- European inflation is hovering at all-time highs

- Russian gas displacement from European markets is sending energy costs soaring

- Europe is Australia’s second-largest trading partner; how long can Europe sustain these high prices before the economy succumbs and what would be the impact on Australia?

Sky-high inflation

European inflation is currently hovering around all-time highs in recorded levels.

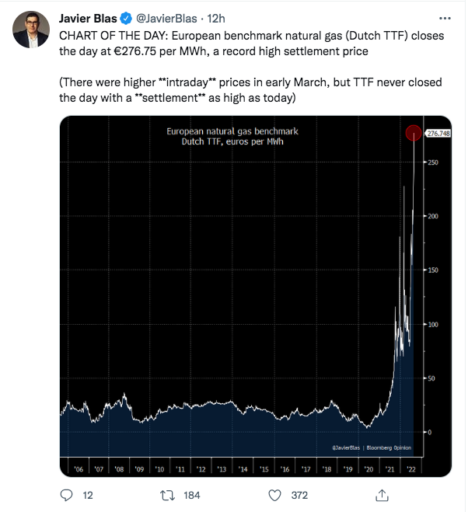

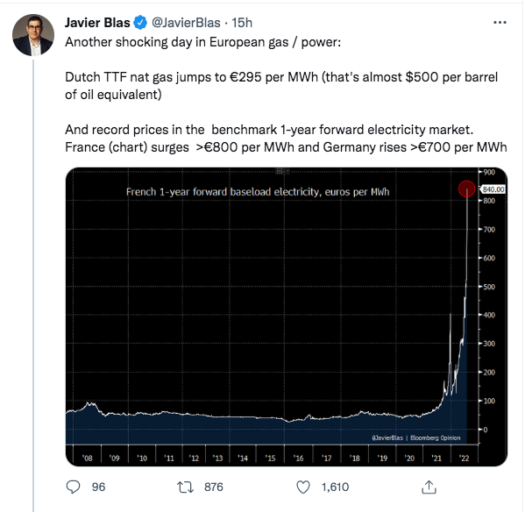

The displacement of Russian gas and the threat of a complete shutdown of flows to Europe is sending the price of gas and electricity in Europe to unprecedented highs.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Extremely high demand for coal is offering no relief for European power producers looking to switch between coal and gas for power generation.

Coal for loading from Newcastle continues to be exchanged at more than 400 USD per tonne. Levels that not even the most optimistic coal miners could have possibly dreamed of at first strike.

The price impacts are being drawn out along the curve, with transactions of power for delivery in 12 months being agreed upon at more than ten times the historical mean.

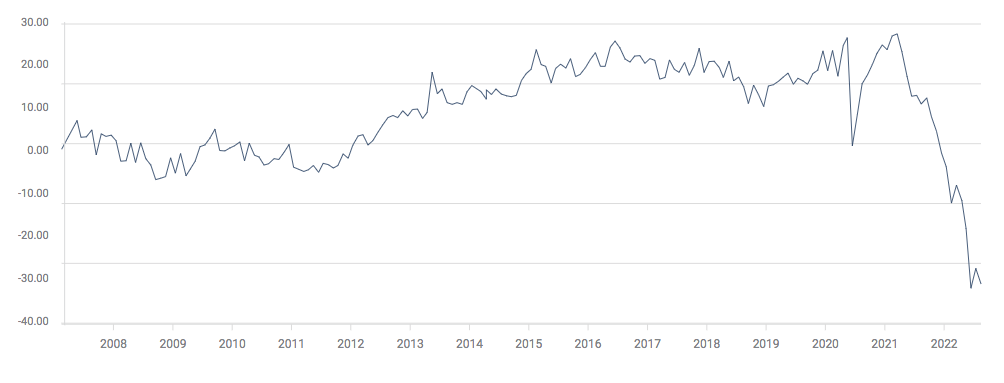

The European trade balance has collapsed under the weight of energy imports.

Monthly European Trade Balance

Core price indices in Europe and the UK are rising untethered. The euro has fallen below parity to the US dollar for the first time since the early 2000s.

The July 2022 v July 2021 UK consumer price index

UK consumers are paying 10% more for their shopping baskets than at the same time last year.

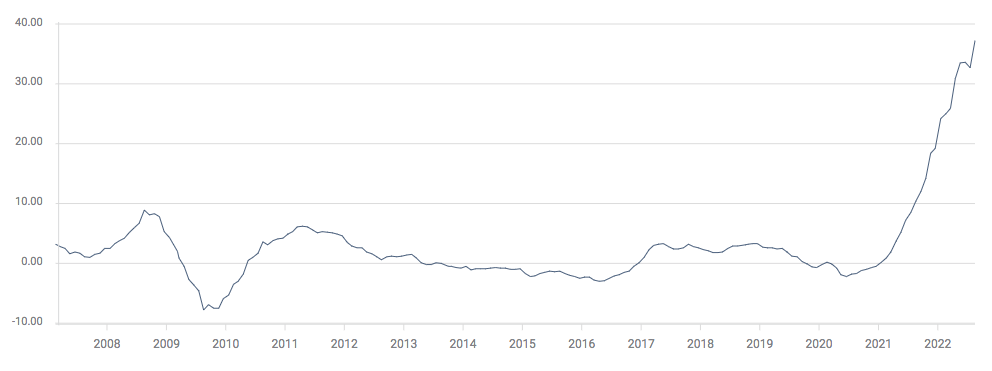

The German Producer Price Index July 2022 v July 2021

German industry is struggling under gas price rises, with input costs rising more than 35% from this time last year.

Europe and Australia

Coal and gas producers Whitehaven Coal Ltd ASX:WHC (WHC) and Woodside Energy Group Ltd ASX:WDS (WDS) have benefited enormously from the strong demand for their coal and gas, respectively.

When Russian supply lines were cut, the European market turned to Australia for reliable energy resources.

WHC is exchanging hands at $7.74 AUD in afternoon trade, above all-time highs. WDS recovered well from the pandemic to surge above $33 AUD per share. WDS will exchange minimal amounts of its product at the current price levels. Still, some opportunistic spot cargoes can be sought as well as the locking-in term contracts for future delivery at these higher levels.

As Australia’s second-largest trading partner, the long-term stability of Europe’s economies is critical to the overall financial health of several of Australia’s biggest companies.

European outlook

While prices are up, consumption is tracking downwards. Germany’s gas consumption was 15% below average in July, which matches the government’s commitment to lowering gas usage across the continent.

The industry is starting to be throttled at the expense of high prices. It means that consumers across the continent are unlikely to run out of power this winter, a genuine fear earlier in the year. Still, it also means that industry isn’t going to be able to make large swathes of hires to boost employment.

As the euro currency wilts and inflation cannot be brought to heel, coal and gas trade volumes will likely retreat. We are nearing the end of the aggressive winter restocking programs for Europe and North Asia, so some relief in gas prices could be in sight.

The economic retreat is already in action in Europe and the UK. For how long and deep it will be remains to be seen, but a severe decline will put a lot of pressure on Australia’s raw material producer stock prices.