China

China continues its zero-COVID policy as Shanghai has reimposed lockdowns, and Beijing is on high alert after detecting several new COVID cases. A staggered reopening will harm the Australian resource sector and downstream services. BHP Billiton Ltd (ASX:BHP) is up 11% year-to-date (YTD) and Rio Tinto Ltd (ASX:RIO) is up 16% YTD.

United States

Australian stock market movements are closely related to those of the US stock market. On Friday, the US published the lowest consumer sentiment index on record of 50.2. Simultaneously, May’s US consumer price index (CPI) reached 8.6% from the same month last year, the highest in 41 years.

The Fed has already signalled another 0.5% hike in the fund’s rate in July, taking the tally to 1.75% for this year with a 2.75-3% anticipated total hike for 2022. That is the most since the 1980s.

The S&P 500 was down 2.9% on Friday, and the more interest rate-sensitive growth stocks led the NASDAQ index down 3.5%.

The market nervousness may be attributed to the anticipation of even more significant hikes in the coming months, above the 0.5% already signalled. Jerome Powell could switch to a more hawkish 0.75% step, slamming down harder on the inflation brakes.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Concurrently, Fed officials are moving to shrink their $9 Trillion in bonds, with markets concerned that liquidity is getting restrained and, at the same time, more costly. Apple Inc (NASDAQ:AAPL) is down 23% YTD, and Amazon Inc (NASDAQ: AMZN) is down 34% YTD.

Cryptocurrency

The boom in aggressive retail trading made famous by Reddit and r/wallstreetbets coincided with a cryptocurrency surge. Cryptocurrencies continue to struggle; Bitcoin nears 25,000 BTC/USD and Ethereum ETH/USD the 1,300 handle, down 40% and 65% YTD, respectively.

Equity trading desks and liquidity providers will continue to face a far more challenging year than they found in 2021 and 2020. Macquarie Group (ASX: MQG) is down 19% YTD.

Goldman Sachs (NYSE: GS) and JP Morgan (NYSE: JPM) are both down 25% YTD.

Events to look out for in the week ahead

Australia

On Wednesday, the Westpac consumer confidence figure is published, and the consensus is for a dip in June.

On Thursday, the Australia Bureau of Statistics (ABS) releases the May unemployment and labour change, with overall employment remaining high. A tight labour market will serve to keep wage inflation elevated and maintain the pressure on Australian companies already concerned about rising costs. A drop in consumer confidence could lead to further selling pressure.

United States

On Wednesday, the closely watched Fed interest rate decision and monetary policy statement, as well as the Federal Open Market Committee (FOMC) economic projections, will provide key indicators to the market on the direction of interest rates.

We expect high volatility in international markets if there is talk of raising rates even higher and faster than has already been signalled.

China

China publishes the year-over-year retail sales figure for May; the consensus is for -7.3% following lockdowns. Any surprise to the downside will hurt the China market and Australian companies servicing it, particularly resource companies.

The start of the week

The ASX 200 opened 1.25% lower on Monday after the US S&P 500 closed 2.9% down on Friday. The Aussie dollar is trading at 70c per USD, down 2.3% on the week as the international flight to the relative safety of the US dollar continues.

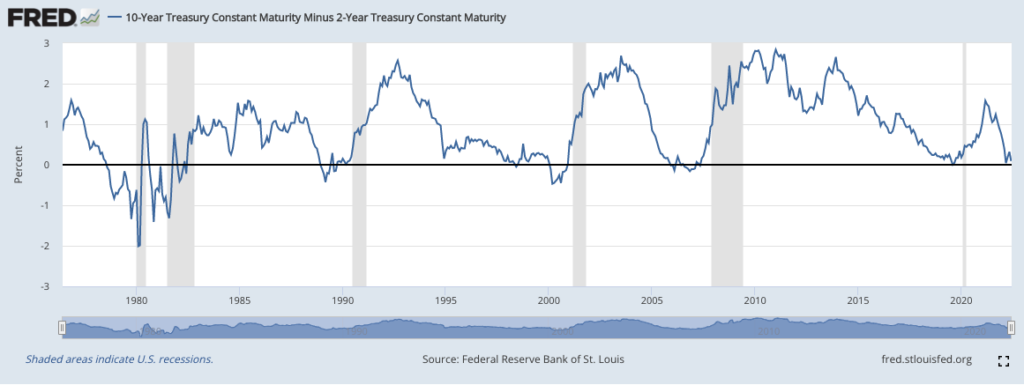

The US 10-year versus 2-year treasury yield is reaching parity and close to inversion. An inverted yield curve is widely accepted as a recession bellwether, one that could potentially spill over into Australia.

We are in for a bumpy few weeks, so stay tuned to TheBull.com.au for all the latest market developments.