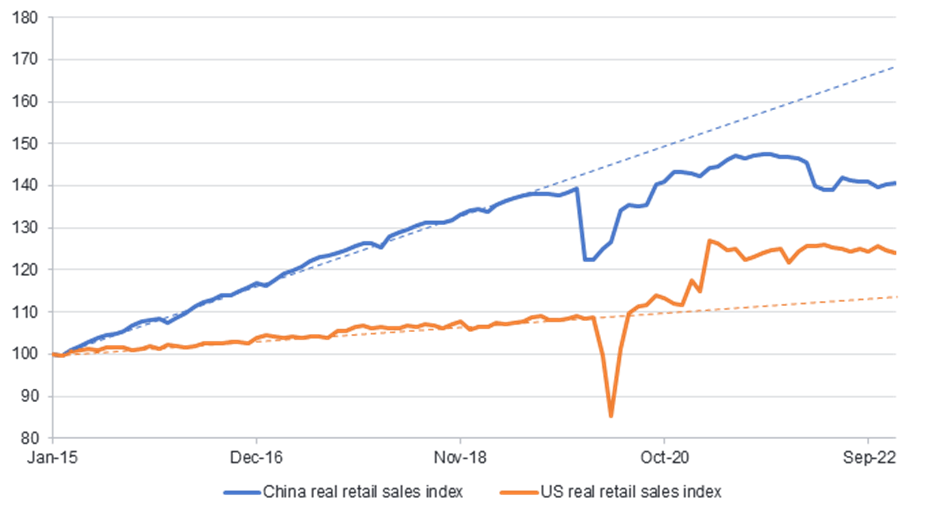

China’s re-opening and excess household savings means there is ample room for a recovery in consumer spending. We are overweight emerging markets (EM) equities because of the more positive outlook for China’s economy as it exits from Zero-Covid Policy (ZCP).

Chinese consumer spending has lagged below its pre-Covid trend, unlike in the US

Note: Indices constructed by deflating monthly nominal retail sales by monthly change in CPI.

Source: Fidelity International, Bloomberg, January 2023.

Consumption in China was weak in 2022 driven by the country’s stringent Covid policies. However, we expect consumer spending will get a boost now that China has begun to emerge from its ZCP much faster than initially predicted. Chinese households are anticipated to be sitting on the largest pool of new savings in history due to the lockdowns last year, accumulating US$2.6tn of bank deposits last year, in comparison to the US$1.5tn built up in 2021. While not all of this is expected to be deployed this year, it should help to lift Chinese growth.

This combination of pent-up demand and high savings in China points to the potential for a boom in consumer spending this year. Supportive fiscal policy is another tailwind for China’s economy at present – policymakers have made increasing consumption a priority after the nation missed its 5.5% growth target last year. The positive growth outlook for China is a driving force behind our overweight EM equities view. We are also overweight EM foreign exchange (FX) and have recently moved from underweight to neutral on EM debt.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Originally published by Fidelity International investment experts