- After selling off last week, the US and Australia’s benchmark indices rebounded on Monday.

- International inflation, retail, business sentiment, and employment data points are being published this week.

- With inflation tapering, employment remains high, and with a bumper start to the holiday retail period, can the stock market finish on a high note this year?

A mixed bag to start the week

Asian markets got off to a stuttering start this week, with the Hang Seng down at Monday’s close before recovering a little ground on Tuesday – up 0.5% by midday.

The S&P / ASX 200 similarly started slowly on Monday before taking the lead of the US markets, pre-empting Tuesday’s closely watched US inflation print by rallying over 1.5% on the Dow and 1.25% on the NASDAQ.

The slight lead the Dow was taking suggests that the position was probably not led by interest rates. Such an outcome would have handed the baton to the tech-heavy Nasdaq, which is more sensitive to changes in the interest rate environment.

Thick and fast later in the week

Immediately after the market navigates an inflation print, it will be told of the FOMC interest rate decision, UK and European inflation and business sentiment, US retail data, UK interest rate decision and Australian employment, and a few more to boot.

Inflation

Forecasters have US inflation moderating from prior months. An expected climb month-on-month of 0.3%, including energy, equates to an annualised 3.6% increase.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

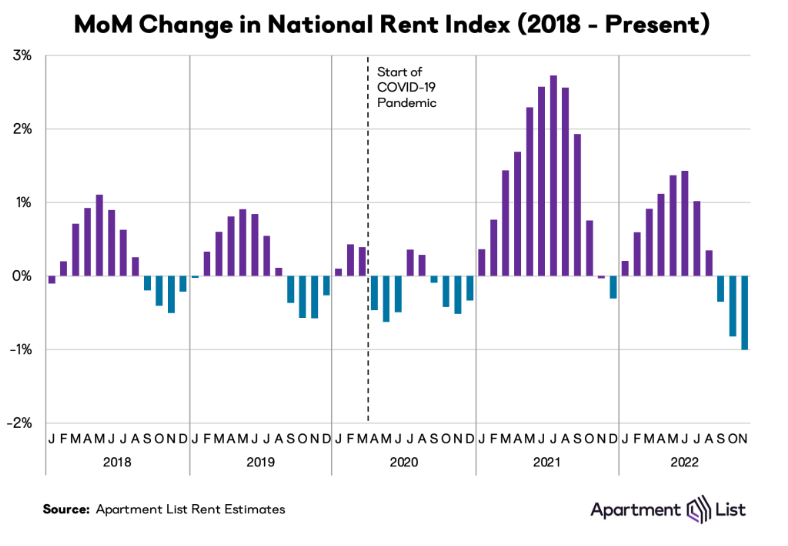

Despite some high wage inflation driving health services, transportation, and education higher, US rental price retracement in the US is doing most of the heavy lifting for the Fed.

The approximate weighting of housing and shelter in the basket of goods and services used to measure inflation is roughly one-third, the largest proportion of all. An annualised drop of 12% or 1% on the month will weigh heavily on the monthly print.

However, commodities, energy, and wage inflation were all higher in November, with energy only falling back in December. Wage inflation was 0.6% higher, and services like education that track inflation will immediately be raised by up to twice the wage increase.

If we factor in the above, with an estimated 1.5% rally in commodities in November, inflation is 0.5% higher in November. Marginally higher than the consensus estimates of 0.3-0.4%, though likely not enough to shift the Fed’s perception of inflation given the rollback of energy prices in December.

Retail sales

If the inflation data sends a few chills through the market on Tuesday, the Fed will likely calm its nerves by Wednesday.

With the Fed already signalling a slowing rate hike, the sharp drop in oil prices in December and rental price cooling should do enough to imbue confidence in the current rate-hike moderation pathway being trodden.

By Thursday, US retail sales figures will be announced. With preliminary data from the US and Amazon suggesting that Black Friday in the US was a new record, there is every reason to expect a bumper figure will provide some cheer in the markets as we head to the holiday.

Closer to home

While keeping an eye on developments abroad, the Australian investor will be looking at the ABS unemployment data on Thursday.

With mining being a robust backbone of the Australian economy and employment, there is little reason to suspect this will be anything other than another tick lower in unemployment.

If to open the week the stock market can overcome any uncertainty abroad, a new record low in unemployment might provide another boost to stocks to close out the week.

Bumpy road

Given the sheer weight of data coming out this week and the reduced volumes of the holiday period, we may be in for a few bumps, though the market may have already priced in the worst of it with last week’s sell-off.