. As a result, there are signs that governments, businesses, and consumers are feeling the pressure and will not be able to sustain these levels for much longer.

Headline oil markets

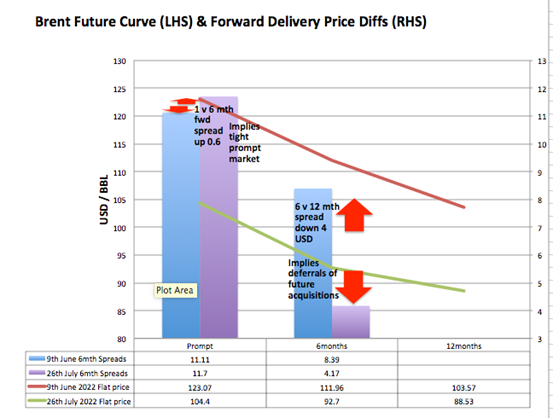

The oil market supply lines are tight if the outright price is trending sideways.

The international benchmark Brent grade is currently at $104.49 USD per barrel, having bounced around this level for several weeks.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The US continues to sell crude oil reserves in an attempt to bring down prices. However, the calibration of international refineries is such that it takes time to adjust the setup to allow for oil feedstocks they haven’t run previously.

With certain producers experiencing high demand for their product, physical oil delivery schedules continue to remain backed up, with refiners willing to pay a premium for immediate delivery for a crude oil specification they are used to rather than wait.

Looking into the future, the difference between the price for crude oil delivered in six months versus 12 months later has narrowed. The market is suggesting a softening of future demand with supply catching up or a mixture of both.

European struggles continue

Industrial and retail energy demand continues to run against the displacement of Russian supply into European markets.

Low river levels in Europe are adversely affecting nuclear power production just as utilities attempt to restock gas for the winter.

Switching in power production feedstocks is sustaining all-time high prices for seaborne coal and gas.

With governments and utilities willing to pay any price to keep the lights on, the enthusiasm for such a policy may start to wane when emergency winter preparations commence and energy shortages become life-threatening.

Construction slowing

The weight of high prices is starting to be felt in the industrial sector, with copper and iron ore being weighed down by construction project deferrals and struggling building developers across the globe.

Copper is down 30% over the last three months.

Iron ore has followed a similar trajectory, down by over 30% over a similar timeframe.

Impacts at home

Australian energy production creates a small buffer against imported inflation for Australians, whereas the energy importers of Europe have been subject to the full force of price rises.

The Reserve Bank of Australia (RBA) measure of price changes (CPI) for the second quarter came in at the market expectation of 1.8% higher than the first quarter of 2022.

There was little more than a ripple from the market in response to no new news. The Aussie dollar hovered at 69.21 cents to the US Dollar on Wednesday morning.

Near term in Europe

European countries are the biggest losers in the energy supply chain reorganisation the world is currently working through.

Prices for energy for European consumers are incredibly high now and will remain that way for some time. Power prices for delivery next year are already setting records.

With the supply unable to quench the high prices before winter, Europe’s consumers will suffer as a result.

Developing markets

The abundance of caution in reopening from COVID and the maintenance of close ties with Russia has to a degree, buffered China, the world’s largest commodity importer, from the worst of the runaway inflation.

There is hope that this policy of waiting and seeing from China will set a floor on global productivity when they decide to remobilise their population fully.

With Europe entering an economic downturn that will drag the US with it, the West will be looking to developing markets for customers to kickstart its slumping productivity.