- Key US inflation readings came in lower than expected on Tuesday.

- The FOMC meets on Wednesday to decide on the present trajectory of US interest rates and, subsequently, the US dollar.

- The lower US dollar presents investing opportunities in developing economies and the mining sector at home.

The US Dollar

The broad basket consumer price index month over month for November read 0.1%, or 1.2% annualised, well below the Fed’s target. One swallow might not make a summer, but you’ll not find many in winter, and we may be on the other side of this recent inflationary storm.

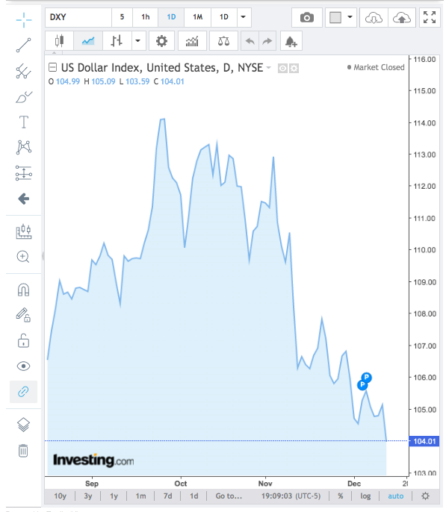

Having spent the last 18 months as a retreating tide, it would appear the US Dollar has entered the second phase and commenced its descending wave.

Tapering in the rate-hike cycle is negative for the dollar. With US costs of shelter on retreat in consecutive months, the market is pricing in additional tapering in the rate-hike cycle, and as a result, the US dollar is weakening.

Some positive deviations in the economic data out of the UK were a welcome surprise. The British Pound jumped 1.2% before consolidating 0.5% higher later Tuesday.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Gold found a footing in the US Dollar sell-off, climbing 2.5% before settling at 1.7% by the end of the day’s trading.

The inclusive of energy inflation reading of 0.1% month-over-month and the ex-energy print of 0.2% will give the Fed some more options going into Wednesday’s meeting. We might expect some change in language to a more dovish monetary policy approach.

Beneficiaries of a weaker dollar

A sliding US dollar will be a welcome relief for developing nations carrying large amounts of external debt. Sri Lanka, Pakistan, Egypt, and Tunisia, amongst others.

Closer to home, gold miner stocks will be boosted by a continued slide in the US dollar. North Star Resources Ltd ASX:NST (NST) is higher by 1.9% in morning trade on Wednesday. Australia’s largest gold miner, Newcrest Mining Ltd ASX:NCM (NCM), is up by 2.3% to start the day Wednesday.

The oil market, already buoyed by news of a shift away from a zero-COVID approach in China, jumped 3% following the US inflation reading. The US indices shot up by a similar amount before closing a modest 0.7% higher for the SE&P 500. The oil rally proved stickier and held on to the gains of earlier in the day.

Beach Energy Ltd ASX:BPT (BPT) is higher by 1.3% in morning trade Wednesday, trailing the gains in the international crude market.

Holding on to gains

It is somewhat pre-emptive to close the book on this inflationary cycle and make a definitive call on the US dollar. The service sector may yet prove a headache for policymakers as wages continue to climb at home and abroad.

For now, the stock market hangs in the balance until the Fed makes it official, but we can enjoy a respite from the selling pressure, however long it might be.