- US Federal Reserve stems the money supply to rein in prices

- The US Dollar is appreciating in value

- Developing nations struggle under the weight of higher borrowing costs, the reduced purchasing power of their currencies, and runaway inflation.

Deadliest catch

In the television show “Deadliest Catch”, Alaskan crab fishermen risk life and limb battling high winds and turbulent seas over the prized Bering Sea fishing grounds.

Amongst the myriad of threats to their vessels, the most dangerous is a situation known as “Slack Tanks”.

When a tank is partially filled with water or catch, sometimes presented due to a faulty pump or sensor equipment, the momentum of the tank contents in volatile seas has the potential to capsize the vessel.

Fed pump slowing

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

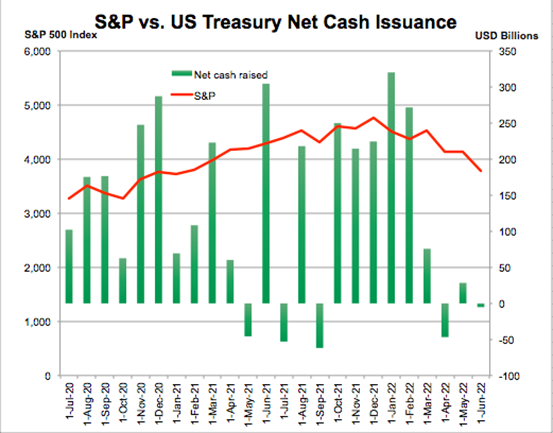

To rein in prices, the US treasury has slowed the new issuance of government debt, and the Federal Reserve has stemmed the new money supply through tempered asset purchases.

The effect of these actions on US government securities is to raise the yield and, as a result, has made US dollar-denominated assets more attractive to investors chasing quality returns.

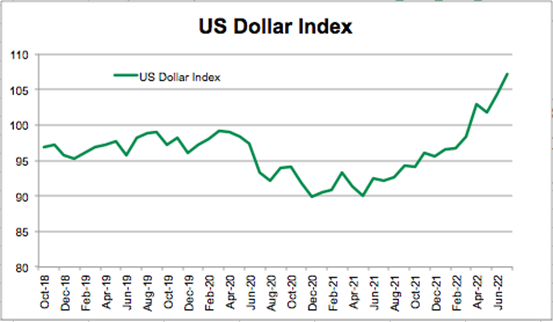

20-year high in US dollar index

The US dollar value against a basket of other currencies is at its highest in 20 years.

Higher dollar lower asset

A higher US dollar has lowered the relative value of assets and clouded the near-term outlook for stocks.

The net removal of US Treasuries from the market from April to June coincided with a 16% drop in the S&P 500.

Momentum in the tanks

With developing nations, Ghana, Pakistan, Egypt, Tunisia, and El Salvador increasingly likely to join Sri Lanka in defaulting on government borrowings, money managers are searching for less risky yield.

The momentum of this trade accelerates and further deteriorates the outlook for developing nations as their currency declines in value relative to the US dollar. As a result, the cost of importing essentials climbs when priced in their own currency.

Liquidity draws and volatility

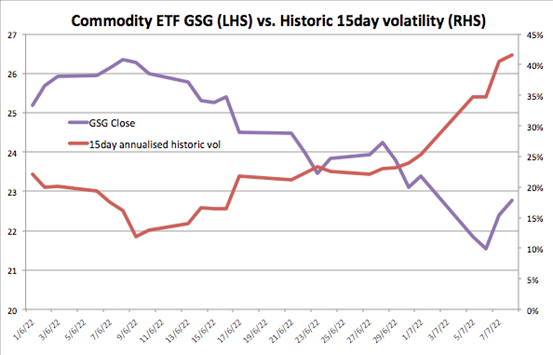

Pain points for commodity importers continue as liquidity is drawn from the market. Money is bouncing in and out of commodities in response to US policymaker actions, continued geopolitical stresses on the commodity supply chain, and still high demand.

International commodity basket ETF NYSE:GSG (GSG) 1-month change in value charted against the realised volatility.

Impact on Australia

A marked downturn in developing nations will have a material impact on Australian trade both directly and indirectly.

Directly through the billions of dollars in trade done with developing nations.

Indirectly is likely the largest segment of risk, and it’s very difficult to assess.

As part of China’s Belt and Road Initiative, many huge loans have been made to developing nations to secure resources and develop infrastructure.

A souring of the credit quality of these nations will likely have a negative impact on the Chinese economic outlook and, as a result, Australian resources, in particular, the bedrock of the Australian economy in recent times, iron ore.

Warning lights

A strong US dollar has not uniformly spread the recent fallback in commodity prices worldwide. Developing nations continue to struggle under raised borrowing costs, high levels of US dollar-denominated debt, and elevated commodity import prices in their currencies.

The removal of the money pump might have temporarily ameliorated commodity prices at home for the US but runs the risk of capsizing the global economy.