- Present gyrations in stock valuations are at the higher end of what we might expect on average.

- The S&P/ASX 200 is currently at the same level it was at this time last month.

- Volatility is rising, yet the market hasn’t declared a course up or down; what are the implications?

Highly volatile, no bang

One measure of volatility in financial markets is the statistical measure of standard deviation applied to the variations in price. The present measure of volatility on the last 30 days of changes in the S&P/ASX 200 is at the highest level it has been for over two years.

Currently, prices are moving quite a lot on a day-to-day basis relative to the recent past, without going anywhere. Volatility is often associated with big moves in either direction, yet we’re back where we started at this time last month.

This is indicative of a great deal of uncertainty in the markets. The significant sell-off in Chinese securities overnight, following a negative interpretation of the Chinese outlook from Western observers, was quickly followed by a rally in US stocks.

Company earnings

US analysts and observers were expecting company earnings to trail the overall negative GDP outlook for the global economy, but this is yet to crystallize. While down on the blockbuster 2021 numbers, the earnings of the big banks beat estimates.

Solid numbers from big tech in Microsoft NASDAQ:MSFT (MSFT) and Alphabet NASDAQ:GOOG (GOOG) could add further impetus to a rebounding stock market.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

With expectations tempered, a big beat of estimates is undoubtedly on the cards and could send all stocks higher again as the market drives home the notion that things aren’t so bad yet.

Buffer

Despite record inflation and unsettling rises in prices for the citizens of the world, employment remains high, and business conditions are, at worst modest if not entirely favourable.

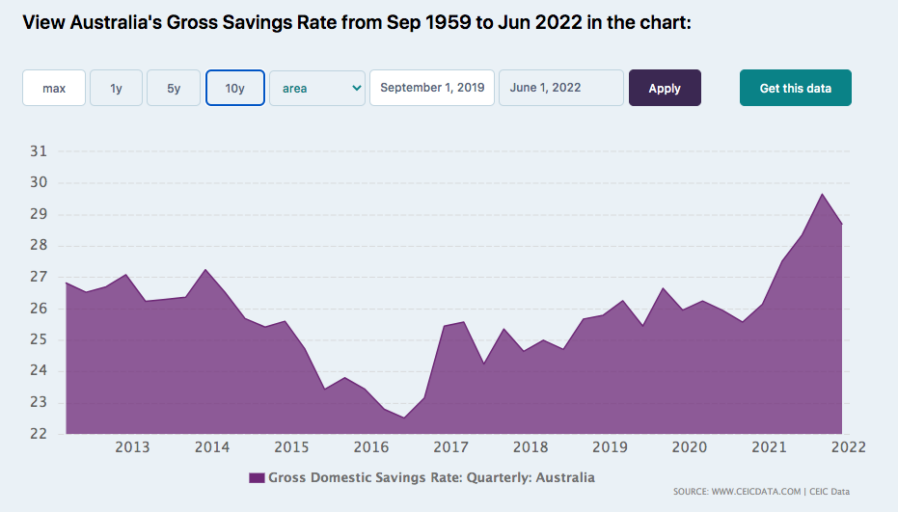

International savings rates are high, with Australia no exception. The pandemic-led restrictions on movement combined with record-low unemployment have provided a buffer to the global economy.

While some businesses like property developers ill-prepared for rapid price rises have folded, retail, technology, mining, and services have exited the lockdown to find eager customers who are willing to pay just about any price up until now.

The current sentiment of uncertainty in the stock market is not about what’s in the books but the anticipation that this eagerness will be short-lived and the focus will return to bargain hunting.

Price wars

We are now starting to see price wars developing. Tesla recently announced price cuts of up to nine per cent. As competition begins to heat up in the heavily invested electric vehicle space, the focus is shifting to price as the critical acquisition differentiator.

Increased competition and productivity in other sectors are probable as businesses look to expand customer bases, faced with high prices. This will inevitably impact margins and lower company profits.

Already under duress from higher borrowing costs and slackening corporate debt markets, companies are finding that the pendulum is swinging away from the easy wins of lofty margins to the more difficult ground of price wars and customer acquisition.

Outlook

International financial markets are unsettled. Record inflation has provided windfalls for some and the death knell for others. Global consumers have enough protection to climb the initial inflationary hurdle but will likely cut spending if this onslaught continues.

The direction in the stock market over the next few weeks and months is still finely balanced; if inflation doesn’t retreat quickly, downward movement is most likely.