Overnight saw a capitulation in the US stock market, particularly in the tech sector, with the NASDAQ down 4.6% and over 30% YTD.

In response, the S&P/ASX200 opened down by over 4%, the hardest hit being the property and tech sector.

Building materials supplier James Hardie Industries plc (ASX:JHX) is down 7% at the open.

Real estate investment trust Goodman Group (ASX:GMG) opened 6% lower.

Wisetech Global Lt (ASX:WTC), which sources most of its revenue from global trade, is down 9% at the open.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

TechnologyOne Limited (ASX:TNE), which develops and sells enterprise software worldwide, is down by 7%.

Central banks

Recent record-high prints in inflation have triggered central banks’ toolkit responses with rapid base lending rate rises to bring inflation under control.

Some might argue that the base lending rates are just returning to multi-year averages, but this time it is different, particularly for Australia.

Australian housing values

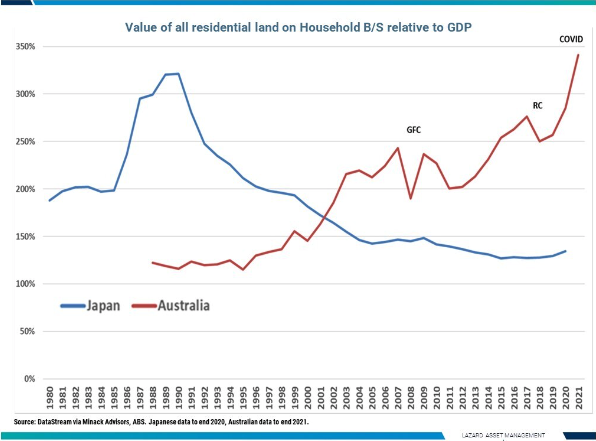

According to Lazard Asset Management, Australian residential land value is at an all-time high as a percentage of GDP. It mirrors that of Japan before the asset value crash of 1991 that precipitated the “lost decade”.

This increased proportion of capital tied up in property means that the average mortgaged homeowner without a fixed rate is more sensitive to lending rate changes than in the past.

Inflation and deferred investment returns

In an inflationary environment, when prices rise, a dollar today will buy more of a good or service than the same dollar will in the future.

The growth technology sector tends to defer cash flows to investors in favour of product development and marketing to win market share.

Aggregation and allocation of capital rather than payouts to shareholders through dividends and buybacks compound the impact of inflation on potential shareholder returns. That makes the tech sector particularly sensitive to changes in the value of future dollars, i.e., inflation.

The residential property investment that is not leased operates similarly in that the return is deferred until a sale. Combine the lowering of future dollar values with increased borrowing costs, and house prices start to suffer.

When asset prices take a hit, the large Australian service economy will suffer, and there will be very few safe havens.

Investor responses and where to put your money

Resource companies continue to hold their own in inflationary environments.

With dividend-paying companies like Woodside Energy Group Ltd (ASX:WDS), the cash generated by the business is returned to shareholders at regular intervals rather than kept on the balance sheet, mitigating the impact of inflation on the investment return.

Santos Limited (ASX:STO) is down 4% at the open, up 30% on the year, and buoyed by international energy prices. WDS is up 51% YTD.

Gold is traditionally a good inflation hedge when real rates (inflation-adjusted baseline lending) are falling.

Central banks are just keeping up, but there is a risk to economic growth from raising rates too quickly, which might force them to adopt a more dovish approach. In that event, actual rates will slide, and gold will appreciate further.

Newcrest Mining Ltd (ASX:NCM) is down 9% YTD and a comparatively modest 2% at the open.

Opportunity

Internationally post-COVID, there is increased sensitivity to interest rates built into the markets generated by larger government and retail balance sheets.

We can expect the volatility in markets to continue for the foreseeable future.

On the other side of the coin, the volatility does present the rational investor with some attractive buying opportunities.