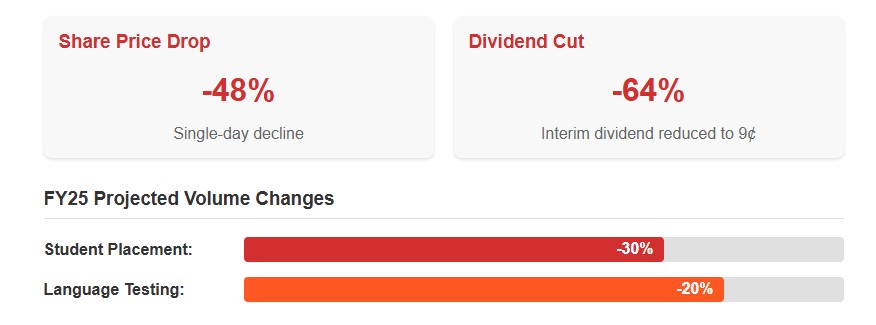

IDP Education shares (ASX:IEL) fell by 48.06% today, making a near decade low at $3.86 before closing out the session at $3.88. The company, a leader in international student placement and English language testing, issued a concerning trading update, that has clearly fuelled the bearish sentiment that already been building over the past year.

Today’s share price decline reflects a market reeling from a significant downward revision of the company’s FY25 guidance, driven by increasingly restrictive immigration policies in key destination markets and a resulting contraction in the international student market. The company, which co-owns the widely recognized IELTS English language test, now faces significant headwinds, casting a shadow over its near-term prospects. Over the past 12 months, IEL shares have lost a little over 75% of their market capitalization, or $3billion.

The company’s announcement that policy uncertainty in several critical markets is severely impacting international student numbers hit hard. Specifically, the company cited heightened uncertainty in the UK following recent immigration policy changes, while Australia and Canada continue to grapple with restrictive policies enacted after recent elections. The situation in Canada is particularly dire, with a sharp decline in student demand attributed directly to policy volatility. Adding to the woes, the company noted an increasingly negative environment for international students in the United States.

The impact of these external factors on IDP Education’s financial performance is significant. The company now anticipates a 28-30% decrease in student placement volumes compared to FY24 and an 18-20% decrease in language testing volumes. This translates to a significantly reduced adjusted FY25 EBIT forecast of between $115-125 million, a substantial drop from previous expectations. In response, IDP Education is implementing cost control initiatives, projecting a roughly 5% reduction in adjusted overhead costs for the second half of FY25 compared to the same period last year, despite facing negative operative leverage. However, the effectiveness of these measures in mitigating the broader market challenges remains to be seen.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The sharp downturn reflects not only the immediate financial impact but also the uncertainty surrounding the future of international education. Proposed changes to immigration policies in Australia, for example, are expected to shrink the international education market by 20-25% over the next year, directly impacting IDP’s core business segments. This contraction in market size is putting pressure on both testing and student placement volumes, forcing analysts and investors alike to reassess the company’s growth trajectory.

This challenging environment has already led to analyst downgrades and revised price targets. Jefferies initiated coverage of IDP Education with an ‘Underperform’ rating, citing increased competition and regulatory changes as key concerns. The average one-year price target for the stock has also fallen by 16.48% to AU$14.70, reflecting diminished growth expectations.

IDP Education’s recent financial performance further underscores the challenges it faces. The company reported a 39% fall in first-half net profit to $59.7 million, driven by declines in student placement and English language testing volumes. In response to this profit decline, the company’s board slashed its interim dividend by 64% to 9 cents per share, a move that is likely to further disappoint investors.

Despite these challenges, IDP Education retains a strong market position, particularly through its co-ownership of the IELTS testing business, which contributes the majority of its revenue. The company also boasts a network of experienced directors with significant shareholdings, suggesting a vested interest in the company’s long-term success. However, in the current climate, even these strengths may not be enough to offset the headwinds facing the international education sector.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2025.

We’re giving away this valuable research for FREE.

Click below to secure your copy