Coronado Global Resources – a Dividend Powerhouse for the Risk Tolerant

Coronado Global Resources claims to be one of the largest producers of metallurgical coal on the planet. The company provides a variety of coal content to customers on five continents. Coronado has a major coking coal operation here in Australia and three producing mining operations in the US. Coronado saw a revenue dip and posted…

What’s Going on with Pointsbet Holdings

Pointsbet holdings listed on the ASX on 11 June 2019, touting its innovative betting products and services, including Fixed Odds Sports and Racing along with Points Betting and iGaming and something new – Spread Betting. Trading at $0.89 per share on its first day, news of successful moves into US states drove the price to…

IGO Limited – In the Sweet Spot for Battery Minerals

Lithium, nickel, cobalt, and copper are considered critical minerals for a clean energy future, and IGO mines them all. The company owns and operates three nickel mining operations in Western Australia – Forrestania, Cosmos, and the Nova nickel/copper/cobalt operation. In June 2022, IGO expanded its nickel resources, acquiring rival Western Australia nickel mine Western Areas…

Newcomer Green Technology Metals Setting Its Sights on Lithium Production in Canada

Green Technology Metals (ASX: GT1) began its life on the ASX without sole ownership of its lithium projects in Canada. Within a year the company secured 100% ownership. Drilling began within a month of listing, with positive results announced repeatedly since. The Green Technology Metals share price shot up shortly after listing on 9 November…

A Mixed Outlook for Corporate Travel Management

Corporate Travel Management had a solid history of share price appreciation and dividend payments in the pre-pandemic era. The global travel industry was arguably the hardest hit business sector by COVID and the variants in the aftermath of the initial phase. The pace of online business meetings exploded because governments restricted travel. Corporate Travel Management…

Buying BHP on the Dip

In 2021 BHP was ranked fifth among the top brands in Australia. By market cap, BHP is the largest mining company in the world. BHP has merged its oil and gas assets with ASX-listed Woodside Energy Group (ASX: WED) to focus on resources essential for the transition to reduced carbon emissions and global economic growth….

EBR Systems – A Promising MedTech Company Under the Radar

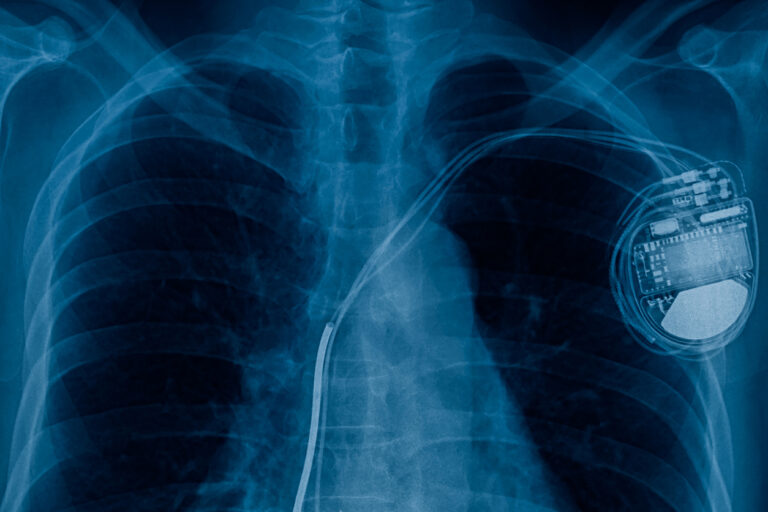

US-based EBR Systems listed on the ASX on 23 November 2021. The share price immediately fell into a sustained downward trend, beginning a major reversal in November 2022. The company has developed an innovative approach for Cardiac resynchronization therapy (CRT), an alternative to the traditional pacemaker. Traditional pacemakers employ implantable devices with wire leads attached…

Can Accent Group Withstand Declining Discretionary Spending

Accent Group increased profits at the onset of COVID-19, but they declined in FY 2022. The Half Year 2023 results signalled a return to form. Inflation and rising interest rates appear to be impacting consumer discretionary spending. From its origins in New Zealand in 1988, Accent Group has become an Australia/New Zealand powerhouse online and…

Johns Lyng Group – A Business Model Perfectly Fit for Troubled Times

Johns Lyng Group is a global provider of restoration services for insurance companies, commercial businesses, governments, and the retail sector. The company has a solid history of financial performance, and it is growing. International incidents of destructive events put the company amid a sector that is sure to prosper. In December 2021, Johns Lyng Group…

Boss Energy Reopening Shuttered Honeymoon Uranium Mine

Investment in nuclear energy declined drastically following the Fukushima disaster in 2011. Uranium mines went into care and maintenance as the price of uranium collapsed. Current events are boosting the outlook for uranium. In 2013 Boss Energy (ASX: BOE) shuttered its flagship Honeymoon uranium mine in South Australia following the global rush to cut back…