“Expert” investors are more likely to believe that investing sustainably is key to driving long-term returns compared with their peers who rate themselves as less knowledgeable, research by Schroders has found.

The finding is from Schroders’ Global Investor Study 2022, the bellwether annual survey which highlights trends based on the answers and opinions of more than 23,000 investors in 33 locations. Data was gathered between February and April.

How important is a sustainable approach to long-term returns?

More than two-thirds (68%) of people who class themselves as having “expert/advanced” investment knowledge believe sustainable investment is the only way to ensure profitability in the long term.

This compares with 52% of ‘”intermediate” investors and 43% of those who believe they have “beginner/rudimentary” investment knowledge.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Hannah Simon, Head of Sustainability Strategy, says: “The interaction between sustainability and returns has seen some polarising results this year. While self-professed beginner investors appear more sceptical, the majority of people believe sustainability is crucial to delivering long-term returns.”

What draws people to sustainable investments?

Similarly, 69% of “expert” investors share the view that investing sustainably can support positive change when it comes to challenges such as climate change.

“This is encouraging to see and further emphasises the crucial role asset managers and advisers have to play in helping investors better understand how investing sustainably can not only help overcome challenges such as climate change, but also support their long-term returns,” Hannah says.

She continues: “The study suggests an intrinsic link between long-term sustainable investment returns and solutions to some of the world’s social and environmental challenges.”

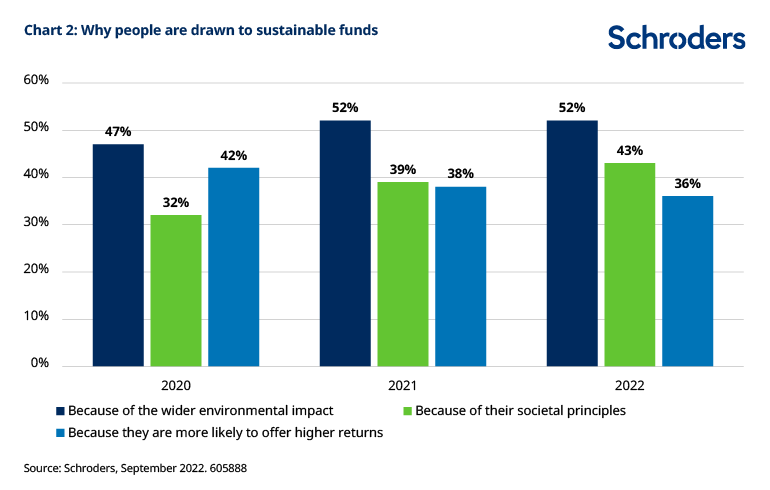

Specifically, the study found that environmental impact was the main reason people are attracted to sustainable investing. However, investing according to social issueshas grown in importance compared with previous years (selected as a driver by 43%, compared to 39% in 2021 and 32% in 2020).

What types of funds are investors most drawn to?

A focus on delivering financial returns unsurprisingly remains a priority for many investors. More than half (56%) seek funds that focus primarily on delivering financial returns while integrating sustainability factors.

That is particularly the case for people in Asia (61%) and the Americas (60%), while people in Europe were more likely to choose a fund with sustainability characteristics (51%).

What would encourage people to increase their sustainable investments?

As well as the ability to choose investments aligned to their personal sustainability preferences, just under half (48%) said that more education around sustainable investing would encourage them to allocate more sustainably. The lack of clear definitions of sustainable investments was cited as one of the most significant barriers to investing sustainably by all knowledge levels.

Andy Howard, Global Head of Sustainable Investment at Schroders, says of the overall findings: “This year’s survey results show that environmental challenges remain one of the key reasons individuals are looking to invest sustainably. However, the focus on the ‘S’ in ‘ESG’ can’t be forgotten, with human capital, education and equality all top of people’s investment priorities.

“Financial education is a key element in driving more capital towards sustainable investing. It is clear from our research that what people seek is essentially guidance and clarity. The more people are able to understand what they are investing in and their impact on society and the environment, and the relationship to portfolio returns, the more capital we should see flowing into sustainable investing.

“That is why, each quarter, Schroders provides an update on the themes shaping the sustainability landscape. These reports have been created to demonstrate Schroders’ commitment to considering ESG factors into the firm’s investment processes.”

Originally published by Schroders