- The US Dollar is at 20-year highs against a basket of currencies.

- Faced with inflation and devalued currencies, international central banks fret over the direction of monetary policy.

- Can we make sense of the economic data and what may be on the immediate horizon?

The Mighty Dollar

The US dollar relative to a basket of major international currencies is presently valued higher than at any time in the last 20 years.

Looking for relief in the data

The US Federal Reserve has raised the currency’s value with the goal of reigning in prices. In some regard, the Fed’s actions have proven effective; in others, its hands are tied.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Gasoline futures for delivery to the Gulf of Mexico are down by 45% from June valuations. NYSE:WEAT (WEAT) is a basket of Wheat futures; prices in this staple crop have moderated under assurances of Ukrainian supply, down 30% from June highs.

Hands Tied

In other critical industrial and staple crop markets such as seed oil, coal, and base metals, the Fed actions are less relevant, with prices being more reliant on supply chain security.

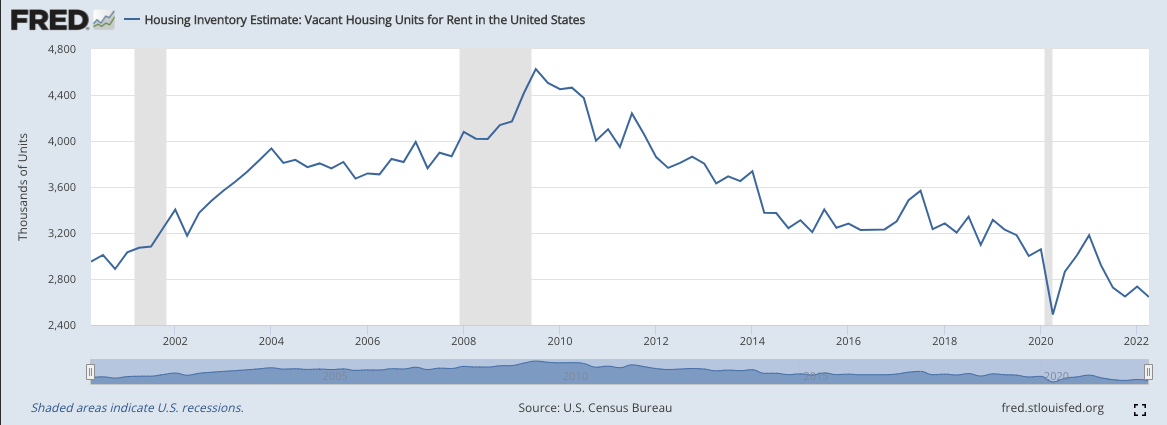

The largest weighting for inflation measures is housing. The Fed is attempting to stymie mortgage demand by raising the base lending rate. However, if there is a limited housing supply, the few dwellings on the market will be highly sought after, keeping prices up.

The housing inventory estimates suggest that the Fed’s hands are tied in this regard.

Exporting Inflation

European crude marker Brent is down over 30% today from the June highs. Priced in GBP, the price is down only 20%. The US dollar strength for commodities priced in dollars dampens the deflationary impact of a stronger dollar for countries other than the US.

For countries already struggling under the weight of high levels of national debt relative to GBP, the stronger dollar is heaping more pain on national budgets.

The Australian balance of payments is less impacted as a large proportion of their raw materials exports are sold in US dollars. For this reason, the Australian dollar has been faring better than the British pound.

Waiting on the Fed

In the faster-moving and lower inventory days world of raw materials, the Fed’s sanctions have had their desired impact, bringing down a basket of commodities from their June highs.

In the slower-moving field of housing, the impacts are yet to be felt. The rentals across the globe are elevated, and the delayed release of new supply post-COVID has artificially squeezed supply.

Prices will remain high in dwellings until the new housing builds can catch up, which is not being helped by the slew of foreclosures on property development firms in the UK, Australia, China and others.

When debt restructuring and contracts have been transferred from the new raw material price levels, we expect supply to increase, which will take time.

Near-term Outlook

For investors, there are green shoots in the raw material price arena, but there will be little let-off until property construction can catch up. We can expect the strong wording from the Federal Reserve to continue until the housing situation changes.

The hawkish stance of the Fed will continue to rattle markets into the near future. We should be prepared for more volatility.