The Commonwealth Bank of Australia share price (ASX: CBA) saw its impressive rally take a breather as trading closed for the week, hovering just under the A$180 mark. After a period of sustained gains, the stock closed down 0.79% on the day, taking some off the table into the weekend. This pause comes after CBA shares had seen a 6 day win streak, and have surged nearly 8% in the last month, and 24% since early April, fueled by strong financial performance and positive market sentiment. However, some analysts are now closely scrutinizing the bank’s valuation, with current prices exceeding current target ranges.

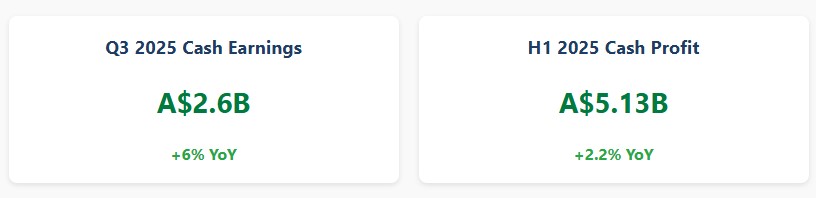

CBA’s recent performance has been nothing short of remarkable. The stock has climbed over 44% in the past year, driven by robust growth in home and business lending, as evidenced by its recent third-quarter results. In May 2025, the bank reported a 6% increase in third-quarter cash earnings, totaling A$2.6 billion (US$1.68 billion), exceeding expectations.

This positive momentum was further reinforced by a strong first-half performance, where cash net profit after tax reached A$5.13 billion, exceeding consensus estimates and allowing for a record interim dividend of A$2.25 per share. The bank’s strategic focus on core operations in Australia and New Zealand, exemplified by its complete exit from Vietnam International Commercial Joint Stock Bank (VIB), has also resonated positively with investors.

Technically, CBA’s stock is exhibiting a bullish trend, trading well above its short- and long-term moving averages. However, the rapid ascent has raised concerns about potential overvaluation. Analyst price targets for CBA range from a maximum of AUD 143.00 to a minimum of AUD 97.49, a significant gap compared to the current trading levels. This divergence suggests that while analysts acknowledge the bank’s strong performance, they are cautious about the sustainability of its current valuation.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The broader economic outlook also plays a crucial role in CBA’s future trajectory. CEO Matt Comyn has indicated that the country’s rate easing cycle would be slower and shallower than anticipated, with further rate cuts likely to be delayed until later in the year. This cautious stance reflects ongoing concerns about inflation and the need for the Reserve Bank of Australia to carefully monitor economic data before implementing further monetary policy easing. The delay in rate cuts could impact CBA’s lending margins and profitability, adding another layer of complexity to the investment outlook.

On a positive note, CBA has been actively investing in technological advancements, particularly in the field of artificial intelligence (AI). These investments are aimed at enhancing customer experience, reducing fraud, and streamlining business operations. The bank’s progress in AI has been well-received by the market and has contributed to the positive sentiment surrounding the stock. As CBA prepares for its next earnings report, expected in August 2025, investors will be closely monitoring the bank’s ability to sustain its growth momentum and manage the various challenges it faces. The next earnings report will provide an opportunity to gauge the ongoing effects of lending, interest rates, and technological advancements.

The bank’s market capitalization has now surpassed A$300 billion, solidifying its position as one of the most valuable companies on the ASX; with the strong performance of CBA’s shares undoubtedly contributing to the overall positive sentiment in the Australian financial market. However, investors should remain vigilant and carefully assess the risks and opportunities associated with this high-flying stock. The pause observed today may signal a period of consolidation as the market digests the recent gains and reassesses the bank’s valuation in light of the evolving economic landscape, or it could be a temporary pause with some profit taking into the weekend. Either way, risk management heads on.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2025.

We’re giving away this valuable research for FREE.

Click below to secure your copy