- Several key Multi-National Corporations (MNCs) have announced slowing hires or deliberate retrenchments in 2022 and 2023.

- The IMF expects global growth to slow from 6% in 2021 to 3.2% in 2022 and 2.7% in 2023.

- The Fed highlighted persistent service sector inflation on Wednesday and marginally raised the inflation outlook in the US. Costing the S&P500 4% from the Tuesday highs.

Stagflation

Stagflation is defined as a set of economic conditions categorised by slowing economic growth, high inflation, and high unemployment.

It is considered undesirable by policymakers and politicians as such conditions will quickly decrease the standard of living in any nation harbouring them. It can also quickly change political alliances.

Employment and Stagflation

Talk of stagflation is on the rise. Until now, the near or actual highs in employment participation and the lows in unemployment in the UK, Australia, and the US, amongst other nations, have quelled any disquiet from those banging the stagflation drum.

As entities, banking conglomerates Goldman Sachs NYSE:GS (GS) and social media giant Meta NASDAQ:META (META) announce large scale job cuts in 2022 and 2023, the market is catching on that our stellar employment figures may soon lose their lustre.

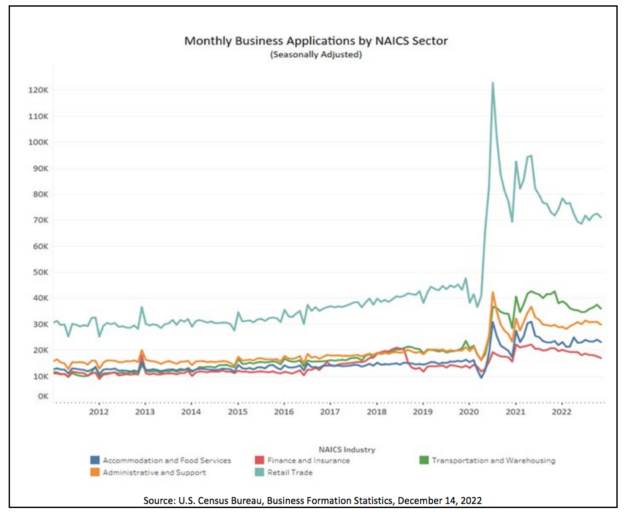

The sharp rise in new businesses created at the onset of the pandemic will soon meet the high cliff of survivability odds. US government published statistics show that 20% of new businesses fail within two years and 45% within the first five years.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The feast-to-famine transition might be hard for any business, now faced with its ephemeral survival battle in a field of record size. One might expect a higher loss rate in an environment stripped of its rich fiscal and monetary pastures more than in prior years.

The rationalising of payroll by some MNCs atop a sharp slowdown in new business activity combined with the runoff of a record pool of pandemic-era businesses sets up a challenging few months ahead for the job seeker.

Mountains out of molehills

The exact scope and nature of the next few months’ job losses are purely speculative at this stage. After all, we are coming from a record low in unemployment. Those actively participating in the job market may find a home rather quickly or transition into sectors such as mining and mining services that are desperately trying to fill roles.

From so low to the ground to start with, it’s possible the net job losses may not be material enough to send the global economy into a period of extended economic downturn.

Positives

Though the Fed hasn’t said it in as many words, given the political sensitivity of employment, a moderate uptick in unemployment would go a long way toward achieving its goals of reigning in prices and inflation in the service sector, thereby quenching the fires of inflation and opening the door to spending growth.

The sharp sell-off on Wednesday was led by market participants’ fears of a budding stagflationary environment in the US and possible international contagion.

Australia

Australia, until now, has mainly been inoculated from any talk of stagflation and sharp rises in unemployment. The windfall profits made by the largest miners in recent years have provided additional job security to their large immediate and indirect workforces.

That is not to say we’re immune from the global effects of stagflation. A sharp downturn in Europe and Asia, led by economic malaise there and in the US, would negatively impact the commodity prices responsible for our present condition.

Outlook

Talk has risen of stagflation in 2023, though at this stage, it is nothing but that, talk. Significant advances in AI can potentially increase productivity sharply, the Chinese reopening may prop commodity prices for months to come, and workforce rationalisation may keep wage inflation in check.

That is not to say it won’t be talked of further, and the economic malaise of stagflation is an ever-present risk to some of our biggest trading partners.