In a seismic shift within the Australian corporate landscape, Brickworks Limited (ASX: BKW) and Soul Patts (ASX: SOL) have sent shockwaves through the market with the announcement of a merger. The news propelled both companies to new all time highs, with Brickworks shares surging a remarkable 27.59% to a new 52 week/ATH of $35.20, and Soul Pattinson shares climbing 16.44%, also reaching a new high at $43. The market capitalization of the combined entity, dubbed “TopCo,” is projected to reach a staggering A$14 billion (US$9 billion), marking one of the most significant corporate deals of the year. Often times during mergers or acquisitions, once company tends to come out of the deal looking better than the other as far as near term price movement, but today’s news has sent both stocks soaring.

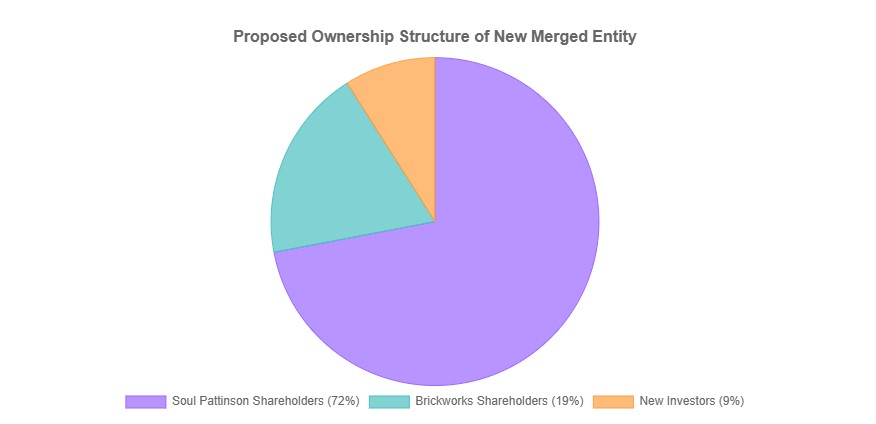

The merger aims to consolidate the complex cross-shareholding structure that has characterized the relationship between Brickworks and Soul Pattinson for decades. Under the terms of the agreement, Soul Patts shareholders will hold a controlling 72% stake in the newly formed entity, while Brickworks shareholders will own 19%. The remaining shares will be offered to new investors, injecting fresh capital and broadening the shareholder base. This simplification is expected to unlock significant synergies and streamline operations, creating a more efficient and agile organization poised for future growth.

Beyond the merger itself, several other factors have recently influenced Brickworks’ stock performance. The settlement of litigation with BGC in April removed a significant overhang of uncertainty, boosting investor confidence. While the company’s FY24 results revealed an 80% decline in underlying EBITDA and an 88% drop in underlying net profit after tax, the decision to increase the final dividend by 2% to $0.43 per share signaled management’s confidence in the company’s long-term prospects. This shareholder-friendly move may have provided a cushion against further stock price declines.

However, it’s crucial to acknowledge the challenges Brickworks has faced. In FY24, the company recorded a total non-cash impairment charge of $123.5 million (post-tax), including impairments for Austral Masonry and Brickworks North America. These impairments reflect difficulties in specific business units and highlight the need for strategic adjustments.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Despite these challenges, Brickworks received a boost in June 2024 when Bell Potter upgraded the company’s shares to a ‘buy’ rating, citing its significant stake in Soul Pattinson as a key driver of value. The broker set a price target of $29.50, implying substantial upside potential. This positive outlook may have contributed to the stock’s resilience in the months leading up to the merger announcement.

Looking ahead, the focus will undoubtedly shift to the integration of Brickworks and Soul Pattinson and the realization of the anticipated synergies. Regulatory approvals will be a key hurdle, and investors will be closely monitoring the progress of the transaction. The new entity, “TopCo,” is expected to provide revised financial guidance in the coming months, offering greater clarity on its future strategic direction.

The merger represents a bold move by both Brickworks and Soul Pattinson, creating a diversified powerhouse with significant growth potential. However, as with any major corporate transaction, risks remain. Successful integration will be crucial, and the market will be scrutinizing every step of the process.