In the turbulent tides of the markets, Pilbara Minerals Limited (ASX: PLS) share price is currently weathering a downturn with its share price experiencing an 13.15% slip over the past month. This decline might disconcert investors at a glance, but a deep dive into the company’s fundamental financial health indicates this may be little more than a momentary blip on an otherwise strong financial radar providing underlying market fundamentals are also in sync.

Pilbara Minerals, a powerhouse in the lithium and tantalum mining sector, has reported stellar metrics, one of the key indicators being an outstanding Return on Equity (ROE). With an ROE clocking in at 43%, the company’s profitability efficiency is remarkable indeed. This reflects a company that not only makes good use of its shareholders’ funds but does so at a level above the industry norm.

This efficiency in generating profits hasn’t been a flash in the pan either. Over five years, Pilbara Minerals has shown a net income growth of 77%, handily trumping the average industry growth rate of 21%. Such an impressive long-term growth trajectory suggests a robust competitive advantage and an adept management team that is steering the company towards sustained profitability.

Despite this growth, PLS has taken a strategic stance by not distributing dividends to shareholders. This decision allows the company to channel financial resources back into the business, fuelling its high earnings growth. While the absence of dividend payouts might be less attractive to income-seeking investors, it is a boon for those looking to capitalize on the company’s expansion and value appreciation over time.

Analyst Price Targets Not Strong For PLS

The road ahead isn’t devoid of bumps if analyst consensus is anything to go by. Market analysts have cast a watchful eye, predicting a potential decline in earnings for PLS shares, with the consensus target of $3.71 more than 3% below the current mark of $3.83. The current high bar is set at $4.50, with the low down at $2.50. This forecast contrasts starkly with the company’s noted past earnings escalation and might contribute to investor wariness, adding to the share price pressures observed.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The critical question for investors becomes whether the recent price decline represents a good buying opportunity or if it is a harbinger of more fundamental issues. Given Pilbara Minerals’ solid past performance and strong fundamentals – including a high ROE, impressive income growth, and strategic reinvestment policies – the current weakness in their stock price could be a temporary phase for the company amid a cautious market outlook.

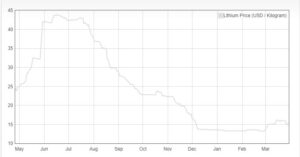

So why is Pilbara Minerals share price dropping? Looking to the fundamentals and the market Pilbara Minerals operates in can give some indication. As a major player in the Lithium industry, the underlying price of Lithium will have an undoubted impact on the success of the company. Prices for lithium have been tailing off since mid July last year, and PLS has followed the trend at least as far as sentiment. You can see from the images here that the pattern as far as peaks and troughs can be identified quite clearly.

Investors might do well to weigh these factors heavily against the anticipated headwinds. In the calculus of risk and reward, the former seems to stand tempered by a proven record of financial strength, leaving room for potential gains if the company can navigate through the predicted future earnings dip as adeptly as it has in the past but much of the future direction will depend on the appetite for lithium.