The ACCC’s latest gas inquiry report forecasts a supply shortfall of 30 petajoules (PJ) in Australia’s east coast gas market this year if the LNG producers were to export all their uncontracted gas. However, the LNG producers have enough uncontracted gas to prevent a domestic shortfall.

The report covers a period of record high domestic gas prices, which led to the Australian Government introducing a temporary price cap in late December 2022. As the data in the report goes up to early December 2022, it does not yet show the impact of the price cap.

In July last year, the ACCC forecast a 56 PJ supply shortfall in 2023. Today’s report shows that outlook has improved, with Australia’s east coast now forecast to produce 1,983 PJ of gas in 2023 compared to demand of 2,013 PJ. 1,296 PJ of that gas is forecast to be exported overseas by the three LNG ventures in Queensland under long-term contacts.

The LNG producers are also expected to produce a further 146 PJ more than they need to meet their contractual commitments, of which 30 PJ is needed domestically to avoid a shortfall (see chart 1).

“The east coast gas supply forecast for 2023 has improved, but the outlook remains uncertain as the LNG producers haven’t yet committed sufficient volume under firm contracts to address the risk of a domestic shortfall,” ACCC Chair Gina Cass-Gottlieb said.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

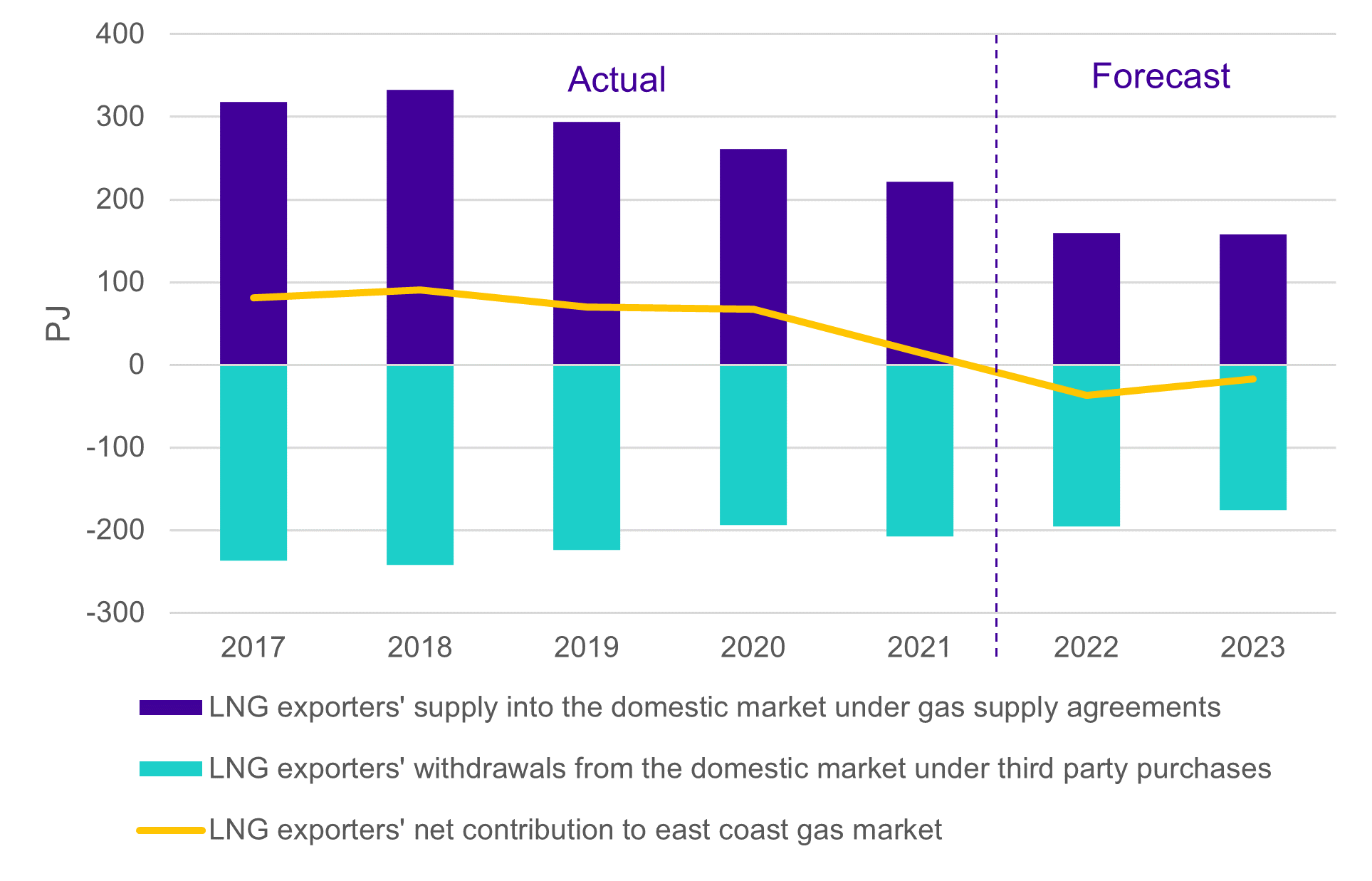

The report shows that the three LNG producers have been net withdrawers of gas from the domestic market since 2021, buying more gas from other gas producers than they supply to domestic customers, which has worsened the gas shortfall (see chart 2).

Demand for gas in the southern states is expected to exceed production by 52 PJ from gas sources located in the southern states, which is equivalent to about 12 per cent of forecast southern demand. While the latest information suggests forecast gas production from the Gippsland Basin will increase in 2023, this is offset by a reduction in forecast production from the Otway Basin due to unexpectedly poor performance of gas wells.

Gas prices hit record highs

The international energy crisis has increased global demand for LNG and pushed prices to record highs around the middle of last year. As the LNG exporters and their associates influence almost 90 per cent of the proven and probable east coast gas reserves, much higher international prices have increased Australia’s domestic wholesale gas prices.

The report shows prices offered for supply on the east coast in 2023 increased sharply last year to the highest levels the ACCC has observed in the almost six years of its gas inquiry.

Between March and August 2022, the average price of supply offers from gas producers to commercial and industrial users increased by 88 per cent to $19.77 per gigajoule (GJ), compared to the previous six-month period. However, as many higher priced supply offers were not accepted by users last year, the average price of supply contracts signed by producers increased by 30 per cent to $12.38 per GJ between March and August 2022, compared to the previous six-month period.

“The average price of gas being offered to Australia’s commercial and industrial gas users around the middle of last year was almost double what it was at the start of 2022,” Ms Cass-Gottlieb said.

In December, in response to concerns about the impacts of the international energy crisis on Australia’s gas markets, the Australian Government introduced a temporary price cap of $12 per GJ for gas sold and supplied under Gas Sales Agreements by gas producers and their affiliates in the east coast and Northern Territory markets. The ACCC will enforce compliance with the price cap, which does not apply to the sale of gas for export.

The Government is also consulting on its intention to introduce a mandatory gas code of conduct, which will include provision for a reasonable pricing requirement for gas producers and users negotiating supply contracts.

“Our role monitoring and reporting on the market will be particularly important this year as it will provide an information base for assessing compliance with the Price Order and reviewing its effectiveness,” Ms Cass-Gottlieb said.

Chart 1: Forecast east coast supply-demand balance in 2023

Source: ACCC analysis of data obtained from gas producers as at December 2022 and of the domestic demand forecast (Progressive Change scenario) from AEMO’s March 2022 GSOO.

Note: Totals may not add up due to rounding.

Chart 2: LNG producers’ net contributions to the east coast gas market

Source: ACCC analysis of data obtained from LNG exporters as at December 2022.

Notes

The report emphasises that the ACCC’s net contribution calculation is based solely on the LNG producers’ supply into the domestic market under gas supply agreements, and withdrawals from the domestic market under purchases from third parties.

Our approach does not consider whether these purchases from third parties are ‘third party export compatible gas’ as defined in the Australian Domestic Gas Supply Mechanism (ADGSM) and as the question of determining if gas in ‘third party export compatible gas’ is a matter for the Minister for Resources under the ADGSM Guidelines, the ACCC has not collected information from parties that would help determine this question.