We expect a high degree of volatility and uncertainty for global equities in 2023, as stubbornly high inflation and interest rate rises lead to a rough landing for large parts of the global economy. However, earnings expectations are diverging across different economies, allowing investors to capitalise on select opportunities.

Markets continue to expect central banks (led by the Fed) to stop hiking at the first sign of inflation cooling, but there is a growing risk that by then it may be too late. The squeeze on the consumer is already taking place and some parts of the global economy are headed for recession or are already there.

Regionally, Europe looks the most exposed. Much depends on whether businesses and consumers can make their way through the winter without blackouts that weaken demand and on how the Ukraine conflict develops from here. Tail risks for stock markets remain and a recession seems baked in, as the European Central Bank ploughs ahead with rate rises at a time when households are already suffering from the surge in the cost of living.

After the sharp sell-off spurred by the worsening outlook and government missteps, there is a case for the UK equity market becoming an attractive hunting ground in 2023. While the UK market has done better than most this year, partly due to sector composition (with most large cap earnings derived from outside the UK), it remains relatively cheaply valued with a forward PE that is around 25 per cent below long-term averages and close to 50 per cent cheaper than the US. The large cap FTSE 100 index remains primarily a play on the global economy and a beneficiary of sterling weakness, while small and mid-cap names tend to be more exposed to the domestic economy. The latter are unloved and could be beneficiaries of any positive surprise on the economic front.

The US presents a different picture. While there are some signs of increasing pressure on consumers, real data has yet to turn downwards, and markets are some way off pricing in the sort of corporate earnings downgrades that would reflect a full-blown recession. That leaves us with the risk of a more dramatic drop in the S&P 500 next year if growth slows suddenly. Nevertheless, small/mid-cap stocks appear cheap relative to large caps, which should present some opportunities. Meanwhile, growth stocks still look relatively expensive versus value stocks, with the valuation gap at historic highs.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Dollar strength

Another potential risk for investors is further US dollar appreciation, which would continue to erode corporate earnings. Emerging markets have historically been especially sensitive to changes in the greenback’s value and US companies are not immune to these headwinds as their offshore revenues begin to shrink. The S&P 500’s foreign exposure is around 30 per cent.

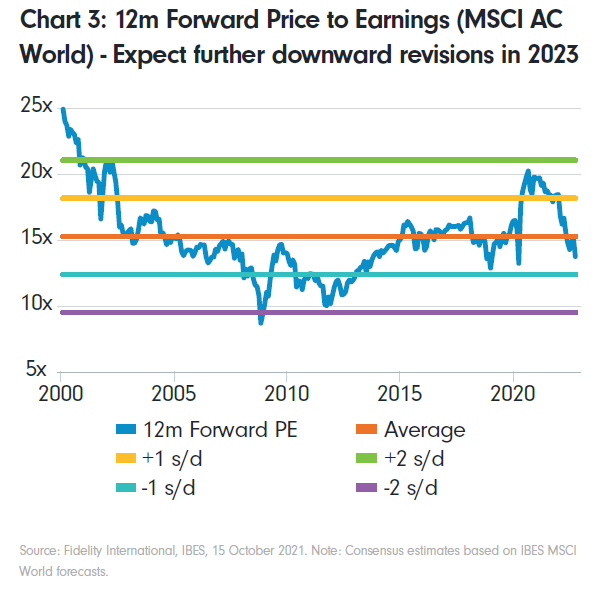

For global equities, multiples will continue to decline as discount rates rise. Corporate profits and earnings will need to adjust further to reflect the uncertain economic picture, which is likely to persist near term. Valuations are likely to come down further as companies publish annual earnings numbers and expectations in the first quarter.

Investors should also monitor the trajectory of China. Not only is it a big market in its own right but it was also among the first in and first out of lockdowns, and the first major market to show signs of earnings fatigue. Its performance in the coming months may indicate how things will play out in developed markets.

China is investible but investors need to be selective

In China, monetary conditions are more accommodative with relatively low inflationary expectations. The big question for the first months of the year is whether the economy can start to perform. Unlike Europe there is no energy crisis, and our base case is for a moderate and gradual recovery of growth as the year progresses. Domestic earnings will improve, as should margins, against the backdrop of renewed levels of investment in infrastructure. We are positive on consumer staples, financials, and healthcare, but in general much has been discounted across the market.

Caution required

If central banks remain excessively hawkish and over tighten monetary conditions through a mix of interest rate hikes and quantitative tightening, there is a risk of an inflationary bust this year, with economies struggling to mitigate the damage. This could hurt both the real economy and asset prices. We remain cautious of current conditions and believe now is the time to be invested in high quality stocks that are best placed to weather market volatility, while also looking for opportunities to gain exposure to long-term secular growth sectors like clean energy and electric vehicles. Defensive areas such as financials and utilities could outperform as the economic slowdown takes hold. For utilities, we favour names (ex-US) with valuations that provide a good margin of error and where better cash generation/ certainty of returns will be rewarded, despite elevated power prices that are likely to come off – a headwind to earnings growth.

Regionally, we are more positive versus consensus in Asia Pacific excluding Japan, with the Asean and Indian economies standing out, building on a robust recovery thus far in 2022. Within the region, we are long-term positive on both India and Indonesia, amid robust multiyear growth supported by favourable demographics, including a growing middle class and rising disposable incomes. On its own, Indonesia is a net energy exporter and is one of a few countries to benefit from increased energy prices, which should persist into 2023.

Originally published by Fidelity International investment experts