DroneShield shares (ASX:DRO) are the darling of the ASX today, soaring to an all-time high of $3.24 at the close, for an impressive 16.97% jump on the day.

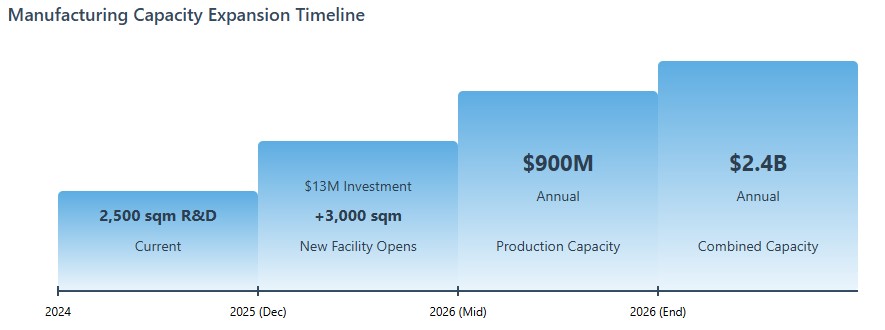

Whilst momentum has been strongly building in recent months, the catalyst for today’s surge is DroneShield’s announcement of a significant $13 million investment in a new 3,000sqm production facility in Alexandria, Sydney. Scheduled to open in December 2025, this facility will significantly increase DroneShield’s manufacturing capabilities, complementing its existing 2,500sqm R&D hub.

The company projects that this expansion will boost its annual production capacity to $900 million by mid-2026, with a combined annual manufacturing capacity target of a staggering $2.4 billion by the end of 2026. This bold move signals DroneShield’s confidence in its ability to capture a larger share of the rapidly growing global counter-drone market.

The new facility isn’t the only reason for investor optimism. DroneShield recently secured its largest contract to date, a A$61.6 million deal with a European military customer. This landmark agreement, encompassing three separate contracts, dwarfs the company’s entire 2024 revenue of A$57.5 million. The contract includes the provision of handheld detection and counter-drone systems, along with accessories, underscoring the increasing demand for portable counter-UAS solutions. DroneShield anticipates fulfilling the order during the third quarter of 2025, with payments expected in the latter half of the year.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

A look at DroneShield’s recent performance paints a picture of relentless upward momentum. The stock has risen in each of the last six trading sessions, and has gained 83% over the past month.

DroneShield’s robust financial performance in FY24, where the company reported record revenue of $57.5 million (a 6% year-over-year increase), provides a solid foundation for future growth. Moreover, the company already has $52 million in contracted revenue for delivery in 2025, representing 90% of the previous year’s revenue.

To fuel its ambitious expansion plans, DroneShield successfully completed a capital raise earlier this year, securing $29.4 million, significantly exceeding its initial target of $3 million. This financial injection has enabled the company to ramp up production and operations, with $67 million worth of counter-drone products currently under production.

Despite all the bullish momentum, potential risks remain. The counter-drone market is becoming increasingly competitive, with new players constantly emerging. Furthermore, geopolitical uncertainties and shifting government regulations could impact demand for DroneShield’s products. The company’s ambitious expansion plans also carry execution risk, and any delays or cost overruns could negatively affect its financial performance.

The company’s proactive expansion, significant contract wins, robust financial performance, and increasing market recognition appear to position it for continued growth in the rapidly evolving counter-drone technology market. Whether the current rally is sustainable remains to be seen, but for now, DroneShield is firmly in the spotlight as a leader in its field.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2025.

We’re giving away this valuable research for FREE.

Click below to secure your copy