We have accepted the fact that there won’t be many quiet weeks in markets this year.

Equity markets tumbled on Tuesday morning (newswires blamed growing recession fears), but most stock markets climbed for the rest of the week and ended up gaining almost 2.0% heading into Friday.

Bond yields ended a touch higher, with yields across maturities out to 10 years trading right around 3%, but not before they briefly fell all the way to 2.75% on Wednesday.

In foreign exchange, the Euro is approaching parity with the US dollar for the first time since the early 2000s. Expect to see a lot more Paris and Positano on your Instagram feeds this summer.

The commodity sell-off continued, although a Thursday bounce flattered the performance of the complex. Nonetheless, retail gasoline prices in the U.S. are set to fall back towards $4.50 per gallon from a peak above $5 in early June.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Meanwhile, investors parsed reports that increased stimulus may be coming from policymakers in Beijing and watched the end of Prime Minister Boris Johnson’s memorable tenure as the head of the U.K. government.

On Friday morning, the U.S. awoke to sad news from Japan. Shinzo Abe, who served as prime minister for the country for most of the 2010s, was assassinated while giving a campaign speech. Investors will remember him for being a champion of unprecedented economic policy dubbed ‘Abenomics’.

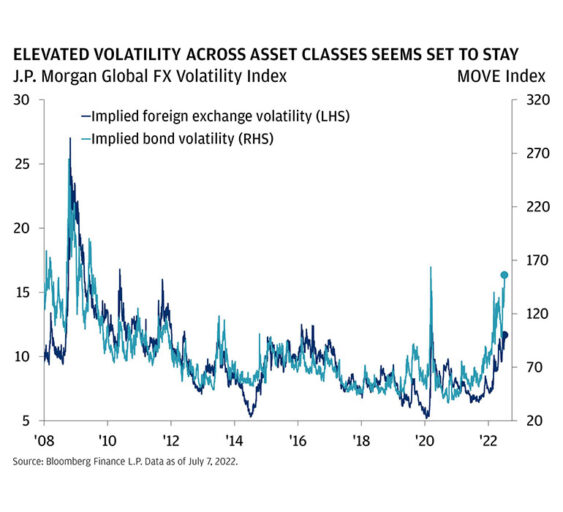

As much as we’d appreciate a breather, volatility seems set to stay. The VIX index of equity market volatility suggests a move of around 1.5% higher or lower every day for the S&P 500 for the next month. Fixed income implied market volatility is higher now than any point over the last 10 years. Foreign exchange volatility was only higher during the Chinese currency devaluation episode in late 2015/early 2016 and the initial COVID crisis.

We don’t think markets will calm down until central banks feel satisfied that they have bent inflation back to a more tolerable rate. Policy rates are the foundation for the global financial system. When investors have little clarity on where they will be in the future, it introduces tremendous uncertainty for the proper price of assets now.

The good news is that we think that most of the hard work in controlling inflation has already been done. The bad news is that also means recession risks are elevated. Now investors will just have to wait to see if Central Bankers see enough evidence of falling inflation in the data so that they can feel confident enough to take their feet off the brakes.

Spotlight: Glimmers of Hope

This week was encouraging for those who think the U.S. economy will avoid a near term recession. While the risks of a material economic downturn are clearly elevated, we did see evidence this week that inflation could deteriorate faster than the labor market.

Financial markets seem to be taking the Fed’s message of fighting inflation at all costs very seriously. Even after a bounce on Thursday, broad commodities are 16% below recent highs, retail gasoline is down 21%, and copper is down 29%. Industrial metals prices are lower now than they were one year ago.

In equities, the energy sector is 25% below early June highs, copper miner Freeport McMoRan is down 45%, and U.S. Steel is down 55%. In bond markets, 5-year inflation break-evens derived from TIPS are close to 1 year lows.

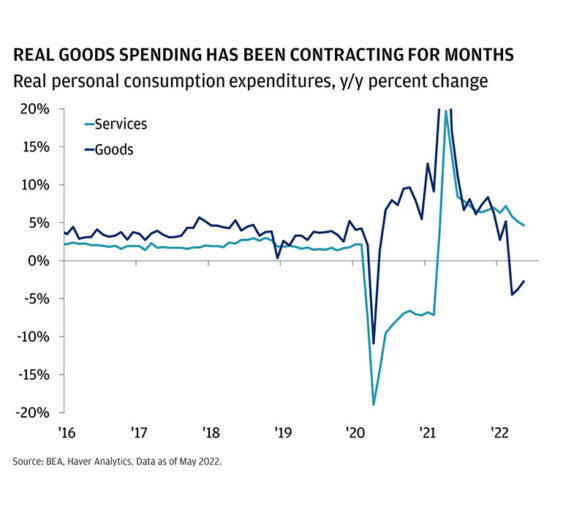

The weakness in commodities, housing (new home sales in San Diego are down 35% year over year), and durable goods (how about those outdoor furniture sales?) provide evidence that inflation is rolling over in part because of what the Fed has already done and what it is signaling it will do. Of course, it also provides evidence that an intractable growth slowdown is well underway.

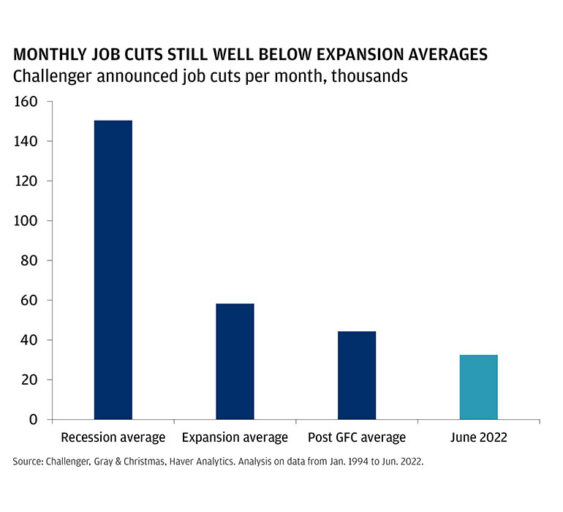

However, the labor market seems to be cooling at the margin, but there are very few signs of outright weakness. The Challenger job cuts data for June generated headlines due to the 57% percent surge in layoff announcements, but the rise from 20,700 announced job cuts in May to 32,500 layoffs in June doesn’t have us all that concerned. In fact, the uptick to 32,500 just gets us closer to the average for expansionary months in the data back to 1994.

Initial jobless claims are hovering right around 230,000 per week, which is entirely commensurate with an expanding economy. The non-farm payroll report released this morning showed that the economy added 372,000 jobs last month, which, if anything, is probably still too strong in the Fed’s eyes. In all, these data seem consistent with a labor market that is moving from extremely tight to pretty strong.

While the market has been preoccupied with the durable goods bust, the latest PMI services survey data for the U.S. also painted a picture of moderating, not plunging, growth. The ISM services index for June came in above expectations and very solidly in expansion territory (55.3 vs. 54 expected, anything over 50 indicates further growth). Remember, services make up over 2/3rds of overall consumption, and real spending there is still growing at a 4.7% year-over-year pace, more than 170 bps faster than it was at any point in the post-Global Financial Crisis period. We are in the midst of a growth slowdown, but the exodus from goods is probably making it seem worse than it really is for now.

This week supported the idea that weakness in commodities could cool headline inflation and should help temper consumer inflation expectations, that a moderating labor market could reduce the risk of a wage-price spiral, and that continued jobs gains could support future spending, investment, and hiring.

Of course, that is if everything goes right. All it takes is for another energy supply disruption, an unhinged consumer inflation expectations survey, or for labor market weakness in the real estate of financial technology sectors to spread to tilt the balance towards a much more negative outcome.

Investment Takeaways: Portfolio Maintenance

While the range of possible outcomes seems wide, we do have a confidence that inflation and growth are set to slow, and that volatility will remain elevated. That is why we think investors should be focused on core fixed income, quality equities, and strategies that effectively monetize volatility before, so won’t belabor those again.

Instead, we wanted to highlight two clear considerations for investors even though the outlook is murky.

First, tax-loss harvesting can help extract some value from positions that are underwater. Second, cash and short term asset management is quite important now that yields are higher. Many investors value the liquidity and relative safety that treasury bills provide, but we believe that they are historically expensive relative to what synthetic markets expect from the Fed. Based on liquidity and risk preferences, there could be better options available.

Finally, we could reach a point this year where markets sell-off to a point where we will be more inclined to actively add to risk assets. Preferred equities and small and mid-cap stocks are two areas that we are watching closely.

Please reach out to your JPMorgan team to discuss what our latest views may mean for you and your plan.

All market and economic data as of July 8, 2022 and sourced from Bloomberg and FactSet unless otherwise stated.

We believe the information contained in this material to be reliable but do not warrant its accuracy or completeness. Opinions, estimates, and investment strategies and views expressed in this document constitute our judgment based on current market conditions and are subject to change without notice.

RISK CONSIDERATIONS

Past performance is not indicative of future results. You may not invest directly in an index.

The prices and rates of return are indicative, as they may vary over time based on market conditions.

Additional risk considerations exist for all strategies.

The information provided herein is not intended as a recommendation of or an offer or solicitation to purchase or sell any investment product or service.

Opinions expressed herein may differ from the opinions expressed by other areas of J.P. Morgan. This material should not be regarded as investment research or a J.P. Morgan investment research report.

IMPORTANT INFORMATION

All companies referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by J.P. Morgan in this context.

Bonds are subject to interest rate risk, credit and default risk of the issuer. Bond prices generally fall when interest rates rise. Investing in fixed income products is subject to certain risks, including interest rate, credit, inflation, call, prepayment and reinvestment risk. Any fixed income security sold or redeemed prior to maturity may be subject to substantial gain or loss.

All market and economic data as of July 2022 and sourced from Bloomberg and FactSet unless otherwise stated.

The information presented is not intended to be making value judgments on the preferred outcome of any government decision.

Originally published by J.P.Morgan