- The rise of cheap solar cells and scaled wind turbine production displaced new nuclear on price.

- The Fukushima disaster caused many countries to re-evaluate their existing relationship with nuclear.

- Hostilities on the European continent have caused countries to shore up their energy mix and nuclear is now returning to vogue – what are the easiest ways for investors to participate?

A product of a bygone era

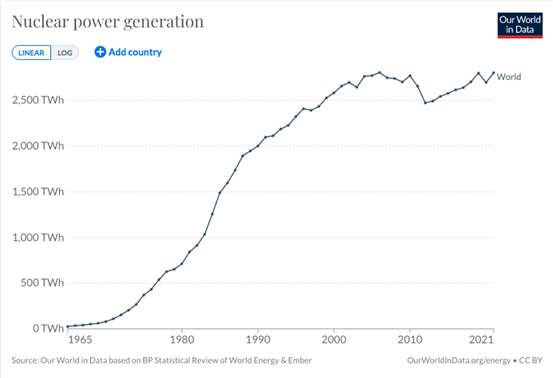

Nuclear power generation exploded through the 1960s to 80s as it lessened energy importers’ reliance on volatile foreign oil and gas markets.

Though expensive, nuclear power generators come with several benefits. Provided that you can safely dispose of the waste, nuclear does not emit pollutants into the atmosphere.

If you have enough water, nuclear power generators provide round-the-clock stable power load to the grid.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Renewable hardware costs have declined dramatically recently, with wind and solar forming the bulk of new generation capacity.

Wind and solar come with drawbacks – as often happens, the wind dampens and the sun retreats and the power dries up. Termination of flow results in blackouts unless there is a baseload generator to fall back on.

The heavy lifting in the baseload power role has fallen to steam coal and a shift into gas turbines. The recent volatility in power and gas prices has caused countries to re-evaluate their energy security mix and pushed governments to order restart and reinvestment in nuclear generators.

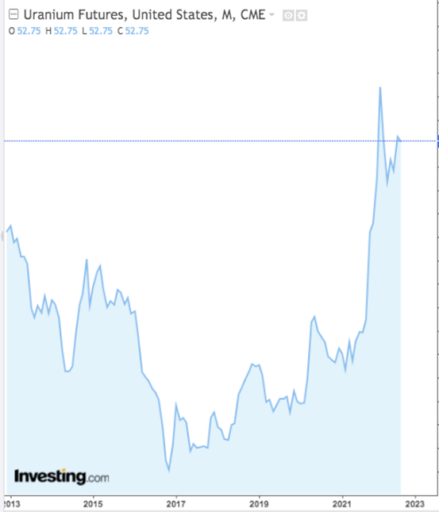

The anticipated return of nuclear power to the power generation mix across the globe is sending the price of the primary feedstock of uranium higher.

The return of nuclear

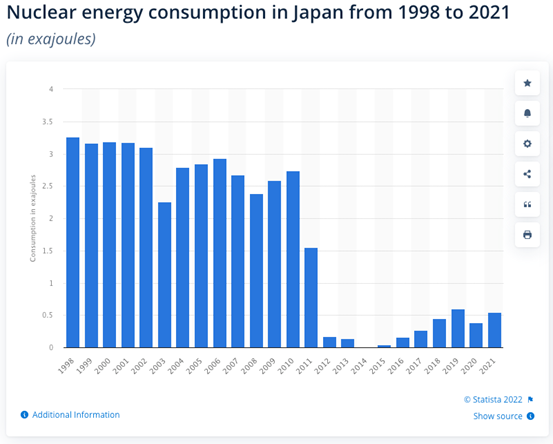

Japan’s nuclear energy consumption fell precipitously after 2011 as its nuclear power generators were shuttered.

The stark acceleration in gas prices has caused the Japanese government to turn 180 degrees on its nuclear policy of the last 10 years and order the restart of generators across the country.

Groupthink squeezing prices

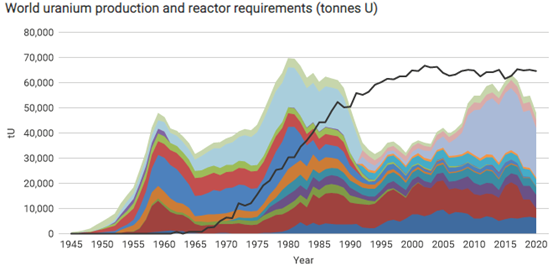

Investment in uranium mining has lagged given that investors were funnelling dollars to renewable generation. The squeeze in gas and coal has forced policymakers to pay more attention to their baseload power mix.

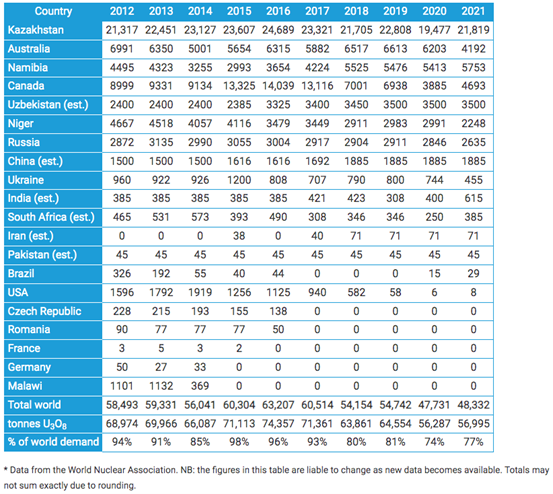

The reintroduction of nuclear will not come without cost, as the draw from renewables has caused a shortfall in uranium production versus projected demand. A Japanese restart will exacerbate these issues.

Australia’s position

Australia holds vast uranium reserves – 28% of global resources. The extraction and export of refined ore is a politically sensitive topic that has stymied investment. Australian exports are less than 10% of the worldwide basket.

The reduced international demand post-Fukushima slowed Australia’s production further to match the market requirements.

US firm Heathgate and BHP Billiton ASX:BHP (BHP) produce the bulk at Beverley Four Mile and Olympic Dam respectively.

BHP as the largest producer in Australia will be the primary beneficiary from any new demand tightness and is best placed should production expansion be tabled.

For the Australian investor, BHP remains the easiest route to participation in the uranium market. An alternative is the Global X Uranium ETF NYSE:URA (URA), which bundles international uranium miners and processors.

Turning point

The anticipated restart of Japanese demand, Germany staving off shuttering through the winter of 2022-23, and a busy Chinese schedule of nuclear generators starting over the next decade could mark the return to the spotlight for nuclear and uranium.