- Lithium is riding the electric vehicle boom.

- Australia supplies over 40% of the global lithium exports.

- Three Australian lithium stocks to consider for your portfolio.

Lithium has captured a lot of headlines in recent times, and a precipitous fall in the cost of solar cell production has left utilities clambering for energy storage solutions as renewable electricity capacity is being installed at a breakneck pace.

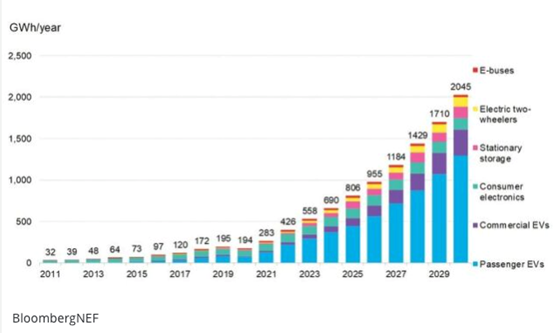

New markets are opening in all forms of transportation, retail and industrial energy storage, though it is the lithium component batteries in electric vehicles (EV) and hybrid EVs underpinning the global ramp in lithium demand.

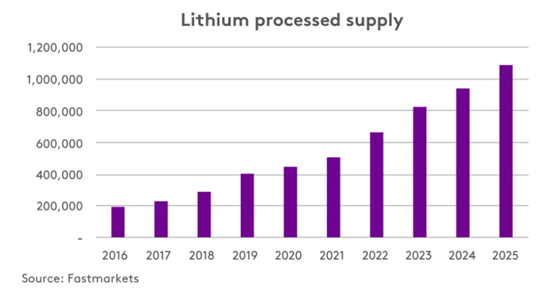

Lithium’s energy density, lower weight and strong charging cycles make it the best-suited component under current battery technology, and extraction is now matching the battery production growth.

The closely followed NYSE:LIT Global X Lithium & Battery Tech ETF (LIT) has climbed over 140% in the last two years. LIT is comprised of lithium miners, producers, suppliers and battery makers.

Forecasted segments of battery capacity demand

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

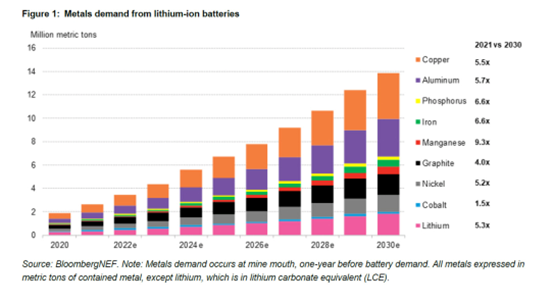

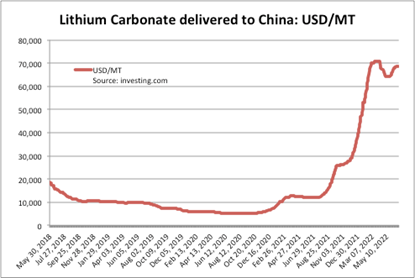

Lithium’s disproportionate weighting in value proposition to battery versus other utilities has sent the lithium price skyrocketing with battery demand.

This is in contrast to other metals such as copper and aluminium that are applied to a range of other electrical or manufacturing components.

Lithium demand growth

Demand is forecast to grow annually at approximately 25% per year.

Supply

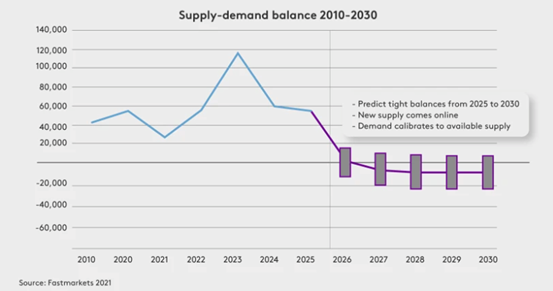

Supply is expected to match demand growth for the next few years before EV production is anticipated to outrun the current supply pipeline.

As a result of the growth in EV production and supply constraints during the COVID-19 pandemic, the lithium price is at an all-time high.

Lithium extraction is roughly split between brine evaporation and mineral rock extraction. Currently, extraction of the carrying mineral spodumene is favoured over brine evaporation and separation as the former is easier and cheaper.

The lower lead time in mineral extraction plus expertise on the ground have manoeuvred Australia to an outsized export share relative to its resources.

One such beneficiary is Mineral Resources Ltd.

ASX:MIN Mineral Resources Ltd (MIN)

MIN has seen an impressive 189% climb in the share price from January 2020.

Mineral Resources is a mining company with interests in the Mount Marion and Wodgina lithium projects, though the majority of revenue is drawn from West Australian iron ore.

Record-setting commodity prices have propelled this stock to all-time highs in the last 12 months.

Riding the wave of commodity price increases last year, MIN was able to lower impairments on the improved outlook for resources – this somewhat buffered the financials from the sharp uptick in transportation and raw materials charges.

The firm has been propped by high prices but rocked by stubbornly high costs, which points to a rocky period ahead for the MIN share price even with record-setting lithium prices.

The half-year earnings to 31st December 2021 have suffered as a result – its net income is a paltry AUD$19m on revenues of AUD$1.4bn.

The swoon in iron ore combined with a stubbornly high inflationary environment clouds the future for this stock price.

ASX:AKE Allkem Ltd (AKE)

There has been a 240% appreciation in the market capitalisation from January 2020 for AKE.

Allkem has a large 22.5 million MT brine resource in north Argentina forming part of the Andean ‘lithium triangle’.

As production ramps up in this basin, the majority of the company revenues are drawn from the Mount Cattlin dry spodumene resource.

AKE is currently borrowing and raising money in capital markets in order to fund the Argentina expansion – AUD$114m issuance and AUD$114m borrowings in FY 2021.

The brine extraction techniques are still being developed internationally, so this investment does come with some risk. The comfort is that there is expected to be a shortfall in lithium supply in the years ahead, and this will provide an adequate runway for Allkem to execute.

Certainly, the stock has potential for value appreciation given the size of the resource and extraction projections, but large obstacles lay ahead.

ASX:PLS Pilbara Minerals Ltd (PLS)

PLS is up a stunning 725% from January 2020.

Pure lithium play in the Pilbara is currently producing approximately 570,000 MT per year of spodumene, ramping to 1 million MT in the next few years.

It has been an extremely impressive half-year 2022 of AUD$290m revenues and a net profit of AUD$114m returns and an implied PE ratio of 17.5 based upon an annualised profit of AUD$228m and AUD$7bn market capitalisation. The gross margin is improving as the business scales and is improving the company outlook.

Under the current expansion plans and with a sustained lithium price, PLS does present an attractive value proposition.

It is historically extremely difficult to forecast future commodity prices, but given the expected shortfall in 2025 and the firm’s proven ability to improve margins on scaling, this stock could be worth putting away for the future.

Bright future

All three stocks will likely experience volatility in the share price for the next few months and years as the extraction and battery manufacturing landscapes evolve rapidly. Through the ups and downs, the future of transportation is electric and lithium will have a big part to play.