- Natural gas for delivery in Japan and Korea is hovering at all-time highs.

- The price of coal for loading from Newcastle, Australia has never been higher.

- What is causing the high prices for these critical winter supplies, and how can investors participate in the record run?

The gas market

Oil prices are down 4% this week and more than 25% from the early-June highs, yet coal and gas markets remain tight and prices cling to historic highs.

For the gas markets, there are two main drivers:

- Russian gas exports to Europe have slowed considerably from 2021.

- Legislation introduced in Germany obligates gas suppliers to maintain storage above 90% capacity before the start of the winter.

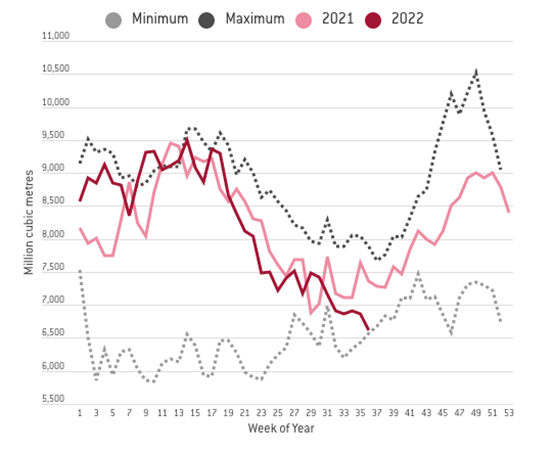

This chart illustrates how the gas flow to Europe from Russia has petered off from the 2021 levels:

Top Australian Brokers

- eToro - Social and copy trading platform - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- Pepperstone - Trading education - Read our review

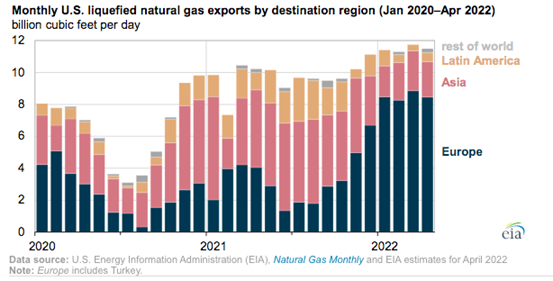

US liquefied natural gas (LNG) for export to Europe has gone some of the way to replacing the displaced Russian molecules, though at the expense of Asian requirements.

The dual impact of higher European import requirements and stymied Russian flows has sent seaborne gas prices soaring, both in Europe and Asia.

The coal market

The EU was dependent on Russia for 45% of its coal imports and 70% of steam coal before the start of the year.

Part of the European strategy to cover the reduced flow of gas is to switch some of the power generators from gas to coal.

European power production from coal-powered generation could reach 20% of the mix by the end of the year.

Strong European demand for coal has sent Australian coal prices to hitherto unsurpassed levels.

Investing in energy

The demand for coal, gas and oil is not likely to abate in the short term. Renewable energy outside of large hydro projects is not able to provide the round-the-clock ‘baseload’ power generation required to keep an electricity grid online.

With Russian supply to be closed off to the Western markets for the foreseeable future, prices are likely to remain elevated in European and North Asian markets.

Energy stocks to consider

Fresh off its merger of oil and gas operations with BHP Billiton, Woodside Energy Group Ltd ASX:WDS (WDS) is looking to stamp its authority on the global gas supply market.

As a result of its merger with BHP, WDS is now able to simultaneously supply to Europe from the Gulf of Mexico assets now under management and continue to supply North Asia from the legacy West Australian fields.

Whitehaven Coal Ltd ASX:WHC (WHC) has benefited enormously from the gas market tightness, as European power producers under duress have switched out some of their gas turbine generation for steam coal, opening new markets to WHC. WHC is up 225% this year.

Further afield, EQT Corporation NYSE:EQT (EQT) is the premier gas-producing company in the lower 48 states of the US. Operating out of Appalachia, EQT gas is piped all over the country and has joined the exodus to Europe.

The recent expansion of the US LNG export terminals has propped the price of onshore US gas and provided a boon to EQT shareholders. EQT is up 120% this year.

Some room left to run?

As we enter the peak demand period for coal and gas in the Northern Hemisphere winter, we may expect the tightness in the winter fuel market to remain and possibly leave some headroom for energy stocks to climb further.