- Inflation is weighing heavily on the current global political climate.

- US monetary policy is centred around the direction of inflation.

- With international policymakers and investors closely monitoring the next inflation print, what can we expect from this week’s US consumer price index (CPI)?

Inflationary headwinds

Rewind to mid-2021, and US President Joe Biden is quoted as outlining current inflation as “temporary”. At that time, the blanket reopening while personal savings rates were high, businesses well-funded, and some sectors of the service economy understaffed resulted in a sharp uptick in prices.

The conflict on the European continent was to blame for a short-lived spike in energy prices. Under some interventionist policies on supply and exports from the US Department of Energy (DOE), the impact of rising energy costs on aggregate inflation has been dulled, at least in the US.

Presently the US economy is being weighed down by a headline CPI of an annual 6.6% through September this year. Well above the target of 2%.

Higher inflation reduces the outlook for goods and services as prices rise, which will defer or reduce overall consumption. That will impact businesses in the long run and form a negative cycle as jobs are cut to compensate for the reduced revenues.

International impact

The typical response of central bankers is to raise the cost of borrowing to stem the tide of inflation and, by extension, investment, incentivising the deferral in business expansion through higher savings rates.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

A slowing US economy will likely not end at the country’s shores. Higher rates are fuelling a stronger US dollar and heaping pain on developing countries that have borrowed the currency.

Corporate boards nervous about the near-term economic outlook are freezing hiring; that is being felt offshore as large swathes of multinational corporation revenue are sourced overseas. The cuts impact lucrative opportunities for employees of US firms in foreign markets.

An anticipated lowering of consumption and a switch to lower inventories is already starting to impact China’s factory output and exports. The country’s exports, year over year in October, were down by 0.3%.

The concerted impact of the above will start to weigh on Australian trading partners and, by extension, the Australian stock market.

Inflation forecast

It is essential that inflation is brought to heel, not just for the US economy but also the international economy.

Thursday brings a critical marker for inflation watchers. The US CPI print for October. The consensus view is for the trend to head downward marginally, from 6.6% to 6.5% annualised.

Why do economic forecasters expect this moderation in prices, and is it warranted?

By the numbers

CPI is a basket of goods and services intended to reflect the expenditures of the average consumer.

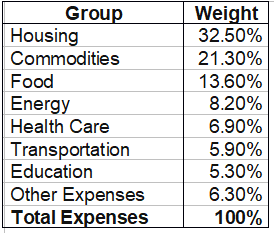

The approximation of weighting is thus:

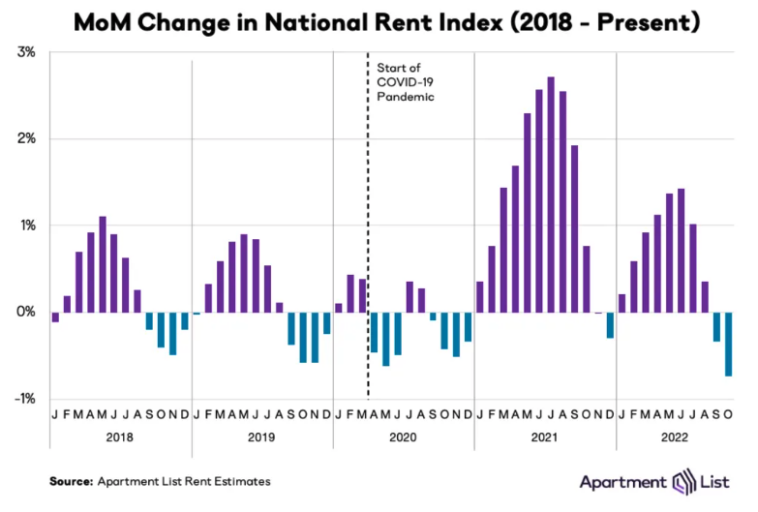

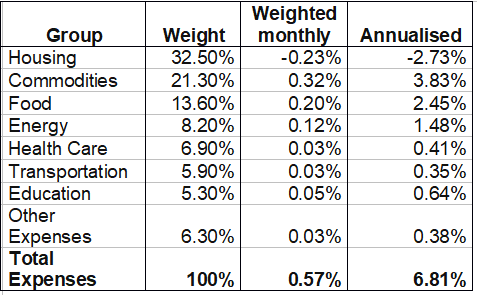

The most significant weighting goes to shelter. The moderation in US rental prices by 0.7% in October provides some relief.

The inflation of education costs typically runs twice that of baseline inflation, and airline tickets are 25% higher year over year and are outpacing inflation.

Energy and commodities are marginally higher in October: Aberdeen all commodity ETF NYSE:BCD (BCD) up by 1.5%. Food prices are trailing the commodity price rises.

When we plug in all these factors, despite the fall in the cost of shelter and house prices in October, a rough estimate of inflation is above the 6.5% forecast at 6.8%. This is a very rough guide but highlights how difficult the task is for policymakers.

A new front will open as one battle is won on house prices. Furthermore, lagging indicators like education and other service prices linked to inflation will aggravate the issue for months to come.

Outlook

We are not quite there yet, and there will likely be a few bumps along the road to the baseline inflationary target. Any surprises to the upside on inflation prints will probably weigh heavily on the markets.