- Polar vortex is bringing severe cold to much of the United States

- After selling off on Monday in the US, markets are freezing up

- To warm up, what are some of the big positives for 2022?

The Big Chill

A polar blast is set to hit the US this week and bring sub-zero temperatures to many Lower 48 states. Widespread disruption to transport and energy supply is expected.

Though anticipated in the charts, the adjustment in pricing to the more probable short duration in storm length has sent the US gas and heating oil prices sharply lower over the last week.

US Heating oil futures for prompt delivery fell almost 10% from last week’s close to Tuesday.

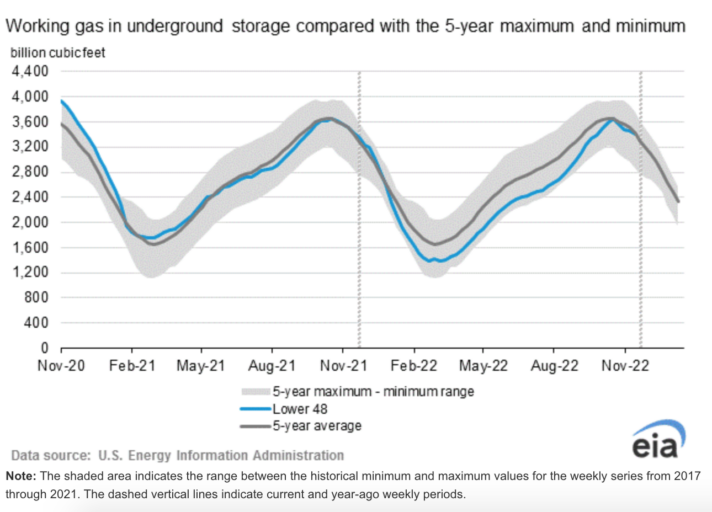

Natural gas futures for prompt delivery fell over 20% from the end-of-play on Friday. Despite the record LNG exports, US gas producers have rapidly ramped up production to replenish stocks quickly.

Working gas in underground storage is only marginally below the 5-year average. With plenty of gas in the ground to cover US needs for now, a great deal of the sting in the energy price has been taken out of the market.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

A chill in the sentiment abroad

The chill in the air is being felt in the outlook of business insiders worldwide. The slowdown for the holiday season means there are fewer data points to go on, and many of those published are only peripheral readings.

For those that see the light, the perception they’re giving is one of an extended and challenging road ahead in the new year.

The New Zealand ANZ business confidence published on Tuesday is lower than at any time after or during the Global Financial Crisis (GFC). Lower than the immediate freeze following the onset of the pandemic.

Winter fuel warming at home

While overseas countries struggle with the elements and the near-term economic outlook, Australia is being warmed with consistently higher coal (Newcastle coal for prompt delivery clinging to 400 USD/MT), iron ore (price at China port over 100 USD/mt), and natural gas (for gas delivered to North Asia attracting bids over $34 USD / MMBTU).

The strong commodity prices of these three key resources have carried the Australian stock market over the last few weeks and months, with battery component metals providing an added surge in valuations.

Australia’s largest gas producer, Woodside Energy Group Ltd ASX:WDS (WDS), is up over 2% on Wednesday, closing out a stellar year, appreciating more than 65% from the start of the year.

Where technology stocks wilted under the selling pressure originating in overseas markets, traditional value and mining stocks have either held their ground or, in the case of energy, powered ahead.

Summary

Of late, there has been a lot made of recession and market selloffs in the technology and crypto sectors. As we close the books on yet another year, it might be better to dwell on some of the positives in the markets.

Some companies and sectors have had a bumper twelve months serving their communities and stakeholders and have provided solid results for their shareholders.

Undoubtedly, as we turn the corner into 2023, many of those same companies, plus a few new battery component producers, will be looking forward to 2023 with optimism.