- To start 2023, the finance sector follows the technology sector’s lead with layoffs.

- Goldman Sachs NYSE:GS (GS), Morgan Stanley NYSE:MS (MS), and others are following the lead of FAANG in laying off staff.

- Despite bumper revenues and profits, large US multinationals (MNCs) and the Federal Reserve are performing an unlikely delicate dance in directing the US and global economy.

Layoffs announced

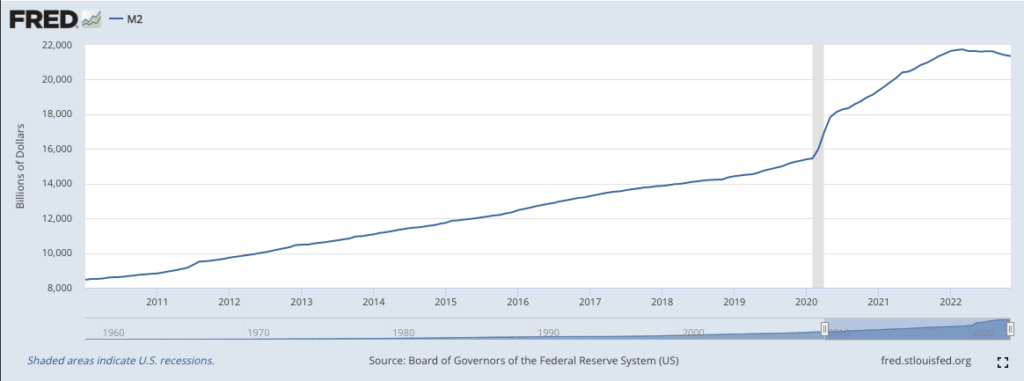

The explosion in pandemic-era money supply commencing in early 2020 had to turn up somewhere. It just so happens that it was US corporate profits in 2021. As the tide starts to turn and bloated corporate valuations normalise to something a little more in line with the respective balance sheets, payroll is one of the first in line for downsizing.

Source: St Louis Fed

The $6 trillion in COVID funding ballooned the existing US money supply and is the main reason for the hyperinflation that presented itself in the US and internationally.

The majority of the relief was desperately needed as businesses were shuttered and jobs were lost. As those funds were spent, they wound their way through the US economy and, in large part, ended up in the corporate structure that houses the most significant share of the US economy.

Top Australian Brokers

- City Index - Aussie shares from $5 - Read our review

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

US corporate profits

Following the lockdowns, pivoting businesses ramped their digital marketing spend and engorged the profits of FAANG. The massive increase in new money ultimately gravitated to the banks and investment houses equipped to take on the surge in deposits.

Restless and furloughed but gainfully employed workers had more time to up their web clicks and to trade their pay packet on new finance platforms like Robinhood NASDAQ:HOOD (HOOD)

Annual US corporate profits were 23% higher in 2021 than 2020 despite concerns over COVID ravaging productivity and output. Alphabet Inc NASDAQ:GOOG (GOOG), Meta Platforms Inc NASDA:META (META), and others in big Silicon Valley Tech, as well as JP Morgan NYSE:JPM (JPM), and Goldman Sachs NYSE:GS (GS) on Wall Street were amongst the big winners in 2021.

Back down to earth

US corporate profits in 2021 were supernatural. The inevitable breaking wave of the meteoric explosion of the US government’s borrowing and funding started in 2020.

By and large, 2022 results will not be too bad for GOOG, META, JPM, GS and many other large US MNCs compared to 2019 and 2020. When compared to 2021, they’ll look less rosy.

And for those business sectors and employees brought in to handle that massive surge in new money in 2021, the wave has long since retreated, and we’re back to a more natural revenue growth marker.

Inevitably, corporate boards are looking at payroll rationalisations to keep their productivity metrics in check as the anomaly of 2021 recedes into the rear-view mirror.

At the forefront of modern commerce, the technology sector was the first to get the knives out by cutting almost 100,000 jobs in 2022, with more workforce reductions announced for this year.

Bonuses and jobs are being shed on Wall Street, too. Further downstream from technology but now looking out at the same falling tide, big US banks are cutting jobs at home and abroad.

Concerted action

Despite the unwelcome news for those bearing the brunt of the layoffs, a softer labour market will bring down core inflation and ultimately, interest rates will fall, a critical objective for global policymakers.

The US and Australia can look to the future as interest rates and prices begin to moderate and businesses prime themselves for the next cycle.