- The US dollar has taken most of the recent headlines as an investor haven in uncertain times

- Meanwhile, Australia has experienced record resource demand and prices

- The Australian dollar is a compelling alternative to international investors seeking return and security

The closely followed Reserve Bank of Australia (RBA) interest rate decision on Tuesday resulted in raising the base lending rates by 0.5%, in line with the market consensus.

The Aussie dollar

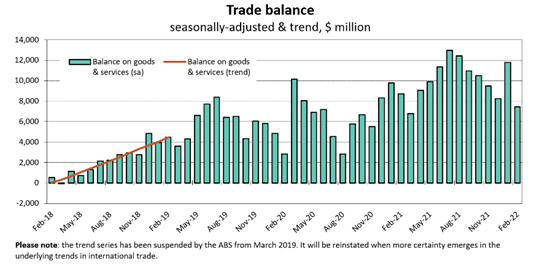

High commodity prices have kept the trade surplus rolling in, and even in the face of a record US dollar, the Australian currency is holding its own.

With Europe and the UK struggling under surging energy import costs, their currencies have wilted approximately 15% against the US dollar over the last 12 months.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Over the same time frame, the Aussie dollar is down a more moderate 5% against the US dollar.

The US dollar is trending higher against most currencies as investors flock to the relative haven. At the same time, supply chains are being disrupted, and the Federal Reserve provides more significant saving incentives through higher interest rates.

Outlook for the Aussie Dollar

Fortescue Metals Group ASX:FMG (FMG) raised its iron ore shipment forecast to 187Mt-192Mt, having exported 189Mt in the June financial year.

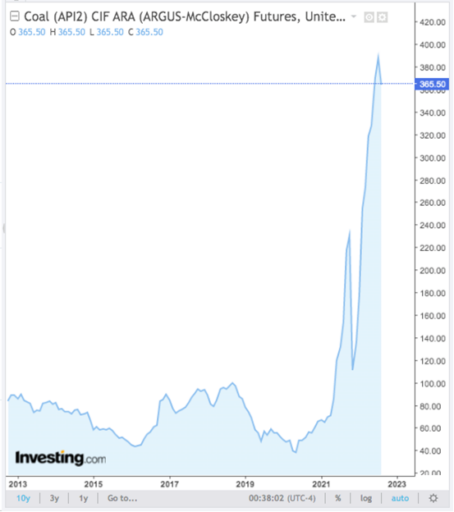

Demand for Australian coal delivered into Europe remains elevated, with international demand set to return to the highs of 2013.

Despite a recent dip on the back of a favourable weather outlook for renewable energy generation, the price of coal landed in Europe remains at stratospheric levels.

Whitehaven Coal Ltd ASX:WHC (WHC) continues to benefit from the opening of the European market for Australian coal.

The fast-approaching northern hemisphere winter against the backdrop of Russian gas displacement has thrown the afterburners on seaborne gas prices, LNG.

The gas price reference for North Asia, JKM, is back in unchartered territory as North Asia utilities restock for the winter having forgone some US cargoes to Europe in recent months. As the two regions compete for supply, prices have headed north quickly.

Australian gas supplier Woodside Energy Group Ltd ASX:WDS (WDS) valuation is returning to the highs of early 2020. It is currently trading at $32.56 AUD per share due to record gas prices.

Outlook for resource trading

Australian mining firms continue expanding their operations into a market offering extremely high margins on their product.

The shuttering of some international supply to developed markets has left the window open for Australian firms with their stable and well-seasoned low-cost operations to profit.

The financial year 2023 has all the potential to replicate the success of the financial year 2022 for Aussie miners and will provide healthy returns to shareholders.

The relative stability and security of Australian supply from developed and low-cost extraction with high near-term international demand will continue to drag profits back to Australian shores.

With no immediate sign of slowing demand for Australian resources in Asian and European markets, the Australian trade surplus will continue into the near future, supporting the Aussie dollar through repatriated earnings.

Aussie dollar outlook

The RBA will be forced to continue to apply the monetary policy brakes through rate rises to prevent inflation from getting too far away from them, providing an attractive yield for buyers of the currency.

The Australian dollar will continue to swell in this favourable monetary climate, and the likelihood is that it will continue to rise relative to its peers.