- Oil supply is stretched around the world.

- Squeezes at any juncture are ballooning prices.

- What is driving these jittery markets?

Tight supply lines

Libyan oil ports are experiencing blockades from the Eastern political factions, threatening the supply of 1 million barrels of oil per day to the global markets.

In already stretched trading, the removal of oil that European refiners are calibrated for, given its petrol yield and sulphur content, is pressuring alternatives, most notably in the comparable North Sea resource.

North Sea oil barrel auctions feed the widely referenced crude price of Brent.

The international oil market bases approximately 75% of all traded oil upon Brent.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Any squeeze in the Brent price affects all consumers of petrol across the globe.

More heat

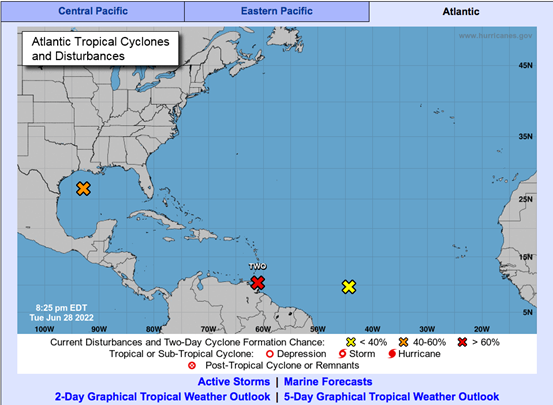

To add further fuel to the oil fire, the Gulf of Mexico and the Caribbean are currently entering the peak Atlantic hurricane season.

Tropical storms with a high probability of transforming into cyclones in the Gulf of Mexico intermittently threaten the US and Mexico production in the region, roughly 4 million barrels per day.

Present and impending demand

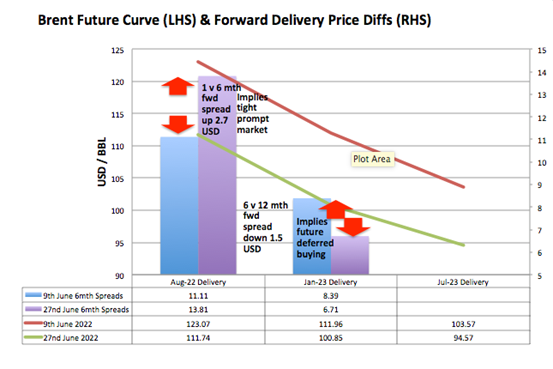

Most trade in the Brent crude-marker is done in the futures market.

It is also flashing warning signs of tightness.

Currently, the market is paying an extremely high premium for prompt delivery over waiting for a month or two, implying that refiners are willing to pay any price and will still book a profit due to the presently high petrol and diesel demand.

There is some relief down the line: six months out delivery compared to 12 months out has softened over the last three weeks, implying some demand destruction at these price levels, though it is coming from a high number.

Feeling the heat

Certainly, these elevated and sticky oil prices are not helping policymakers’ concerns over inflation.

Prime Minister Albanese recently announced a wage bump for those most impacted by inflation.

A wage hike is welcome to those under the pump, but it is not exactly what the doctor ordered when inflation is enemy number one for those holding the monetary policy levers.

The fixed-income markets are equally as jittery as the key US recession indicator of 10-year versus two-year is flirting with inversion.

Woodside Energy Group Ltd ASX:WDS (WDS), supplier of oil and gas to international markets, is up 4% on the month.

Gold in tact

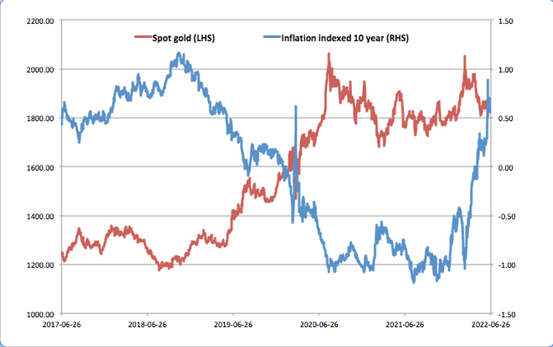

Spot gold is hovering around the 1,800 handle as the US Federal Reserve is just managing to stay out in front of inflation with its rate hikes – though only just and it could go either way over the next six to 12 months.

The inflation-adjusted 10-year yield is inversely related to the gold price.

If and when the dollar loses the fight and the 10-year yield less inflation goes down, the gold price will head higher.

The Fed chair Jerome Powell makes his scheduled speech today, and as in recent times, the wording will be scoured for any hint of a shift in tack.

The market will be tuned to listen for any positioning toward additional rate hikes, which will send equity markets lower and further pressure the gold price.

Newcrest Mining Ltd ASX:NCM (NCM), Australia’s largest gold producer, is down 13% on the month.

Pressure gauge

The key international volatility indicator the VIX is trading at 28.36 and well above the five-year average of 20.1.

With geopolitical tensions elevated, supply lines taut, and the COVID-19 lockdown exiting and consumers wanting to stretch their legs, a bumpy few months lie ahead for the markets.