Potential merger with Newmont could create an Australian gold-mining giant

- Newmont Mining and Newcrest Mining are reportedly still in discussions about a potential merger.

- Combining the two companies would result in the largest mining transaction in Australian history.

- Newcrest revealed significant growth potential for its Red Chris, British Columbia mine.

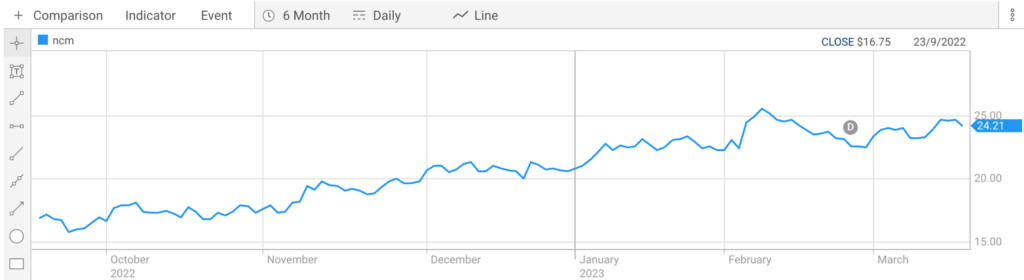

Newcrest Mining (ASX:NCM) is Australia’s leading gold mining company and one of the world’s top gold miners. The company has benefitted from the surge in gold prices since September 2022, and many analysts believe Newcrest is a buy at current levels.

Source ASX

The recent rise in gold prices has occurred despite a strong US dollar. But this USD strength may be short-lived as banking sector jitters in the USA and Europe create global economic uncertainty. Amid this turmoil, investors are likely to become more risk-averse, leading to a shift away from the US dollar towards safe-haven assets like gold and silver.

Another factor that could drive NCM’s share price higher is the possibility of a takeover bid. In February, the company rejected a $22.4 billion AUD offer from Newmont Corporation (ASX:NEM), the world’s largest gold mining company.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Newcrest and Newmont are reportedly still in discussions regarding a potential deal. The two miners have signed non-disclosure and standstill agreements, allowing them to meet in person and consider the price required for a takeover.

Newcrest’s local institutional investors quickly recognised the benefits of a merger but asked the board to hold out for a higher price. Newcrest recently released an exploration update for its 70%-owned Red Chris gold and copper mine in British Columbia, highlighting growth potential it believes Newmont has discounted in its proposal.

Combining the two companies would create a gold mining behemoth through the largest mining transaction in Australian history. There is also potential for another company to bid for Newcrest, especially as the price of gold continues to rise. However, Canada’s Barrick Gold, the world’s second-largest bullion producer, said it was unlikely to place a rival bid.

The future looks bright for Newcrest

Overall, Newcrest Mining is a strong company with a bright future in the gold mining industry with a track record of delivering solid financial results. Its management team has demonstrated a commitment to shareholder value, and the company is well-positioned to benefit from the current positive sentiment towards gold.

Newcrest’s diverse portfolio of gold and copper mines across Australia, Papua New Guinea, and Canada helps mitigate the risks associated with mining in a single location and makes the company an attractive opportunity for investors seeking exposure to the gold sector.

Despite the positive outlook for Newcrest, investors should always conduct their research before making investment decisions and be aware of the risks associated with the mining industry.

The price of gold can be volatile and is subject to various economic and geopolitical factors. In addition, the mining industry is subject to regulatory and environmental risks that may impact Newcrest’s operations.