When in doubt, go big!

Australia’s Amcor PLC is a defensive stock pick. When uncertain times lay ahead, stocks like Amcor provide security to the investor due to their size and market reach. A sizeable defensive play like Amcor can secure funds while continually supplying income yield in a market where investor and company instability is rife. Originally incorporated as…

Global building material powerhouse: James Hardie Industries

James Hardie Industries PLC ASX: JHX (JHX) is a defensive choice of stock. James Hardie Industries sells its branded building materials across the globe. The company’s global reach and cross-market uses – for commercial and residential buildings – can provide investors with security. James Hardie Industries PLC ASX: JHX (JHX) develop cement and wood fibres,…

A Resilient Investment in Uncertain Times

Ramsay Health Care Limited ASX: RHC (RHC), is a dependable healthcare business. For the more risk-averse and to lower the riskiness of a portfolio, RHC offers investor security. In uncertain times, health care is always a go-to for stock investors as the service is always required. RHC is a large and resilient international healthcare provider…

A High-Potential Biotech Investment

Nyrada Inc ASX: NYR (NYR) is a risky biotechnology stock pick. Biotechnology stocks offer the chance to win big for the more speculative investor when drugs and drug applications pass clinical trials and win regulatory approval. NYR is a speculative stock market investment heavily reliant on the outcomes of single clinical trials. Investors should trade…

Australian Exploration Company to mine in-demand rare earth elements

Meteoric Resource is an independent explorer expanding its mineral offering. Through acquisition, Meteoric is looking to expand into rare earth extraction. Rare earth elements are critical for use in complex electronics like smartphones and computers. Rare earth minerals are found in the ground all over the globe, though only in a few places can they…

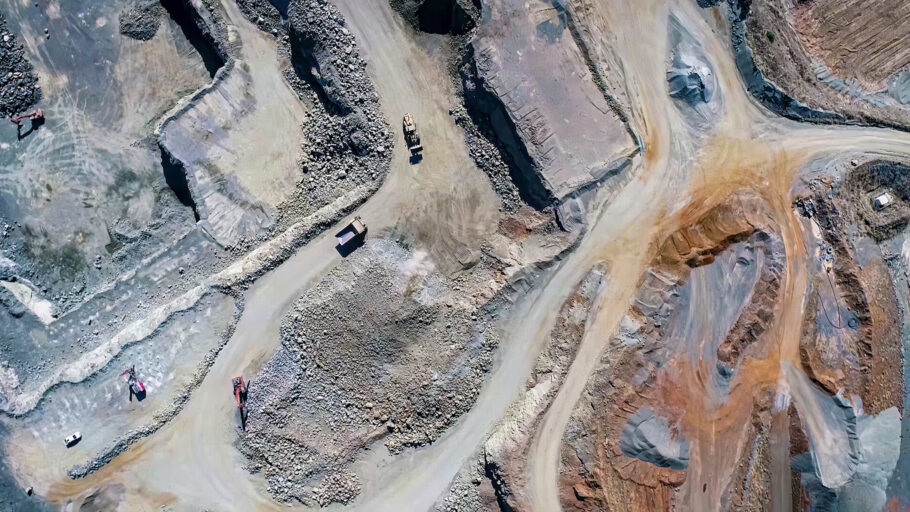

A Promising Investment Opportunity in the Mining Sector

Sandfire Resources is an international miner based in West Perth. Here, we dive into why it might be a good stock investment. A cross-section of metals and minerals continues to see an influx of capital expenditure. Sharply growing international production has done little to dampen runaway consumer inflation. One of the companies benefiting from the…

Beyond Lithium: The Broad Investment Appeal of Mineral Resources Limited

Mineral Resources has undergone rapid growth in its share valuation in recent years in no small part due to its lithium and iron ore interests. Is MIN stock a good investment today? Mineral Resources Limited (ASX:MIN) operates in the exciting lithium sector and tenured iron ore operations. It allows investors to gain exposure to a…

Lithium Powerhouse in the Making

The lithium market is expanding rapidly, and mining companies are racing to keep up. Sayona Mining is expanding operations at home and abroad to meet the surging demand, keeping Australia at the forefront of world production in this burgeoning sector. The lithium sector is currently experiencing a significant surge, driven by an increasing global shift…

Pioneering the Next Generation of Mining Technology

Surging mining activity in Australia continues to insulate the economy. Technological advancements in software and hardware are keeping Australian mining productivity at the forefront of the global sector. Imdex investments and M&A activity is furthering Australian expertise in the sector. The outlook for mining services, particularly those leveraging technological advancements like Imdex, is highly promising….

Dropsuite: A High-Growth Data Protection Investment

This week it’s an Australian technology company investment. The company is focused on the profitable cloud computing sector, providing accounting software, data backup services, and data protection. Modifications in the headline interest rates have an impact on the value of the money in your wallet. When rates rise, it indicates an increase in inflation, which…