MinRes shares (ASX:MIN) have fallen sharply today, dropping 5.47% to $22.45 by the end of the day, as investors react to disappointing news regarding the company’s Onslow Iron operations. This decline follows an announcement released after market close on Tuesday that has significantly impacted investor sentiment, already under pressure after a 35% YTD decline in the share price.

MinRes is a mining services company with operations spanning mining services, commodities production, and integrated supply of goods and services to the resources sector. The company has interests across iron ore, lithium, and other resources, with Onslow Iron representing one of its key iron ore production assets.

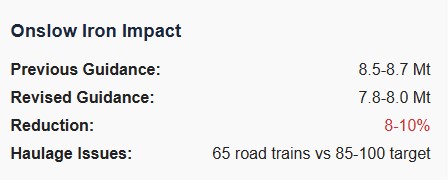

The primary catalyst for today’s share price decline is the company’s downward revision of its Onslow Iron volume guidance. According to the company’s latest update, released ahead of an investor and analyst tour of the Onslow Iron operations, production guidance is revised down to 7.8-8.0 million tonnes (Mt) from the previous target of 8.5-8.7 Mt. This represents a reduction of approximately 8-10% from earlier projections, or on a 100% project basis, this equates to 13.8-14.1 Mt, down from higher previous expectations.

The company attributed this shortfall to specific operational challenges; including lower-than-expected availability of contractor road trains for haulage (65 available vs a target of 85-100), and below forecast daily cycles (actual 2.7 vs a target of 4.0). These issues offset what the company described as a “steady ramp of haulage volumes”.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Today’s drop extends a period of heightened volatility for MIN shares. While the stock has posted a robust 23.4% gain over the past month (after today’s decline), it remains a long way off its January 2023 all-time high of $96.97. Over the past year, MIN has shed more than two-thirds of its value (-70%), reflecting both cyclical pressures in the resources sector and company-specific challenges.

Technical indicators suggest that MinRes is now hovering near key support levels, with Fibonacci and volume-based support zones clustered around the $22.70-$22.90 range. A sustained breach below these levels could trigger further downside, with the next significant support at $21.08. On the upside, resistance is now seen at $24.08 and $24.66.

Despite the recent downgrade in operational guidance, some analysts remain constructive on MinRes’ longer-term outlook. Current analyst consensus points to a target of $28.81, reflecting a healthy perceived upside from the current price action. These optimistic forecasts are underpinned by Mineral Resources’ diversified business model, spanning mining services, iron ore, lithium, and other resources, as well as its substantial director holdings, with CEO Christopher Ellison holding over 45 million shares.

Markets will no doubt be watching closely for further updates from management on how it plans to address the current challenges and restore confidence in its growth trajectory.