- The Asian market broadly sold off Monday morning.

- Markets have reacted poorly to positive economic data out of the US.

- Positive economic news troubled the stock market Friday as investors anticipate further rate tightening to stifle inflation.

Positive economic news troubles the stock market

In a twist to the normal proceedings, positive economic news is currently negative news for the stock market and vice versa.

On Friday 7th October, the September print of the US labour force participation rate was marginally above the consensus prediction at 62.3%.

The closely watched US Nonfarm payrolls were higher than the expected addition of 250,000 jobs – 263,000 were added in September.

The previous print of 315,000 suggests that the market is cooling to a degree, though not to an extent to warrant the US Federal Reserve to take its foot off the monetary policy brakes.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Resilient employment figures have investors fearing a drawing out of the rate-hike cycle currently being utilised to stamp out stubborn inflation, with a buffer on employment available for the Fed to lean into.

Market response

The more interest rate-sensitive and technology-heavy NASDAQ was down 3.8% on Friday, and the US S&P 500 was down 2.8%. The S&P/ASX 200 was trailing the US losses with an open 1.5% lower on Monday.

Australian technology stocks leading the market downward with software company Xero Ltd ASX:XRO (XRO) down 3.84% at the open and buy-now-pay-later payment solution provider Afterpay ASX:SQ2 (SQ2) off 6.37%.

No help from OPEC

As the US arrives at the finish line of the US Department of Energy (DOE) petroleum reserve (SPR) release schedule designed to cap oil prices, oil markets are looking for a direction on the future price.

The US, until last week, was looking to OPEC to take on the additional one million barrels per day market supply that the SPR sales brought. However, OPEC had other ideas and has taken steps to stem participating nations’ production.

The potential three million barrel per day swing from one million barrels per day excess supply from the SPR to a two million barrel per day deficit on the OPEC production has sent a mini shock through oil markets.

As a result of the above developments, Brent crude prices out of the North Sea were up by the close to 10% on the week.

Anticipating the Fed

The 2-year US treasury yield leapt higher Friday to settle at 4.31%. The 10-year versus the 2-year is firmly in negative territory at -0.41%, a recessionary precursor.

A negative yield spread is noteworthy as it suggests that investors are deferring investment, purchasing longer-dated bonds over near-dated bonds to weather anticipated proximal market turbulence.

As investors move money to more secure timelines, the future becomes self-fulfilling as corporate boards react and shy from near-term investment horizons.

Near-term outlook

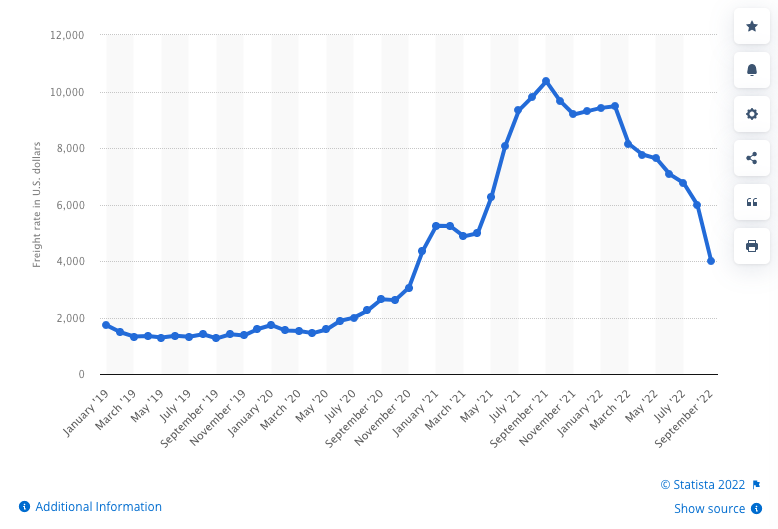

Of course, investors may be acting with an abundance of caution. In a bright spot for the inflation doves, the global container freight index is off markedly from the post-pandemic highs.

There is also the possibility that the DOE will draw out the SPR release to mitigate the OPEC policy.

Nothing is in the books yet, and pre-emptive selling may have jumped the gun on an economic contraction.

Leading indicators of widespread recession are often wide-of-the-mark and returning productivity may still do the deflationary heavy lifting.